Life insurance companies strive for 'protection value' for customers

(Baonghean.vn) - Life insurance companies have been constantly striving to ensure maximum benefits for genuine customers and maintain the health of the market in the context of increasing signs of profiteering.

The Vietnamese life insurance market has only developed in the last 30 years but is increasingly proving its important role in stabilizing the economy and ensuring social security. This stems from the nature of life insurance as a financial reserve for the future, to replace or partially compensate for income in case the insured person encounters unfortunate risks such as illness, accident, death...

Not only is it a solid financial support and provides protection value to participants, life insurance also demonstrates a willingness to share the burden with the community by helping the majority compensate for the minority.

Therefore, to provide optimal protection solutions for customers, life insurance companies - one of the important components of the insurance market - must develop sustainably in many aspects from human resources, products, technology and financial capacity. The combination of these factors is the foundation for insurance companies to always be ready and proactive in resolving insurance benefit requests for customers.

Understanding that life insurance is a practical financial support in difficult times, insurance companies always try to promote the fastest settlement and payment process. This process is carried out on the basis of careful assessment to ensure maximum benefits for customers. However, some insurance companies said that the above process is being affected by the increasing number of suspicious and unclear records appearing in some localities.

“Not only does it make the appraisal and compensation time longer in areas with many questionable records, the profiteering behavior also invisibly makes honest customers disadvantaged in terms of their rights when the insurance premiums they pay must be used to pay compensation for the fraudulent behavior of other insurance participants,”Deputy General Director of an insurance company based in Hanoi shared.

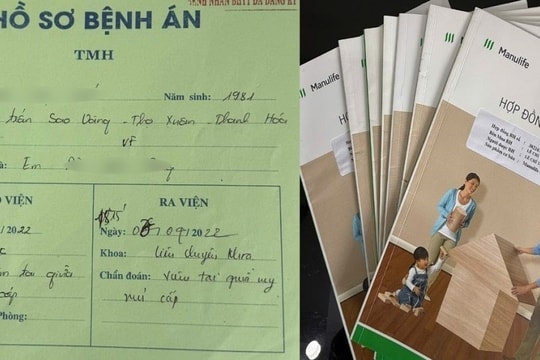

One of the most common fraudulent practices is providing false information about the insured’s condition by inflating the disability rate, using fake medical bills or forging medical orders. In addition, some customers also participate in life insurance contracts with many different companies and hide this information.

The level of boldness and methods of profiteering from life insurance are also more organized, with some subjects causing injuries to themselves to receive insurance compensation. Many other cases discovered also show collusion between customers, insurance agents and medical facilities.

For example, a life insurance company in the top 10 markets continuously received applications for insurance benefit payments for inpatient hospitalizations at a number of medical facilities in Nghe An province. However, when reviewing and comparing information in medical documents in the insurance benefit payment application, the company found that there were abnormalities in 14 applications, specifically the medical documents that these customers provided with a lot of duplicate information. Therefore, the insurance company verified with the medical facility and was informed that not only this patient but also the medical documents were not provided by the hospital. Currently, the company has reported the incident to the competent police agency for handling according to the law.

According to the representative of the Vietnam Insurance Association, in addition to death benefits, businesses have recently tended to expand the scope of insurance benefits such as hospitalization, minor disability, terminal illness, etc. to meet the increasing defense needs of customers, aiming for the most comprehensive protection value. However, this is a loophole for some subjects to commit fraudulent acts.

“Insurance fraud has been a headache for many years as it harms the ultimate goal of life insurance, which is to protect customers from life's events. Therefore, detecting and preventing insurance fraud is the top goal of the Vietnam Insurance Association and insurance companies to ensurehealthy, sustainable development of the market in general"- Mr. Ngo Trung Dung - Deputy General Secretary of Vietnam Insurance Association commented.

To limit insurance fraud and protect the rights of genuine customers, the Insurance Association believes that, in addition to sanctions that are strong enough to deter, it is also necessary to have propaganda programs to raise customers' awareness of their rights and obligations when participating in insurance, especially the obligation to make honest declarations as well as the consequences of participating in fraudulent acts.

In addition, insurance businesses need to continuously standardize business processes, build interconnection mechanisms, and connect data between life insurance, commercial insurance, and health insurance to prevent the concealment of health status, falsification of medical records, hiring people to go to the doctor, etc. On the other hand, the health sector also needs to make changes in patient identification to avoid the above frauds.