Policy Credit: Bringing Learning Opportunities to Poor Students in Nghe An

(Baonghean.vn) - Nghe An is the province with the highest outstanding student debt in the country. With the spirit of "not letting any student with difficult circumstances drop out of school due to lack of tuition fees", the Social Policy Bank, Nghe An Branch is determined to overcome difficulties, bring capital to the people, and bring learning opportunities to tens of thousands of poor students.

Support to school

The days of "not having enough food and clothes" are gone, but Mr. Nguyen The Tuyen (born in 1968) - a member of the Savings and Loan Group in Thuan Phu hamlet, Thuan Son commune (Do Luong) - has not forgotten those difficult days. Without the support fromVietnam Bank for Social PoliciesWithout support, his family would not have been able to pay off the bank debt, develop the family economy and raise their children to finish college and have stable jobs.

In 2007, Mr. Tuyen's family was considered poor; the couple worked as farmers and raised four school-age children. It was so difficult that after graduating from grade 12, his first two children had to pack up and go to work for a living. In 2008, the third child passed the entrance exam to Ho Chi Minh City University of Law, but "the family's economic difficulties meant where would they get the money to study?"

|

In addition to borrowing money for his children's education, Mr. Nguyen The Tuyen's family in Thuan Phu hamlet, Thuan Son commune (Do Luong) also received loans from the Social Policy Bank to develop breeding of buffalo and cows. Photo: Thu Huyen |

Mr. Tuyen said: With the encouragement and comments of the Savings and Loan Group of the Social Policy Bank in Hamlet 8 (now Thuan Phu Hamlet), I boldly borrowed capital from the Student Program at the Social Policy Bank to invest in my children's education. Thanks to that, my family had enough money to cover the education costs of the third child, then the fourth child with a total amount of 76.6 million VND. In addition to borrowing capital for children's education, the family also received loans from the Social Policy Bank to develop breeding of buffaloes and cows.

Up to now, my family has escaped poverty and become a well-off household in the whole commune. Our current assets are 15 buffaloes and cows worth over 300 million VND; especially, our two youngest children have been able to go to school properly, have now graduated and have stable jobs with high incomes.

Over the past 20 years, Do Luong district has had 22,585 households borrow capital to send their children to universities, colleges, and vocational schools. During the implementation of Decision 157/2007/QD-TTg of the Prime Minister on student credit, in Do Luong district there was no case of dropping out of school due to lack of money to pay tuition fees. After graduating, basically all students have jobs and income to repay their debts on time.

|

| Ms. Dau Thi Thu in Minh Thang hamlet, Quynh Bang, Quynh Luu (left) borrowed student loans to invest in her child's education at Vinh Medical University. Photo: Thu Huyen |

In Dien Chau district, the loan program for students in difficult circumstances with a 20-year loan turnover of over 500 billion VND with 26,218 students in difficult circumstances borrowing money to go to school. Many families have 3-4 children going to school and have enough conditions to study. A typical example is the household of Mr. Hoang Van Thu in Xuan Bac hamlet, Dien Van commune. Mr. Thu has 5 children who are all in university, all 5 of them borrowed money from students, were able to study properly, and after graduating, had stable jobs. The loan amount is 125.5 million VND, currently his family has paid off all the debt.

Or Ms. Hoang Thi Huong in Hamlet 5, Dien Tan Commune, also thanks to the policy credit capital, she finished university, now she is the Secretary of the Youth Union of Dien Tan Commune (Dien Chau). Sharing with us, she still remembers clearly the difficult days when she entered the lecture hall of Hue University of Sciences.

|

Ms. Hoang Thi Huong in Hamlet 5, Dien Tan Commune also finished university thanks to policy credit capital, and is now the Secretary of the Youth Union of Dien Tan Commune (Dien Chau). Photo: Thu Huyen |

Ms. Huong said: “In 2006, I passed the university entrance exam but my family's circumstances were so difficult that I was quite worried. Then, thanks toStudent Program fundingThanks to the Social Policy Bank, my parents had money to send us to school. After graduating, we had stable jobs in our hometown and were able to repay the bank. The 37 million VND borrowed during those 4 years of study was very meaningful, helping me to go to school and opening up a bright future. Hopefully, this source of capital will continue to be effective and many families in difficult circumstances will be able to borrow."

Ppromote the value of the program

In order to prevent any student from having to stop studying because they do not have money to pay tuition fees, from the initial loan amount of only 800,000 VND, on March 23, 2022, the Prime Minister issued Decision No. 5/2022/QD-TTg amending and supplementing Decision 157/2007/QD-TTg dated September 27, 2007 on credit for students. Accordingly, the maximum loan amount for the student loan program was increased to 4 million VND/month, meeting the minimum cost needs for students to study.

|

| Mr. Thai Van Chin in Hamlet 3, Ly Thanh Commune, Yen Thanh borrowed money for his son to go to university. Photo: Thu Huyen |

In addition, this decision also amends and expands student loans for households, in addition to poor households, near-poor households, households with sudden difficult circumstances, and households with average living standards according to the standards prescribed by law.

Another very open new policy to support students is that on April 4, 2022, the Prime Minister issued Decision 09/2022/QD-TTg to help studentsbuy computers and equipment for online learning, maximum loan amount of 10 million VND/case, with interest rate of 1.2%/year. The condition is being a member of a poor or near-poor household, a household with an average living standard according to the law or a household in difficult circumstances due to the impact of the Covid-19 epidemic.

Implementing the policy of lending to students with difficult family circumstances to buy computers and equipment for online learning, Yen Thanh district is the first unit in Nghe An to disburse loans for students to buy computers. That is the case of student Thai Van Luc - son of Mr. Thai Van Chin in hamlet 3, Ly Thanh commune, studying at Hanoi University of Industry. Mr. Thai Van Chin's family is poor, both husband and wife are farmers and often sick, so raising their children to study is difficult. In addition to being able to borrow 12.5 million VND to cover their children's study expenses, the family is supported to borrow 10 million VND with an interest rate of 1.2%/year, loan term of 36 months.

|

| Representatives of the Social Policy Bank of Quynh Luu district gave gifts to encourage students in hamlet 12, Quynh Tan commune. Photo: Thu Huyen |

Mr. Phan Huu Trang - Director of the Transaction Office of the Social Policy Bank of Yen Thanh District said: Yen Thanh is a land with a tradition of studiousness, in the whole district there are tens of thousands of students studying. Up to now, 27,836 students with difficult circumstances have been able to borrow money for their studies; thanks to that, there is no longer a situation where poor students have to drop out of school because of lack of money to pay tuition fees, helping them have the opportunity to study to improve their qualifications, learn a trade and have the opportunity to find stable jobs.

According to the aggregate data, loan salesCstudent loan program,students according to Decision No. 157/2007/QD-TTg dated September 27, 2007 of the Prime Minister,Nghe An province reached 4,475 billion VND with more than 250000625 households borrowed capital000pupil,students studying. Debt collection revenue of 4,179 billion VND, outstanding debt todayJune 30, 2022 is 295 billion VND, accounting for 100%tears2.8% of total outstanding debt, with 8.4 thousand households borrowing capital.

Credit for students shows profound social significance, affirms the Party and Government's preferential policies and guidelines, and has created a high consensus among the social community. The program has made an important contribution to the policy of developing, training and improving the quality of human resources to serve the country's industrialization and modernization.

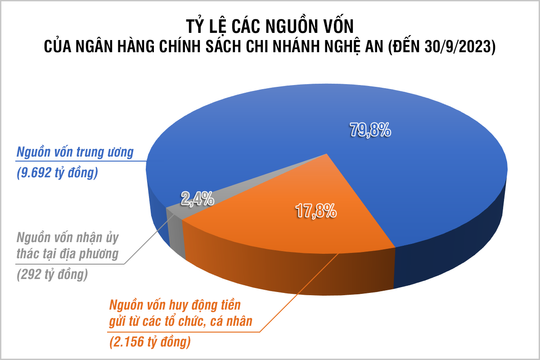

Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: This is a highly socialized policy credit program, involving many levels, many sectors, many organizations and individuals from the central to local levels in mobilizing capital to organizing loans, collecting and handling debts. For the program to continue to be highly effective, authorities at all levels need to regularly review and promptly supplement poor households,near-poor households, thereby having a basis for seriously implementing the confirmation of families eligible for student credit loans, promoting the positive values of the program.