China rushes to spend money to buy the world

In recent years, Chinese corporations have poured hundreds of billions of dollars into acquiring companies in countries included in the “Belt and Road Initiative” (BRI).

|

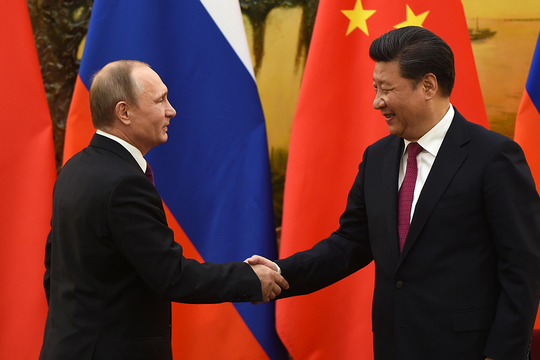

| HNA Group, an emerging conglomerate from China, is leading in overseas M&A deals - Photo: Reuters |

While Beijing's tight control over capital outflows continues to be in effect, the value of M&A deals by Chinese corporations has continued to increase in 68 countries within the BRI.

Specifically, as of August 15, Chinese enterprises have spent 33 billion USD on 109 M&A deals in the above countries. This figure is much higher than the 31 billion USD of the whole of 2016.

China's investment value in BRI countries in the first seven months of 2017 stood at $7.65 billion, up 5.7 percent year-on-year, according to Xinhua.

Two opposite trends

The growth and momentum of Chinese businesses in BRI countries is contrary to the bigger picture.

In late 2016, the Chinese government imposed strict controls on capital outflows.

“The Chinese are thinking long-term when investing in BRI countries. Of course, such mergers are shaped by decisions from the Chinese government. Commercial lawyer HILARY LAU |

According to official Chinese government data, in 2016 Chinese companies spent a record $220 billion to acquire everything from a film studio to a European football club.

Such huge capital outflows are believed to have contributed to the devaluation of the yuan, which is under pressure from a slowing domestic economy.

Faced with this reality, the Beijing government immediately changed its policy, tightening foreign investment projects, warning of "blind, irrational investment".

Soon after it was launched, many M&A deals initiated by Chinese enterprises around the world collapsed or were postponed indefinitely.

As a result, investment value, including M&A activities of Chinese enterprises, globally in the first 7 months of 2017 decreased by nearly 42% compared to the same period last year, according to Reuters.

However, in the 68 countries in the BRI, the situation is different. M&A activities initiated by Chinese enterprises are bustling. Money from China continuously flows into these countries.

favor

First mentioned in 2013, BRI is seen as a way for Chinese President Xi Jinping to promote the “Chinese Dream”.

During the BRI Summit held in Beijing in May 2017, Mr. Tap announced that he would spend 124 billion USD on the above ambition.

The Beijing government has also actively promoted the BRI with a commitment to increase investment and create more jobs in BRI participating countries.

It is therefore not surprising that Chinese businesses are favored when doing business in the BRI, even though Beijing's general policy is to limit capital flows abroad.

Enterprises transferring money to BRI countries will be considered in a separate channel, with more favorable conditions than enterprises investing in countries outside the BRI.

“If you intend to invest in a BRI country, that will be the first sentence that will be noticed in your application for approval,” Reuters quoted an anonymous senior investment advisor of a Chinese company.

In late July, China Merchants Ports Holdings Group spent $1.12 billion for a 70% stake in the deep-water port of Hambantota in Sri Lanka, a BRI participant.

Earlier, Global Logistics Properties, a Singapore-based group, agreed to merge with a Chinese joint venture for $11.6 billion, which is considered China's largest M&A deal in a BRI country.

HNA Group, a Chinese conglomerate specializing in acquiring global companies and assets, after two failed deals due to capital restrictions, has begun to shift its priorities to BRI countries such as the Philippines, Singapore, Malaysia, etc.

Speaking to Bloomberg, experts predicted that China's policy of restricting and controlling capital flows abroad will likely be maintained for at least another 12 months. Positive signals from the yuan and China's successful holding of the 19th National Congress of the Communist Party of China could partially "untie" businesses affected by the above policy. |

According to tuoitre.vn

| RELATED NEWS |

|---|

.jpg)