To make insurance truly a 'shield' for every family

(Baonghean.vn) - The essence of insurance is to protect against health and financial risks. However, the core value is sometimes "overshadowed" by incomplete understanding and false expectations. But if purchased for the right needs, insurance will bring out its value - sometimes exceeding expectations.

Value from insurance

Incorrect expectations about insurance such as high profits in a short period of time or liquidity like deposits have made many people forget the first and most basic benefit of life insurance is to protect health and life from unforeseen risks.

Thanks to its protective features, life insurance brings peace of mind, because it is a form of financial reserve for the future when everything is prepared to deal with risks. In fact, accidents, illnesses, and diseases often come with long-term and expensive treatment, not to mention the fact that it also entails many other consequences. Therefore, insurance not only ensures financial resources to overcome the consequences of risks, but is also a way to protect existing assets and future plans from being broken.

When purchased and understood correctly, insurance will bring out its greatest value as a solid "shield" and an effective backup plan, Mr. Vu Van Hai, Prudential Consultant in Thai Nguyen, emphasized through the story of a 29-year-old customer who received more than 3.4 billion VND in insurance benefits in Thai Nguyen City on June 10.

Ms. Nguyen Hong Nhung (residing in Thai Nguyen City) participated in the "PRU - Flexible Investment" package ofPrudentialfrom September 2021. She is the contract owner and the main insured, Mr. Ly Tung Lam (her husband) is also the insured of 3 supplementary products.

The couple was still young, so they did not think about using insurance one day, but unfortunately, something happened to Mr. Lam in the first year of participating. In March 2022, he had a serious traffic accident. After a long treatment, he was discharged from the hospital to go home, but his two legs could not recover forever, he had to move around in a wheelchair and lost the ability to work.

With the desire to help the customer's family, consultant Vu Van Hai shared:“Although this is not an Insurance Contract that I take care of, I am aware of the special circumstances of the customer. It is worth mentioning that due to economic difficulties, the customer was unable to pay the premium, leading to the invalidation at the time I knew about the incident.”.Even Mr. Lam and his family did not expect to receive benefits. Mr. Hai wholeheartedly guided his family to complete the necessary procedures and documents for the insurance company to appraise the payment because he believed that Lam's case would be compensated.“At the time of Mr. Lam's accident, the contract was still in effect, so I tried tosupportthe best family possible, as long as I can help them in times of difficulty and change",Mr. Hai shared.

After receiving more than 3.4 billion VND in total and permanent disability benefits, along with a number of other benefits, Mr. Lam was moved to thank Prudential and the consultant who enthusiastically supported him:“After the accident, my family had a really hard time. My child was only in first grade. Since the day I had the accident, my wife had to quit school and stay home to take care of me. She didn’t go to work and didn’t have a salary. This money is a lifeline for my family.”At decisive moments, insurance has played its true role and value that no other solution can.

Talking about his family, Mr. Dinh Ngoc Hung - a relative of a customer in Quang Binh admitted that he and his wife were hesitant to participate in insurance. As farmers and small restaurant owners, their finances were not very good, so at first they were quite hesitant to have to deduct a sum of money each month to put into insurance. In the end, the couple still decided to participate in insurance for "peace of mind" and also as "savings".

If it had changed, his family would not have been able to overcome the current difficulties, Mr. Hung confessed: "It was not until my wife got a serious illness that the whole family realized it was the right decision because for a farming family, a few billion is really a huge amount. Without insurance support, we wouldn't know what to do.".

His wife, Ms. Tam, suffered from spinal deformity and was medically diagnosed with an 81% disability rate. The difficulties made the family think that everything was at a “dead end”. With the nearly 2.6 billion VND in insurance benefits paid by Prudential, the family was given more motivation and confidence for her to treat the disease and raise their children to adulthood.

Accompany and protect

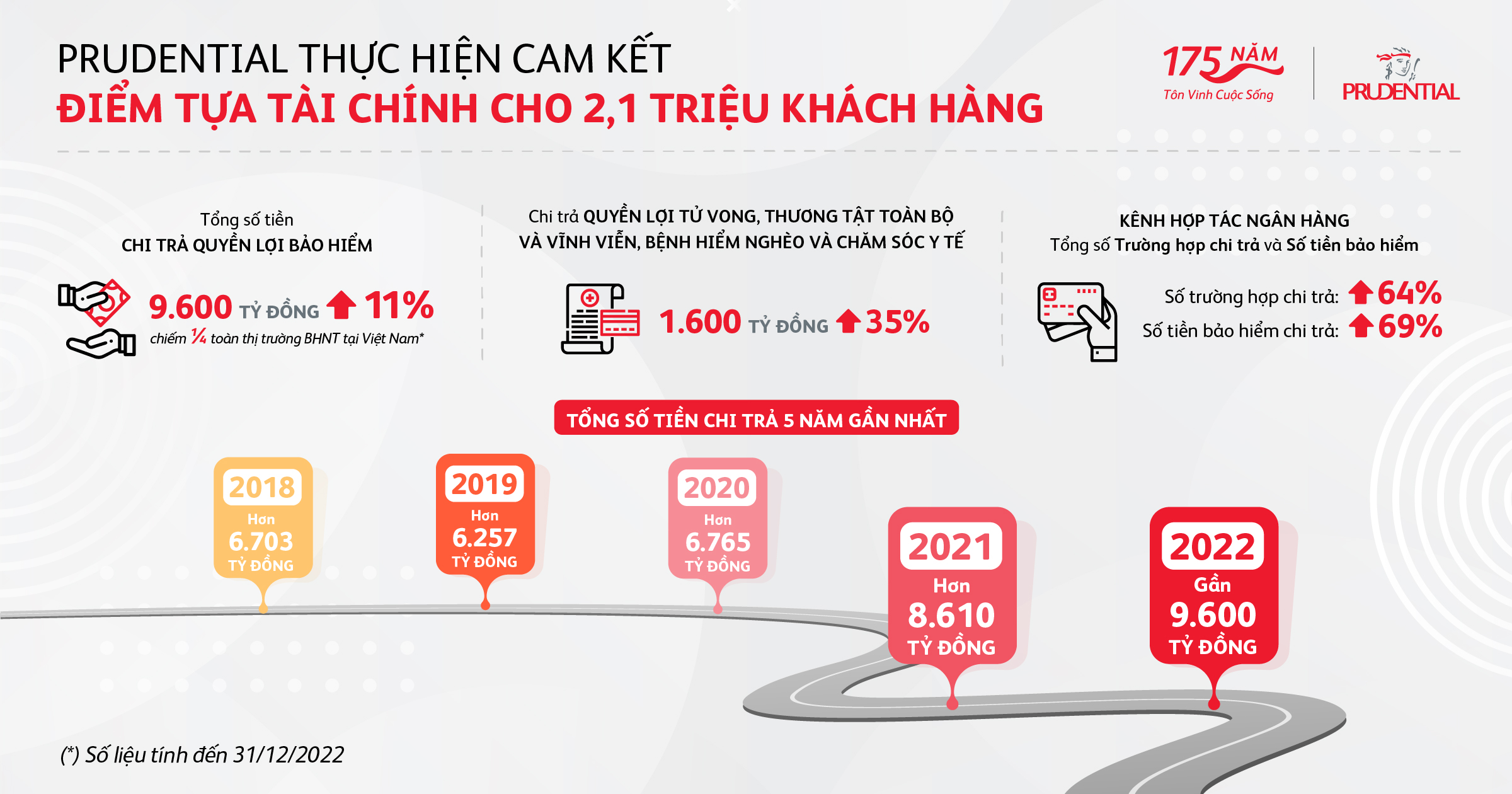

According to life insurance industry data, insurance payments have been increasing in recent years. At Prudential Vietnam, total insurance payments in 2022 reached nearly VND 9,600 billion, an increase of 11% compared to 2021, accounting for 25% of the life insurance market in Vietnam. Of which, the amount paid for insurance benefits including Death, Total and Permanent Disability, Critical Illness and Medical Care was more than VND 1,600 billion, an increase of 35% compared to 2021.

In particular, the payment statistics of this enterprise also show that up to 80% of customers receiving insurance benefits are under the retirement age group, 50% of insurance benefit payments are between the first and fifth years of the contract. This shows that, in reality, insurance benefits have played their best role in protecting and compensating for financial losses when customers face unpredictable risks, especially for customers of working age and are the economic pillars.

Payment data for 2022 and the last 5 years of Prudential Vietnam.

In 2022, the number of cases and the amount of insurance benefits paid to Prudential customers participating through the banking cooperation channel (Bancassurance) increased by 64% and 69% respectively compared to 2021. The largest payment amount for a customer participating in insurance through the Bancassurance channel was up to 6.8 billion VND.