USD exchange rate today January 8, 2025: Weak USD causes gold price to skyrocket

USD exchange rate today January 8, 2025: The central rate decreased to 24,332 VND. The free market continued to have the second consecutive session with a sharp decrease compared to the previous session.

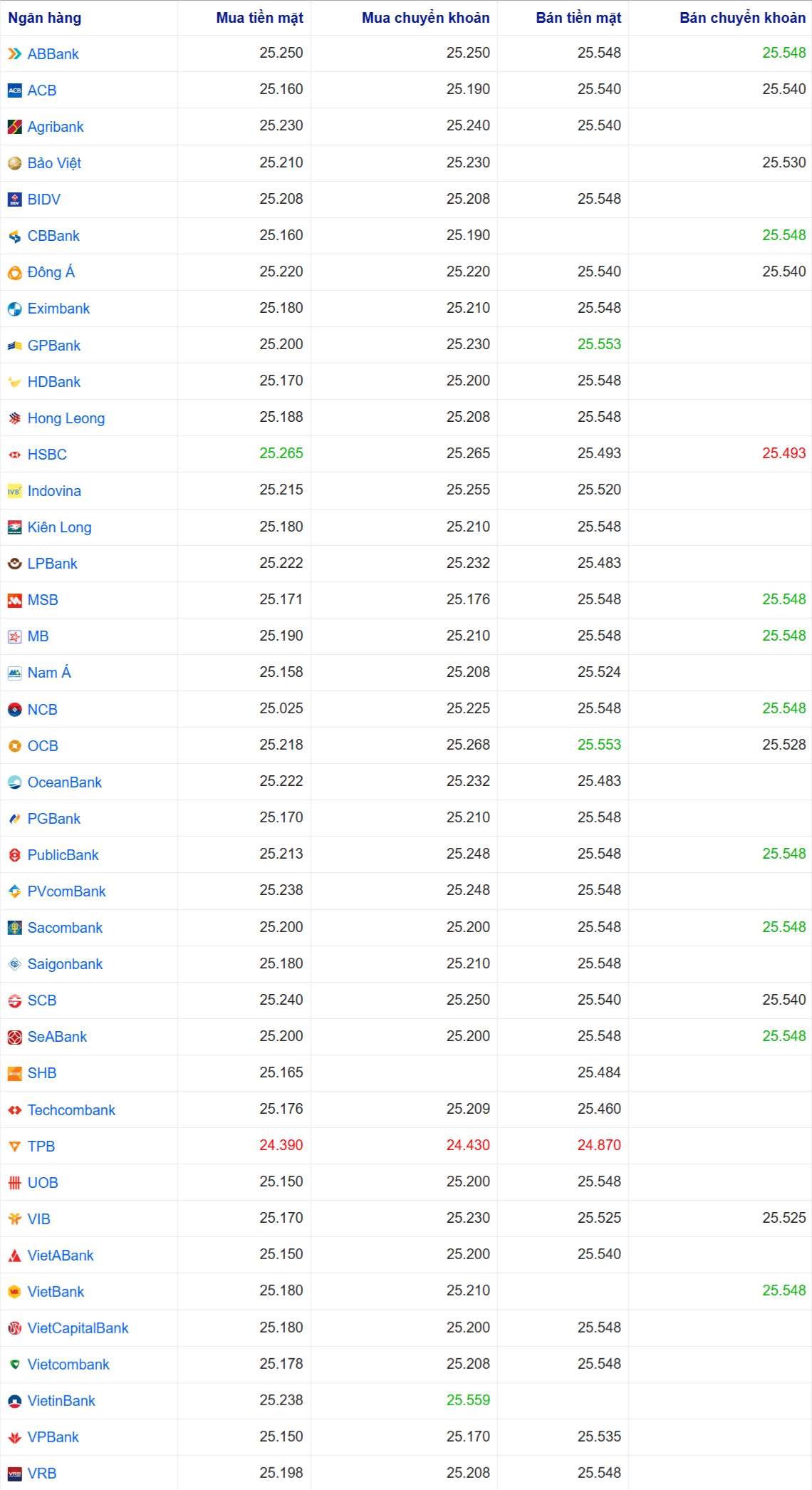

USD exchange rate in the country today

Specifically, the central exchange rate of the VND/USD currency pair announced by the State Bank for application in the session on January 8 was 24,332 VND, down 5 VND compared to the previously announced rate.

The reference USD exchange rate at the State Bank of Vietnam is listed at 23,400 - 25,450 VND/USD (buy - sell), unchanged in both buying and selling compared to the previous session.

Specifically, at Vietcombank, the USD exchange rate is 25,178 - 25,548 VND/USD, buying and selling.

TPB Bank is buying US Dollar cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying US Dollar transfers at the lowest price: 1 USD = 24,430 VND

HSBC Bank is buying US Dollar cash at the highest price: 1 USD = 25,265 VND

VietinBank is buying US Dollar transfers at the highest price: 1 USD = 25,559 VND

TPB Bank is selling US Dollar cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling US Dollar transfers at the lowest price: 1 USD = 25,493 VND

GPBank and OCB are selling US Dollar cash at the highest price: 1 USD = 25,553 VND

ABBank, CBBank, MSB, MB, NCB, PublicBank, Sacombank, SeABank, VietBank are selling US Dollar transfers at the highest price: 1 USD = 25,548 VND

The USD exchange rate in the free market this morning decreased sharply compared to the previous session. At the Hanoi market, at 6:54 am, the USD was traded (buying - selling) at around 25,646 - 25,746 VND/USD, down 52 VND/USD for buying and selling compared to the previous session.

| 1.Agribank- Updated: 08/01/2025 07:00 - Time of the website providing the source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,230 | 25,240 | 25,540 |

| EUR | EUR | 25,840 | 25,944 | 27,040 |

| GBP | GBP | 31,164 | 31,289 | 32,248 |

| HKD | HKD | 3,202 | 3,215 | 3,320 |

| CHF | CHF | 27,512 | 27,622 | 28,478 |

| JPY | JPY | 156.84 | 157.47 | 164.17 |

| AUD | AUD | 15,558 | 15,620 | 16,125 |

| SGD | SGD | 18,291 | 18,364 | 18,872 |

| THB | THB | 715 | 718 | 748 |

| CAD | CAD | 17,394 | 17,464 | 18,872 |

| NZD | NZD | 14,095 | 14,581 | |

| KRW | KRW | 16.66 | 18.36 | |

| 2.Sacombank- Updated: 03/29/2008 07:16 - Time of website supply | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25200 | 25200 | 25548 |

| AUD | AUD | 15590 | 15690 | 16258 |

| CAD | CAD | 17386 | 17486 | 18040 |

| CHF | CHF | 27661 | 27691 | 28564 |

| CNY | CNY | 0 | 3428 | 0 |

| CZK | CZK | 0 | 990 | 0 |

| DKK | DKK | 0 | 3500 | 0 |

| EUR | EUR | 26003 | 26103 | 26989 |

| GBP | GBP | 31370 | 31420 | 32530 |

| HKD | HKD | 0 | 3271 | 0 |

| JPY | JPY | 157.94 | 158.44 | 164.95 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17.1 | 0 |

| LAK | LAK | 0 | 1,122 | 0 |

| MYR | MYR | 0 | 5820 | 0 |

| NOK | NOK | 0 | 2229 | 0 |

| NZD | NZD | 0 | 14223 | 0 |

| PHP | PHP | 0 | 412 | 0 |

| SEK | SEK | 0 | 2280 | 0 |

| SGD | SGD | 18274 | 18404 | 19135 |

| THB | THB | 0 | 680.4 | 0 |

| TWD | TWD | 0 | 770 | 0 |

| XAU | XAU | 8350000 | 8350000 | 8500000 |

| XBJ | XBJ | 7900000 | 7900000 | 8500000 |

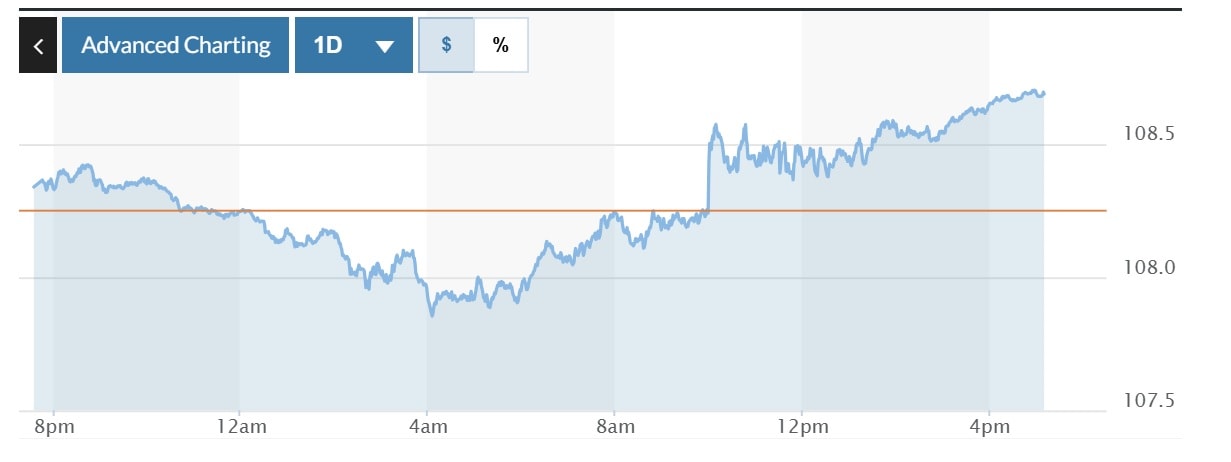

USD exchange rate today in the world

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.43%, currently at 108.68.

After only one session of decline, this morning the world gold price turned to increase thanks to the weakening of the USD. Domestic gold prices reversed and increased slightly, with the price of gold bars and gold rings adjusted up from 100,000 to 300,000 VND/tael in both directions. The difference between the world gold price and domestic gold price is about 1.7 million VND/tael.

The US dollar rebounded in the last trading session, as US economic data showed a generally stable job market and a strong service sector, creating conditions for the US Federal Reserve (Fed) to possibly slow down the current interest rate cutting cycle.

The greenback also rose to a near six-month high against the Japanese yen after the U.S. data. It rose 0.2% to 157.875 yen. Earlier, the dollar hit its highest since July at 158.425 yen.

New data showed that the number of jobs in the US increased unexpectedly in November, while the number of jobs, a measure of labor demand, increased by 259,000 to 8.098 million on the last day of November, according to the Bureau of Labor Statistics' Employment and Labor Turnover Survey, or JOLTS report. However, the number of jobs decreased by 125,000 to 5.269 million in November.

Activity in the US services sector also accelerated in December, while input prices jumped to their highest level in nearly two years, suggesting rising inflation. The Institute for Supply Management's non-manufacturing purchasing managers' index (PMI) rose to 54.1 last month, from 52.1 in November.

The US interest rate futures market has priced in a 95% chance that the Fed will pause its rate cuts this month, according to LSEG estimates. The futures also imply just 37 basis points of cuts by 2025, compared with two cuts expected in the Fed’s “dot plot,” or rate forecast.

Investors are now assessing US President-elect Donald Trump's actual policies on tariffs.

In the afternoon session, the DXY index rose to 108.70, after falling to 107.74, the lowest level since December 30.

On January 2, the index hit 109.58, its highest level in more than two years, on market expectations of fiscal stimulus and tariff hikes that Mr. Trump promised to implement to boost US growth.

In a contrasting move, the euro fell 0.4% to $1.0352, extending losses after the economic data.

Investors are now looking ahead to the US non-farm payrolls report due on January 10. A Reuters poll showed forecasts of about 160,000 jobs created in December, down from 227,000 new jobs created in November.

“The health of the US labor market is paramount to expectations for Fed action this year, so it is likely that, barring any major news from the new administration, we could see a quieter FX market until January 10,” said Helen Given, a FX trader at Monex USA in Washington.