30% of banking jobs will disappear in the next 5 years

The world banking industry is moving towards using modern technology to cut down on labor in order to reduce costs.

Vikram Pandit, who ran Citigroup during the financial crisis, said technological developments could wipe out 30% of banking jobs in the next five years. Pandit told Bloomberg that artificial intelligence and robotics will reduce the need for workers.

“Everything that’s happening with artificial intelligence, robotics, natural language—all of these things are going to make processes easier. It’s going to change offices,” said Pandit, who is now CEO of Orogen Group, a company he co-founded last year.

|

Banking industry staff could lose 30% in the next 5 years. Photo: Bloomberg |

Wall Street’s biggest firms are using technologies including machine learning and cloud computing to automate their operations, forcing many employees to lose their jobs or find new positions. Bank of America Corp. CEO Tom Montag said he will continue to cut costs by using technology to replace people.

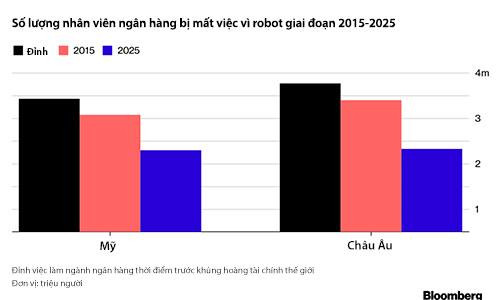

According to a report from March 2016, the number of lenders is estimated to decline by 30% between 2015 and 2025, mainly due to automation in retail banking. This move will cost 770,000 jobs in the US and about 1 million in Europe in the banking industry, Citigroup said.

In June, JPMorgan Chase & Co. CEO Jamie Dimon warned of the excessive impact of technology on jobs. While banks are using technology to cut costs, Dimon said his company's workforce will continue to grow as it hires more technical staff.

Pandit believes that the banking sector is becoming extremely competitive. He foresees the emergence of specialized providers as well as consolidation in the industry.

“I see a banking world moving away from large financial institutions to a more decentralized organization,” Pandit stressed.

Since leaving Citigroup, Pandit has invested in non-bank financial startups such as CommonBond and Point Digital Finance. Last year, he formed Orogen with investment firm Atairos Group to acquire stakes in financial services companies./.

According to VNE

| RELATED NEWS |

|---|

.jpg)