Gold market is gloomy in the first week of the year

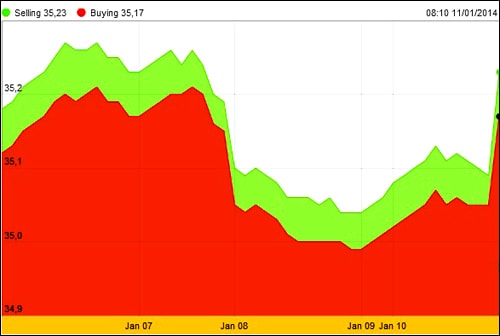

At the end of the week, domestic gold price reached 35.25 million VND/tael, world gold price increased to 1,244 USD/oz.

In the second week of the first month of 2014, the domestic gold market still did not have many fluctuations. Although it was the month before Tet, compared to the same period in previous years, the demand for buying and selling gold and jewelry of people this year decreased significantly, causing transactions in the gold market to become quiet.

Domestic gold prices fluctuate slowly

The domestic SJC gold price last week marked a slow increase after a low decrease in the middle of last week. At the beginning of the first trading session of the week, the selling price of gold continued to increase, reaching over 35 million VND/tael and lasted for 2 consecutive sessions, then decreased slightly in the middle sessions of the week.

|

| This week domestic gold price increased by 120,000 VND/tael. |

Thus, in general, last week, the highest selling price of gold reached 35.27 million VND/tael; the lowest price dropped to 35.04 million VND/tael. Along with that, the trading range of buying and selling prices was also narrowed to 40,000 - 60,000 VND/tael in the markets of Hanoi and Ho Chi Minh City.

Following the movement of domestic gold prices in the first sessions of the week, it can be seen that the fluctuations of domestic gold prices are not instantaneous with the world gold prices due to the lag. There are times when, despite the world gold prices moving in a slightly downward trend, domestic gold prices still increase immediately after the opening of trading sessions and maintain a slow but continuous upward trend.

However, many opinions in the gold business community believe that domestic gold prices are very sensitive to changes in market demand. Accordingly, domestic gold prices can increase faster or decrease slower than world gold prices when purchasing power increases. When purchasing power weakens, domestic gold prices can increase slowly and decrease faster than world gold prices.

During the first 10 days of 2014, the State Bank of Vietnam (SBV) did not organize any additional gold auctions. Previously, at the auction at the end of 2013, SBV organized the sale of 20,000 taels of gold instead of 15,000 taels as before. The reference price to calculate the deposit value was 34.9 million VND/tael. The minimum bidding volume was 500 taels and the maximum was 1,500 taels.

The results of this week’s gold auction show that, with 18 organizations and businesses that have established trading relationships with the State Bank participating, only 2 units were unable to buy gold. The highest price that some businesses paid was only 40,000 VND higher than the floor price, instead of over 100,000 VND higher than the recent sessions. The lowest price was 10,000 VND higher than the floor price.

In the auction at the end of 2013, the State Bank sold all 20,000 taels offered. The highest buyer bought 1,500 taels and the lowest 500 taels. Unlike recent transactions, the number of times this agency sold all of its gold is rare.

In total, from March 28, 2013 to now, the State Bank has gone through 76 gold auctions, with a total offering of 1,932,000 taels and a successful transaction of 1,819,900 taels, equivalent to 69.9 tons of gold.

US employment index affects world gold prices

The world gold market has been fluctuating erratically over the past week, demonstrating the investors' wait-and-see attitude towards the market situation before the announcement of the US employment index in December 2013. In the first trading session of this week, the spot gold price in the Asian market decreased by 1.1 USD/oz compared to the closing price at the end of last week in the New York market, the gold price decreased to 1,237.9 USD/oz.

After many fluctuations, at the end of this week's session, on the Comex floor, the price of gold for February delivery increased by 17.50 USD, equivalent to 1.4%, to 1,246.90 USD/oz, the highest level since December 11, 2013. The spot price of gold also increased by 0.7% during the week to 1,244.68 USD/oz.

|

| 1,248.60 USD/oz is the closing price of the world gold market. |

In addition, the US unemployment rate in December 2013 also decreased by 0.3 percentage points to 6.7% due to many people giving up looking for jobs. According to developments during the week, the world gold price has reached its highest level in nearly 20 days thanks to the buying power of investors when the world stock market fell.

However, the strong increase in the USD index and the optimistic view of the US Federal Reserve Chairman Ben Bernanke on the economic outlook of the country will also be obstacles to the possibility of further increase in gold prices.

Analysts predict that with a weak job market, the US Federal Reserve (FED) will not be able to speed up the reduction of the QE3 quantitative easing package, which will be detrimental to gold prices in the near future./.

According to vov