Suddenly lost 94 million in bank account

The ATM card was still in his wallet and he was living in Hanoi, but Mr. Tam's account was withdrawn more than 94 million VND overnight in Ho Chi Minh City.

Mr. Hoang Minh Tam in Hanoi said that he has been using a debit card account of Saigon Thuong Tin Bank (Sacombank) for more than 7 years now. Before now, he often used it for transactions, payments andcurrently has a balance of more than 94 million VND in the account.

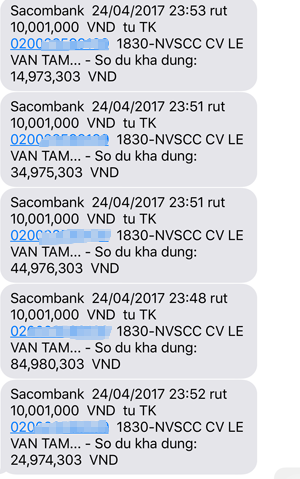

Around midnight on April 24, text messages reporting withdrawal transactions were continuously sent to his phone. However, it was not until the morning of April 25 that Mr. Tam checked his phone and discovered that there were text messages reporting that a total of more than 94 million VND had been withdrawn. For each successful transaction, 10 million VND was deducted. 9 transactions deducted a total of 90 million VND, the last transaction had a balance of 4.9 million VND so the bad guys withdrew this amount.

"I checked again and found the card was still in my wallet and I have never revealed my personal password to anyone before," he said.said to immediately call the card operator to lock the account, then go to the bank branch in Hanoi to file a complaint and ask for investigation.

|

Message notifying successful transaction and deducting money from Mr. Tam's account. |

Speaking to VnExpress, a Sacombank representative said that after receiving the information, the bank immediately conducted an inspection. Initially, the bank determined that the reason the customer lost money was because the information was stolen by a thief to make a fake card to withdraw money. Sacombank will refund the customer tomorrow (April 26), and is coordinating with the High-Tech Police (C50) to investigate.

Previously, a number of similar cases to Mr. Tam's had occurred.

The police investigation results show that the cause of money loss is often due to the cardholder's card information being disclosed when letting family members or others use it, or the account information being stolen... Bank representatives recommend that, to limit risks when using the card, customers need to keep the card safe, keep the PIN secret, not let others borrow or use the card, and promptly contact the Customer Care Center for timely support.

Regarding the recent loss of money in card accounts by some customers due to cybercrime attacks, experts say that this is a normal incident that can happen in any financial system in the world. The recent loss of money by customers is also an isolated case, criminals steal or defraud customers, obtain login information to electronic banking services or payment card numbers through parties outside the banking system...

On the other hand, as Vietnamese banks grow stronger and stronger, the number of customers increases, security will become more and more complex and stressful. Especially when cybercriminals are always running ahead, taking the lead in information technology.

Late last year, the State Bank issued Circular 30, adding regulations on handling complaints, providing guidance on payment intermediary services and managing ATM operations to ensure safety.

In case the loss is not due to the cardholder's fault or is not subject to force majeure as agreed in the contract, the bank must compensate within a maximum of 5 working days from the date of verification results. The maximum time limit for card issuers to notify verification results is 45 days.

If the deadline for handling the request for investigation or complaint as agreed in the contract has expired but the cause or fault of the party has not yet been determined, within the next 15 working days, the card issuing organization must agree with the cardholder on a solution or temporary compensation for the loss until there is a final conclusion from the competent authority clearly defining the fault and responsibility of the parties.

In cases with signs of crime, the State Bank stipulates that the handling of the results of the investigation and complaints is the responsibility of the competent state agency. If it is determined that there is no criminal element, the card issuing organization will negotiate with the cardholder on a plan to handle the results of the investigation and complaints within 15 working days.

According to VNE

| RELATED NEWS |

|---|

.jpg)