How do countries around the world calculate pensions?

(Baonghean.vn) - The pension case of a kindergarten teacher in Ha Tinh with a salary of only 1.3 million VND after 37 years of work has caused a stir in public opinion last week. Let's take a look at some countries in the world and see how they apply pension calculation methods?

1. America

|

| The elderly in the US receive old age benefits from the Social Security fund. |

The elderly in the US receive old-age benefits from the Social Security fund. For those who have worked, the old-age benefit is calculated based on the number of years of work and the salary during those years, similar to Social Security in Vietnam. The salary earner will deduct 6.2% of the salary and the salary payer will contribute another 6.2% of the salary to the Social Security fund.

Many Americans plan for their own retirement through a 401(k) plan because they cannot rely solely on Social Security. Under a 401(k) plan, each person decides what percentage of their salary to contribute to a retirement account.

The retirement account will be handed over to fund management companies or life insurance companies to manage and generate profits. Fund management companies usually create several investment funds with different levels of profit and risk for account holders to choose according to their own preferences.

The money contributed to the pension fund is not subject to income tax until withdrawn. Some employers also add a portion to the employee’s pension fund as long as the employee does not leave the company for more than 3-4 years.

American wage earners are advised to start a 401(k) plan as soon as they start receiving their paychecks. There are articles that direct people to the goal of having a million dollars in their 401(k) by the time they retire.

2. China

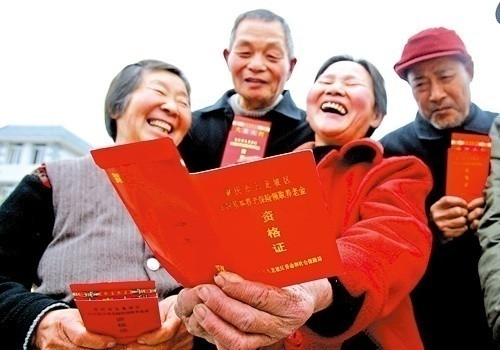

|

| The condition to receive a pension in China is to pay social insurance for at least 15 years. Photo: Internet |

In China, the retirement age is 60 for both men and women working in professional fields. For women working in non-professional fields, the retirement age is 55. For women working in other fields, the retirement age is 50. For workers working in hazardous environments, the retirement age is 55 for men and 45 for women.

The condition to receive pension is to pay social insurance (SI) for at least 15 years.

The early retirement age for men is 50 years old and for women is 45 years old, who have paid insurance for 10 years and are disabled. In the case of men aged 55 and women aged 45 who have paid insurance for 8-10 years and will continue to pay, if they work in a dangerous environment, they will be considered for early retirement.

Those who have reached retirement age but have not paid 15 years of insurance can choose to continue paying insurance until they reach 15 years, or contribute part of their pension to projects in rural areas or for those without pensions in the city.

Those who participated in the basic pension insurance program before 2011, when they reached retirement age but had not yet paid 15 years of social insurance but more than 10 years, can pay the rest in one lump sum to meet the criteria for receiving a pension under the current mechanism, or transfer that amount to projects in rural areas or to people without pensions in the city.

3. Denmark

|

| Regarding old age benefits in Denmark, according to the new law, an ordinary old person can receive a pension from the age of 65. |

There are two types of public pensions in Denmark. The first type guarantees a universal pension to all people over 65 who meet the eligibility criteria.

As of 2015, the maximum amount a person can receive is about $10,081. This figure will gradually adjust for higher-income individuals.

To receive the above pension, an individual must have lived in Denmark for 40 years between the ages of 15 and 65. If the residence is less, the individual will still receive a pension but it will be reduced proportionally.

Pension funds in Denmark are not based on insurance premiums or other contributions, but are funded by state taxes.

The second type is contributory pensions. Individuals who work for a long time and retire late will receive more money later. This is a type of pension that companies must contribute to for their employees aged 16-65 and who work more than 9 hours a week.

The employer will pay two-thirds of the fixed contribution. This amount will be reduced accordingly for part-time workers. There is also a pension based on the agreement between the employer and the employee. Typically, employees contribute between 9-17% of their salary. The higher the current contribution rate, the better the benefits later.

4. South Korea

|

| A soup kitchen serves poor elderly people in South Korea. Photo: CNA. |

The Asian country's pension system is for people over 60 years old and with at least 10 years of contributions. The pension system structure is largely based on taxes and related income.

Workers aged 18-59 are covered by a workplace pension system, based on contributions of 4.5% of their monthly gross income.

In addition, the current pension system is divided into types of benefit distribution according to job characteristics such as military officers, government employees and pension programs for private school teachers.

5. Japan

|

| Japan's national pension system is a program for all registered residents between the ages of 20 and 59. Illustration photo |

Japan's national pension system is a program for all registered residents between the ages of 20 and 59, including Japanese citizens and legally residing foreigners.

Contributions are deducted from employees' wages, while employers pay a set amount. The amount of pension is determined by the contribution rate to the general fund. The Japanese government maintains the pension fund to ensure stability and avoid risks.

For companies with 500 or more employees, employee pension funds are operated and they may not participate in the national pension system.

The employee pension fund operates independently and is managed by a committee consisting of representatives of employees and employers.

6. France

|

| Illustration photo |

In France there are 5 types of pensions, an elderly person in France can receive from 1 to 5 monthly pensions:

Minimum pension: A pension for the elderly who do not have enough money to live on (these people are not required to have previously participated in a pension fund)

State pension: Collects 6.65% of salary from the wage earner and 8.3% from the wage payer to pay the pensioner. The pension received cannot exceed 50% of the highest salary before retirement and cannot exceed €35,000/year.

Additional pension: The wage earner and the payer contribute extra to receive an additional amount upon retirement in addition to item 2 above to get 70-80% of pre-retirement income.

Collective voluntary pension: The wage earner and the payer contribute money to an investment fund to generate profits until retirement. The money in the fund is not subject to income tax.

Voluntary personal pension: Individuals deposit money into an investment fund, the money in the fund is not subject to income tax.

7. Thailand

|

| Elderly people in Thailand. Photo: Asia Correspondent |

People who reach retirement age (55 years old) in Thailand who want to receive a pension must meet the condition of having paid social insurance for at least 15 years. In case of paying insurance for more than 15 years, for each additional year of payment, the pension will be increased by 1.5%.

The total monthly salary of Thai pension will be equal to 20% of the average salary of the last 60 months of work, plus 1.5% of the remaining insurance premium after 15 years of contribution.

The formula for calculating pension in Thailand will be:

Monthly salary = {[20+ (1.5 * (t-15))] * w} / 100

In which, w = average salary in the past 60 months, and t = social insurance payment period.

8. Australia

|

| Illustration photo. |

There is no standard retirement age in Australia. Although some jobs and sectors have a set retirement age, most Australian workers generally start the retirement process when they reach 60.

Of course, if you own a business, you can retire whenever you want. In fact, actors, writers and artists don’t retire, while many others choose to retire early. The common retirement age for Australians is the government’s (currently 65) and will continue to rise to 70 by 2035 (if the government’s recommendations are accepted).

For most Australians, the pension is often not enough to cover their needs, which is why the superannuation benefit is so important. Currently the maximum pension is 766 AUD/2 weeks for a single person and 1154.8 AUD/2 weeks for a couple.

As a result, they often retain the proceeds in their pension funds to continue to generate income. This source can be reduced through a “pension distribution” program. This income is then offset in pensions or other investments.

Peace

(Synthetic)

| RELATED NEWS |

|---|