"The pressure on interest rates is huge"

There are three main factors that are putting great pressure on VND interest rates...However, the leaders of the functional departments of the State Bank recognized that achieving the goal of stabilizing and striving to reduce medium- and long-term interest rates in 2016 is feasible.

On March 1, Mr. Bui Quoc Dung, Director of the Monetary Policy Department (State Bank), gave some comments on the main impacts on the current interest rate level.

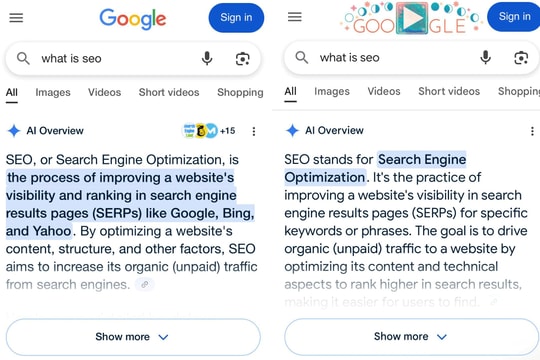

|

| Illustration photo |

The comments of the leaders of the State Bank's functional departments are noteworthy, in the context of the VND mobilization interest rate trending up at the beginning of this year, as well as clearer developments in recent days.

Mr. Dung said that as of the end of February 2016, lending interest rates of credit institutions were generally around 6-9%/year for short terms; 9-11%/year for medium and long terms; down about 0.2-0.5%/year compared to the beginning of 2015, in which the interest rate for medium and long term loans decreased by 0.3-0.5%/year, equal to 50% of the level at the end of 2011 and lower than the period of 2005-2006.

“However, in 2016, in the context of the international financial market having many unfavorable fluctuations, the pressure to mobilize capital from government bonds continues to increase and the demand for medium and long-term credit increases, the pressure on interest rates is very large,” said Mr. Dung.

Specifically, according to the Director of the Monetary Policy Department, there are three main factors creating great pressure on the current interest rate level.

Firstly, with inflation forecast at around 4-5% in 2016 compared to only 0.6% in 2015, this year's inflation expectations are much higher than last year's, thereby indirectly putting pressure on deposit interest rates.

Second, the growth target this year is 6.7%, higher than last year's growth rate of 6.68% and higher than the average of the 2011-2015 period (5.88%), reflecting that the demand for credit capital in 2016 will continue to increase.

Third, the sharp increase in the interest rate of 5-year government bonds from 5.4%/year to nearly 7%/year in 2015, along with the expected demand for capital mobilization from government bonds in 2016 being higher than in 2015, will create great pressure on the medium and long-term interest rate level.

Under those conditions, Mr. Dung said, the State Bank will continue to firmly and synchronously manage monetary policy tools, flexibly implement money pumping/withdrawing, through open market operations and other tools to regulate liquidity reasonably to support credit institutions to have conditions to smoothly supply capital to the economy.

The State Bank will also regulate interbank interest rates at a level consistent with market interest rates 1, ensuring liquidity for the entire system, thereby creating conditions to stabilize deposit and lending interest rates of credit institutions while still controlling inflation and not putting pressure on exchange rates.

According to Mr. Dung, the State Bank will continue to have new solutions and management tools, suitable to macroeconomic developments and monetary market conditions to improve the ability to regulate market interest rates in accordance with monetary policy objectives.

“With the synchronous implementation of such solutions, achieving the goal of stabilizing and striving to reduce medium- and long-term interest rates in 2016 is feasible,” Mr. Dung acknowledged.

According to VnEconomy

| RELATED NEWS |

|---|