Income over 6 million VND must pay personal income tax

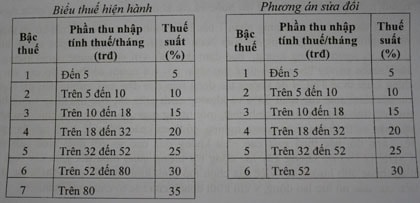

The Ministry of Finance has just announced the Draft Law amending and supplementing a number of articles of the Law on Personal Income Tax. Accordingly, the two most notable contents of this revision are increasing the family deduction to 6 million VND/month and reducing the progressive tax rate to 6 levels, with the highest tax rate being only 30%.

The Law on Personal Income Tax took effect on January 1, 2009. After 3 years of implementation, personal income tax revenue has increased rapidly both in absolute terms and in proportion to total revenue (accounting for 5.5% of total state budget revenue).

|

| Ministry of Finance decides to amend the Law on Personal Income Tax |

On that basis, the Ministry of Finance has decided to amend a number of laws to suit the reality. The content of this amendment includes 4 main issues: increasing the family deduction level to 6 million VND/month (72 million VND/year); reducing the progressive tax rate to 6 levels, with the highest tax rate being only 30%; amending and supplementing the scope and subjects of tax; and re-stipulating the contents of tax settlement and management.

|

| Current progressive tax schedule and proposed amendments |

With the current deduction of 4 million VND/month, if calculated according to the GDP growth rate (from 6.5-7%/year), it will be about 5.85 million VND/month in 2014. If calculated according to the CPI index (at a level below 2 digits), it will be 6.5 million VND/month in 2014.

Therefore, the Ministry of Finance has decided to increase the family deduction level to 6 million VND/month, 1.7 times higher than the GDP per capita in 2014, and 3.6 times higher than the minimum wage applicable to officials and civil servants. In particular, the new family deduction level also ensures two factors: it is higher than the average income of society, and the highest compared to countries in the region with economic conditions similar to Vietnam.

Along with that, the Ministry also increased the deduction for each dependent from the current VND1,600,000 to VND2,400,000. If approved by the National Assembly, the new Law will officially take effect from January 1, 2014.

According to calculations, when the new Law comes into effect, the state budget will reduce revenue by about more than 8,000 billion VND per year. In return, Vietnam's economy will be more suitable for the roadmap to join the WTO (reducing domestic revenue), while creating a more open environment for foreign investors.

According to VTC.vn