Tax payment extension may be until January 2014

According to the draft of the Ministry of Finance, enterprises subject to regulations can have their corporate income tax payment deadline extended to a maximum of January 2014.

Illustration photo

The Ministry of Finance has drafted a Circular guiding the implementation of the extension and reduction of a number of State Budget revenues according to Resolution No. 02/NQ-CP of the Government.

The draft clearly stipulates a 6-month extension of the deadline for paying corporate income tax and value added tax.

6-month extension of corporate income tax payment deadline

Specifically, the deadline for paying corporate income tax for the first quarter is extended by 6 months and the deadline for paying corporate income tax for the second and third quarters of 2013 is extended by 3 months.

The subjects eligible for extension include: Small and medium-sized enterprises, including cooperatives (employing less than 200 full-time employees and having annual revenue of no more than VND 20 billion); Enterprises employing many workers (employing more than 300 workers) in the fields of production, processing, and manufacturing: Agricultural products, forestry products, aquatic products, textiles, footwear, electronic components; construction of economic and social infrastructure works; Enterprises investing and trading (selling, leasing, leasing-purchasing) housing.

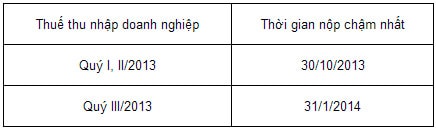

The extension period for paying corporate income tax is calculated as follows:

The extended corporate income tax amount in this clause does not include the tax amount calculated on income from financial business activities; banking; insurance; securities; lottery; prize-winning games; and trading of goods and services subject to special consumption tax.

6-month extension of VAT payment deadline

Draft regulations on a 6-month extension of the deadline for payment of value added tax (VAT) for VAT payable in January, February and March 2013 (excluding VAT at the import stage) for enterprises currently paying VAT using the deduction method.

The VAT payment extension period is as follows:

Subjects eligible for VAT payment extension include:

Firstly, small and medium-sized enterprises, including cooperatives (employing less than 200 full-time workers and having annual revenue of no more than VND 20 billion), excluding enterprises operating in the following fields: finance, banking, insurance, securities, lottery, prize-winning games, production of goods and services subject to special consumption tax.

Second, enterprises employing a lot of labor (using more than 300 workers) in the fields of production, processing, and manufacturing: agricultural products, forestry products, aquatic products, textiles, footwear, electronic components; construction of economic and social infrastructure works.

Third, businesses investing and trading (selling, leasing, leasing) houses and businesses producing products: iron, steel, cement, bricks, and tiles.

This draft is being published by the Ministry of Finance for public consultation.

According to (Chinhphu.vn) - LT