Which channel should I invest money in at this time?

Gold prices tend to go down rapidly and unpredictably, making this investment channel the least attractive for capital.

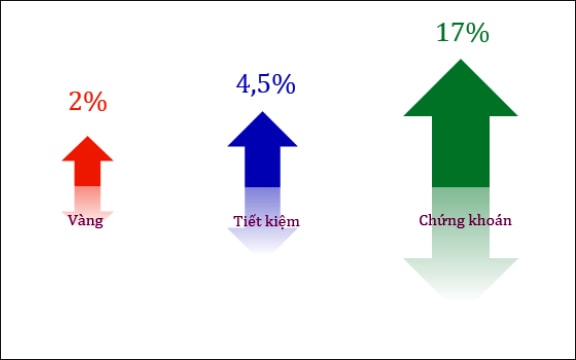

Comparing the correlation between the three channels of gold, stocks and savings since the beginning of 2014 shows that the profitability from gold is less than half of that from savings. At the beginning of 2014, the domestic gold price closed at 34.95 million VND/tael for buying and 35.02 million VND/tael for selling.

By the end of October 20, the gold price only increased to 35.74 million VND/tael for buying and 35.86 million VND/tael for selling. Thus, the gold price in the first 9 months of 2014 only increased by about 2.2%.

At the time when domestic gold prices reached their highest level since the beginning of the year (May 20), the increase in gold prices was only 6.08%, lower than the mobilization interest rate at the same time.

Meanwhile, savings interest rates have been continuously decreasing since last year. Currently, interest rates mobilized at banks with deposit terms of 12 months or more range from 6% to over 7%/year, the highest rate is over 7.5%/year for a term of 36 months. With a term of one month, depositors are paid the lowest rate by the bank, about 4%/year.

|

| Stocks are the most attractive channel but require long-term investment. (Photo: KT) |

Compared to investing in gold prices, the nominal rate of return (not including inflation) from savings deposits is about 3 times higher. However, stocks are the most attractive channel, if viewed from a long-term investment perspective.

Specifically, by the end of the session on October 20, the VN-Index had increased by nearly 17% compared to the beginning of the year. If calculated at the peak of the market reached in early September, the stock market had increased by 27%. With this increase, listed stock investment outperformed the other two investment channels. Of course, the specific investment performance depends on the choice of stock portfolio.

Each investor has the choice to invest their capital in different channels, and more importantly, each investment channel has different “picky” investors. Especially stocks, although attractive with high performance, also come with many risks, including market risks, as happened in May.

Gold prices tend to fall rapidly and are unpredictable, making this investment channel the least attractive of the three channels mentioned above. On the contrary, savings are considered an effective solution for many people, because of their high safety and acceptable low returns (hard to decrease further) in the current context./.

According to Investment Forum