USD exchange rate today 7/1/2025: USD plummets, EUR explodes

USD exchange rate today 7/1/2025: The State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 3 VND, currently at 24,337 VND. The US Dollar Index (DXY) decreased by 0.72%, currently at 108.23.

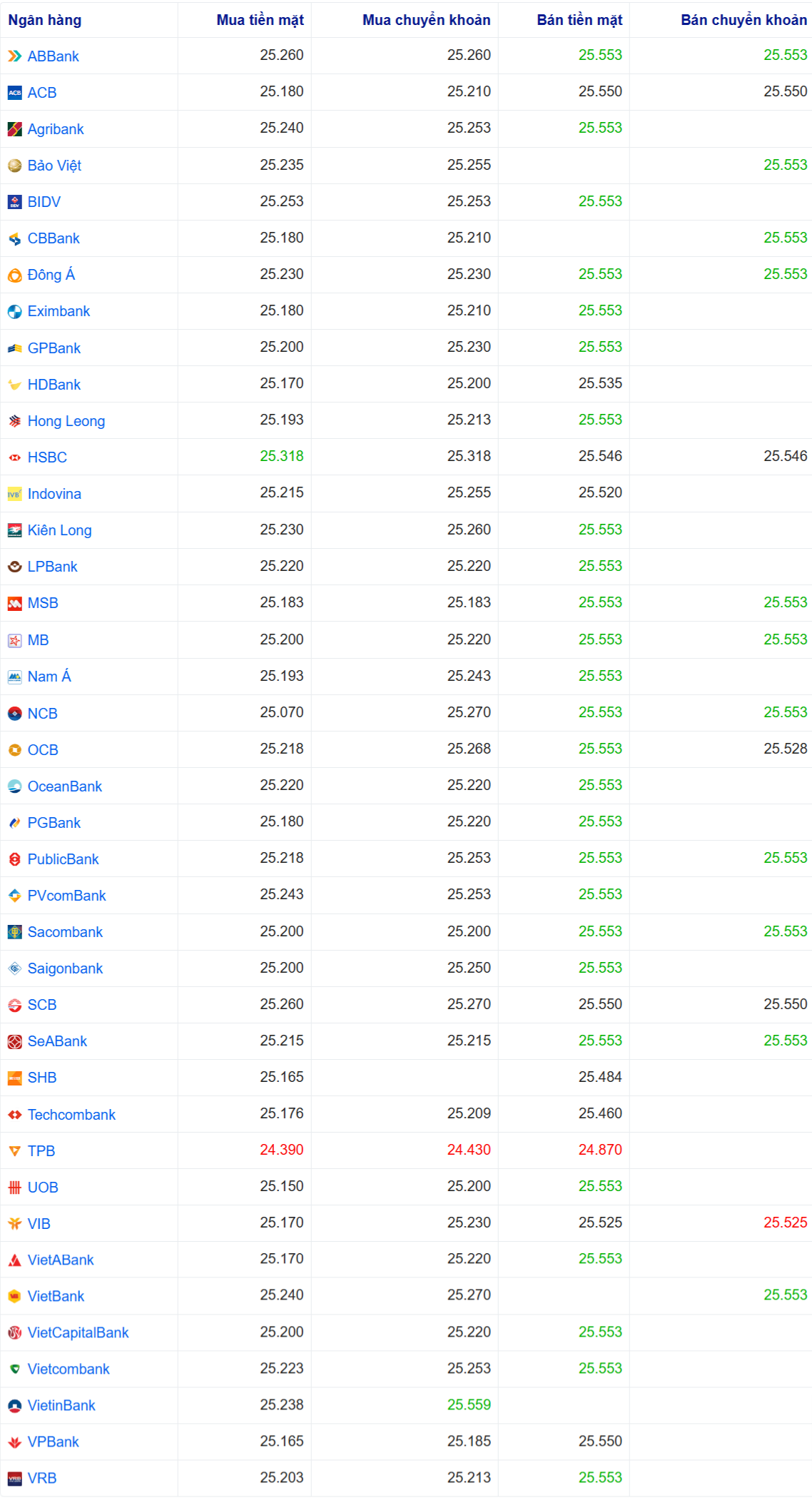

USD exchange rate today in the country

At the time of survey at 5:00 a.m. on January 7, the central exchange rate at the State Bank was currently 24,337 VND/USD, up 3 VND compared to the previous trading session. The USD Index (DXY) was at 108.24 - down 0.6 points compared to yesterday's trading session.

Specifically, at Vietcombank, the USD exchange rate increased by 3 VND in both buying and selling compared to the previous session, at 25,223 - 25,553 VND/USD, buying and selling.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 25,318 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,559 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

VIB Bank is selling USD transfers at the lowest price: 1 USD = 25,525 VND

ABBank, Agribank, BIDV, Dong A, Eximbank, GPBank, HDBank, Hong Leong, Kien Long, MSB, MB, Nam A, NCB, OCB, PGBank, PublicBank, PVcomBank, Sacombank, Saigonbank, SeABank, UOB, VietABank, Vietcombank, VRB are selling USD cash at the highest price: 1 USD = 25,553 VND

ABBank, Bao Viet, CBBank, Dong A, MSB, MB, NCB, PublicBank, Sacombank, SeABank, VietBank are selling USD transfers at the highest price: 1 USD = 25,553 VND

| 1.Agribank- Updated: 07/01/2025 07:00 - Time of the source website | ||||

| Foreign currency | Buy | Sell | ||

| Tên | Mã | Tiền mặt | Chuyển khoản | |

| USD | USD | 25,240 | 25,253 | 25,553 |

| EUR | EUR | 25,664 | 25,767 | 26,861 |

| GBP | GBP | 30,984 | 31,108 | 32,065 |

| HKD | HKD | 3,203 | 3,216 | 3,320 |

| CHF | CHF | 27,405 | 27,515 | 28,364 |

| JPY | JPY | 157.58 | 158.21 | 164.97 |

| AUD | AUD | 15,522 | 15,584 | 16,088 |

| SGD | SGD | 18,266 | 18,299 | 18,804 |

| THB | THB | 717 | 720 | 751 |

| CAD | CAD | 17,297 | 17,366 | 17,856 |

| NZD | NZD | 0 | 14,062 | 14,547 |

| KRW | KRW | 0 | 16.52 | 18.19 |

| 2.Sacombank- Updated: 03/07/2005 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Tên | Mã | Tiền mặt | Chuyển khoản | |

| USD | USD | 25200 | 25200 | 25553 |

| AUD | AUD | 15492 | 15592 | 16159 |

| CAD | CAD | 17297 | 17397 | 17951 |

| CHF | CHF | 27598 | 27628 | 28514 |

| CNY | CNY | 0 | 3428 | 0 |

| CZK | CZK | 0 | 990 | 0 |

| DKK | DKK | 0 | 3500 | 0 |

| EUR | EUR | 25816 | 25916 | 26801 |

| GBP | GBP | 31145 | 31195 | 32303 |

| HKD | HKD | 0 | 3271 | 0 |

| JPY | JPY | 157.9 | 158.4 | 164.93 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 16.9 | 0 |

| LAK | LAK | 0 | 1.129 | 0 |

| MYR | MYR | 0 | 5820 | 0 |

| NOK | NOK | 0 | 2229 | 0 |

| NZD | NZD | 0 | 14099 | 0 |

| PHP | PHP | 0 | 412 | 0 |

| SEK | SEK | 0 | 2280 | 0 |

| SGD | SGD | 18180 | 18310 | 19041 |

| THB | THB | 0 | 677.5 | 0 |

| TWD | TWD | 0 | 770 | 0 |

| XAU | XAU | 8350000 | 8350000 | 8500000 |

| XBJ | XBJ | 8000000 | 8000000 | 8500000 |

USD exchange rate today in the world

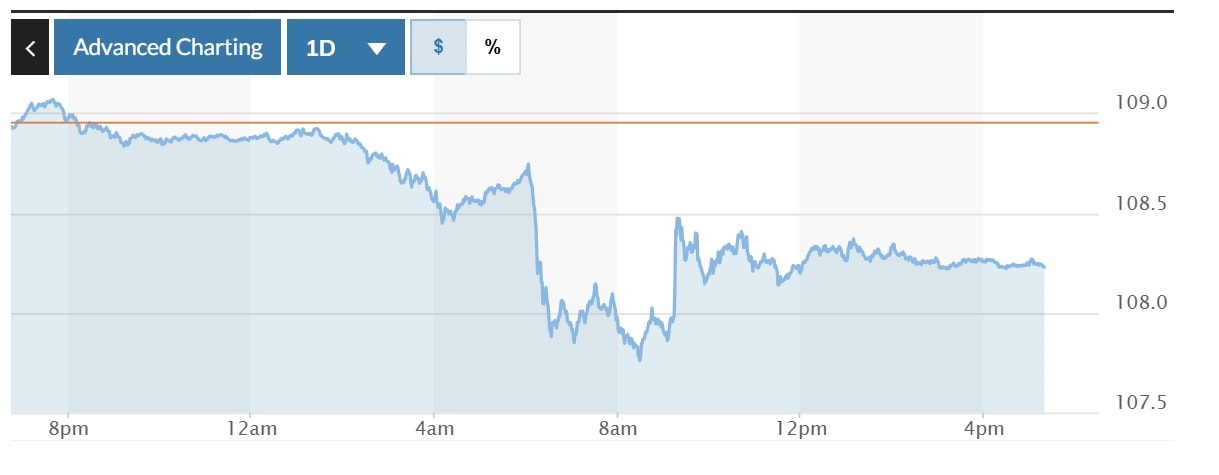

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.72%, currently at 108.23.

The US dollar fell in the last trading session, following mixed reports about the aggressiveness of tariff policies under US President-elect Donald Trump when he takes office.

The dollar fell sharply, at one point hitting 107, after the Washington Post reported that Trump aides were considering plans to impose tariffs on every country.

The dollar's decline was then curbed as soon as Mr Trump denied the report in a post on his Truth Social platform.

The decline in the US dollar has set the stage for the euro to rise 0.76% to $1.0386. The US dollar is on track for its biggest one-day drop since November 27, while the euro is poised for its biggest one-day gain since August 2.

The DXY index hit a two-year high of 109.54 last week and is on track for a fifth straight weekly gain, as a recovering economy, the possibility of higher inflation from tariffs and a slower pace of rate cuts from the US Federal Reserve (Fed) have supported the greenback.

The Chinese yuan rose 0.16% against the greenback to 7.348. The dollar hit a 26-month high against the currency last week as China is seen as one of the Trump administration’s main tariff targets.

Also helping to cool the dollar were comments from Fed Governor Lisa Cook, who said the Fed can afford to be cautious with any further rate cuts given the strong economy and more stable inflation than expected. Several Fed policymakers are scheduled to speak this week and are likely to echo recent comments from other Fed officials that the race against inflation is not over.

The euro, which hit its lowest since November 2022 last week, gained after German annual inflation data came in higher than forecast in December.

US economic data showed new orders for US-made goods fell in November while business spending on equipment appeared to have slowed in the fourth quarter.

Against the Japanese yen, the US dollar rose 0.17% to 157.53 while the British pound rose 0.72% to 1.251 USD.

Investors will assess a slew of US labor market data this week, culminating in a key government payrolls report on January 10.

The CAD rose 0.74% against the greenback to CAD1.43.