Increasing fees, thoroughly collecting from customers: Banks earn sustainable profits

Banking services in Vietnam are not of high quality, but fees are increasing, causing customers to suffer a lot of disadvantages. Roughly, there are currently about 20-25 basic service fees of banks applied to personal account transactions. Non-credit revenue, including fees, is a source of income considered sustainable and is being targeted by banks when restructuring.

Service fee chaos

After successfully opening an account at the bank, the account holder will have to pay monthly fees, including: account management fee, account maintenance fee, cash withdrawal fee, money transfer fee, SMS banking fee, internet banking fee, ATM bill printing fee, etc. That is not to mention other fees that many banks collect such as: nice account number fee (negotiated separately with the customer), account statement fee, account review fee (if the customer accidentally makes a wrong complaint), card making fee, PIN code issuance fee, card loss reporting fee, account closure fee, etc.

Charging fees to maintain operations and improve service quality is completely valid, but creating too many types of fees and continuously increasing fees is making users angry.

Calculations show that if you only register for SMS banking service and withdraw money from ATMs, the account holder will have to pay about 200,000 VND in fees per year. If you register for many services and make many transactions, the account holder will have to spend millions of VND in fees to the bank per year.

|

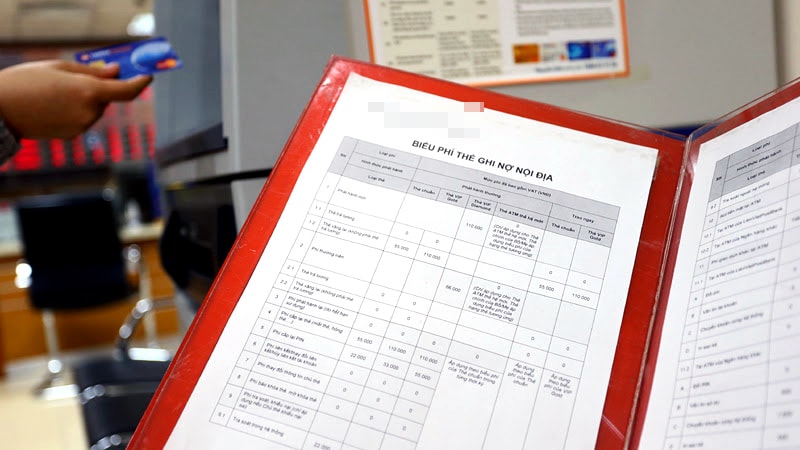

| Domestic debit card fees of a bank (photo by Quang Phuc) |

Mr. Le Anh Tuan, in Thai Ha (Hanoi), has accounts at many banks, said that on average, he makes 4-5 transfers via internet banking to partners every day, each time costs a few thousand dong, which means he loses millions of dong a month with this service. Therefore, he has to open many payment accounts at many banks to transfer money within the same system without fees, or with low fees.

But, what he is worried about is that this fee is tending to be adjusted up by banks. Previously, some banks did not charge for money transfers within the same system, but now they have started to charge.

It is normal for customers to open accounts and make transactions, so they have to pay fees. The problem is that the fees customers have to pay are too high and keep increasing, making them frustrated, Mr. Tuan said.

According to banking expert Nguyen Tri Hieu, the application of internal transfer fees by banks is unreasonable. When transferring money within the bank's network, the money remains in that bank. The bank can use this money for free or at a very low fee, compared to the mobilized capital. For this reason, most foreign banks do not apply internal transfer fees to customers, Mr. Hieu said.

|

| Experts say that too many types of fees lead to overlapping fees, and some banks even charge ATM fees outside of the published schedule. |

Many people who use ATM cards to withdraw money said they have no other choice because of the regulations on salary payment through accounts. Among them, low-income people are the most disadvantaged. Many workers in industrial zones are only paid 5 million VND per month. That amount is often used for daily expenses. When receiving salary through ATM cards, they naturally have to leave a minimum balance of 50,000 VND in their accounts and have to pay fees for withdrawals, account maintenance, money transfer fees, etc. If these fees increase, they will suffer more disadvantages.

According to banking expert Pham Nam Kim, based on the per capita income between Vietnam and the EU, it can be seen that Vietnamese banks charge many times higher service fees. Normally, EU banks do not charge fees for money transfers within the same system, account inquiry fees, free payment account maintenance fees, etc.

Experts say that the excessive number of fees leads to overlapping fees, and some banks even collect ATM fees outside the issued schedule. The Payment Department (State Bank) in mid-2015 had to send a "whistleblowing" document, requiring banks to only collect fees according to their own prescribed schedule, and not to collect additional fees outside the issued schedule. Issuance, annual, and ATM transaction fees must be within the framework of legal regulations.

|

| Bank fees are a pain for many cardholders (illustrative photo - Quang Phuc) |

Huge profits

Banking and finance experts say that on average, service revenue of world banks accounts for 30-40% of total bank revenue. But in Vietnam, very few banks reach 10%. Therefore, improving the proportion of service revenue is being set by many banks. Because this is considered a sustainable source of revenue and less risky than credit activities.

However, increasing fees or setting arbitrary fees will be disadvantageous for account holders. The worrying thing is that when banks increase fees, customers still have to accept it because they have no other choice.

According to data from the authorities, by the end of 2017, the country had more than 100 million bank cards, of which domestic cards accounted for nearly 90%. Customers using domestic cards to withdraw cash accounted for over 80% of the total.

The former general director of a large bank admitted that developing card services brings quite good profits to banks. For example, just with SMS banking service, cardholders have to pay 10,000 VND per month, if the bank has 1 million card customers, then each month they will earn 10 billion VND, a year is 120 billion VND.

Currently, many banks apply a withdrawal fee of 1,100 VND for the same system and 3,300 VND for other systems. If only calculating the withdrawal fee of 1,100 VND/time for the same network and with 50 million cards in regular operation, each card withdraws 2 times/month, the amount of money that the bank collects is 110 billion VND/month, equivalent to 1,320 billion VND/year.

With the minimum amount of money to maintain a card account being 50,000 VND, with 50 million cards, the amount of money the cardholder leaves in the bank has reached 2,500 billion VND,... If all fees, transactions,... are fully calculated, the amount earned by the banking system will be very large.

Fees have increased, but most opinions agree that the quality of service provided by banks is not keeping up. For example, ATMs running out of money, malfunctioning, and temporarily shutting down are common occurrences. The government has had to issue a decree stipulating that banks that run out of money and cannot meet customers' withdrawal needs will be fined.

It can be said that the quality of banking services in Vietnam has not met the requirements. However, the fees are increasing and increasing, which is completely unreasonable, customers are suffering a lot of disadvantages.