Credit in Nghe An province grows quite well

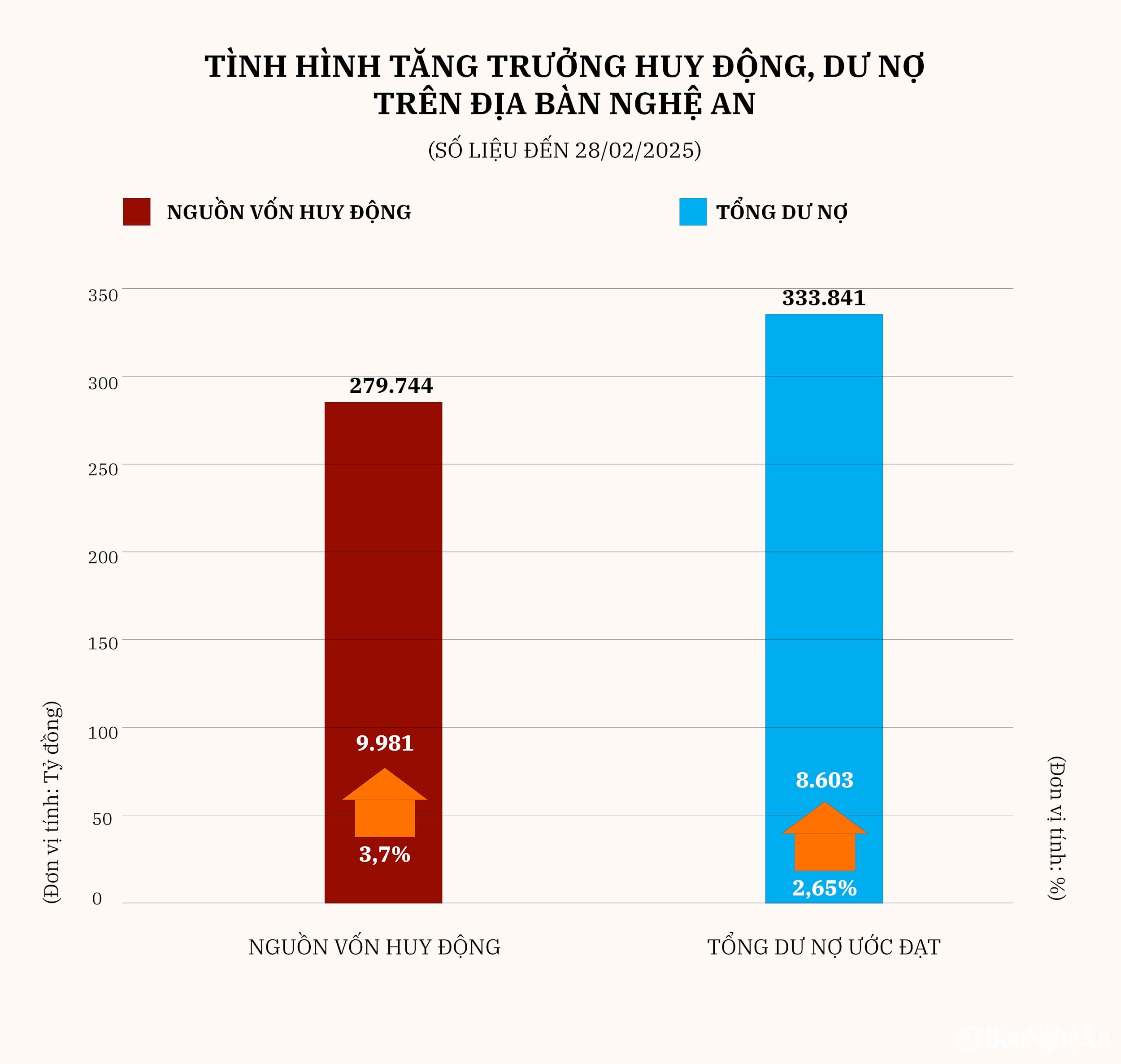

The State Bank of Vietnam, Nghe An branch, said that compared to the beginning of the year, mobilized capital in the province increased by nearly VND10,000 billion, equivalent to 3.7%; credit growth increased by 2.65%, equivalent to more than VND8,600 billion.

By the end of February 2025, mobilized capital in Nghe An is estimated at 279,744 billion VND, an increase of 9,981 billion VND compared to the beginning of the year, equal to 3.7%, and an increase of 4,180 billion VND compared to the previous month, equal to 1.5%.

In early 2025, credit growth across the system showed signs of improvement compared to the same period last year. If in the first quarter of 2024, the total outstanding debt of credit institutions in Nghe An increased by only 0.9% compared to the beginning of the year, by the end of February 2025, the total outstanding debt is estimated at VND 333,841 billion, an increase of VND 8,603 billion compared to the beginning of the year, equal to 2.65%.

Excluding the Development Bank, outstanding debt reached VND 325,711 billion, an increase of VND 8,563 billion compared to the beginning of the year. Of which, medium and long-term debt (excluding the Development Bank) is estimated to account for 38.7% of total outstanding debt, outstanding debt in VND is estimated to account for 99% of total outstanding debt.

Total bad debt of banks in the area is estimated at 4,830 billion VND, accounting for 1.45% of total outstanding debt.

Outstanding balance of some credit programs estimated by the end of February 2025:

+ Outstanding loans for the rural agricultural sector and rural areas in the whole area are estimated at 145,722 billion VND, accounting for 43.7% of outstanding loans in the whole area.

+ Outstanding loans for high-tech agricultural development and clean agriculture according to Resolution 30/NQ-CP are estimated at 19,665 billion VND, accounting for 5.9% of total outstanding loans in the whole area.

+ Outstanding export loans are estimated at 2,600 billion VND, up 13.2% compared to the beginning of the year.

+ Outstanding loans for housing support under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 63 billion VND, down 5.4% compared to the beginning of the year.

+ Outstanding loans for shipbuilding under Decree 67/2014/ND-CP are estimated at 70 billion VND, down 9.7% compared to the beginning of the year.

Expected credit growth of the entire system is 16%: It is known that in 2025, the State Bank will continue to innovate credit growth management measures and implement a roadmap to gradually reduce and eventually eliminate the allocation of credit growth targets for each credit institution, striving to achieve the expected credit growth of the entire system is 16%. Proactively and promptly adjust the credit growth target for credit institutions based on macroeconomic developments and actual situations without needing written requests from credit institutions to promote economic growth.