Recording the first days of electronic invoice implementation in Nghe An

From June 1, 2025, individual business households with revenue of 1 billion VND/year or more are required to use electronic invoices from cash registers. According to actual records, in the first week of implementation in Nghe An, many households seriously implemented it, but there were also people who made excuses to delay and avoid it.

Having been in the business of selling mother and baby products for many years, Mr. Nguyen Huu Tu, owner of a shop on Nguyen Van Cu Street (Vinh City) shared: “We have been calculating money by machine and issuing invoices to customers for decades. Since June 1, we have connected the cash register system with the tax authorities. The staff were initially confused, but after being instructed, they were quick to operate and printing invoices only took a few seconds. It is both convenient and transparent.”

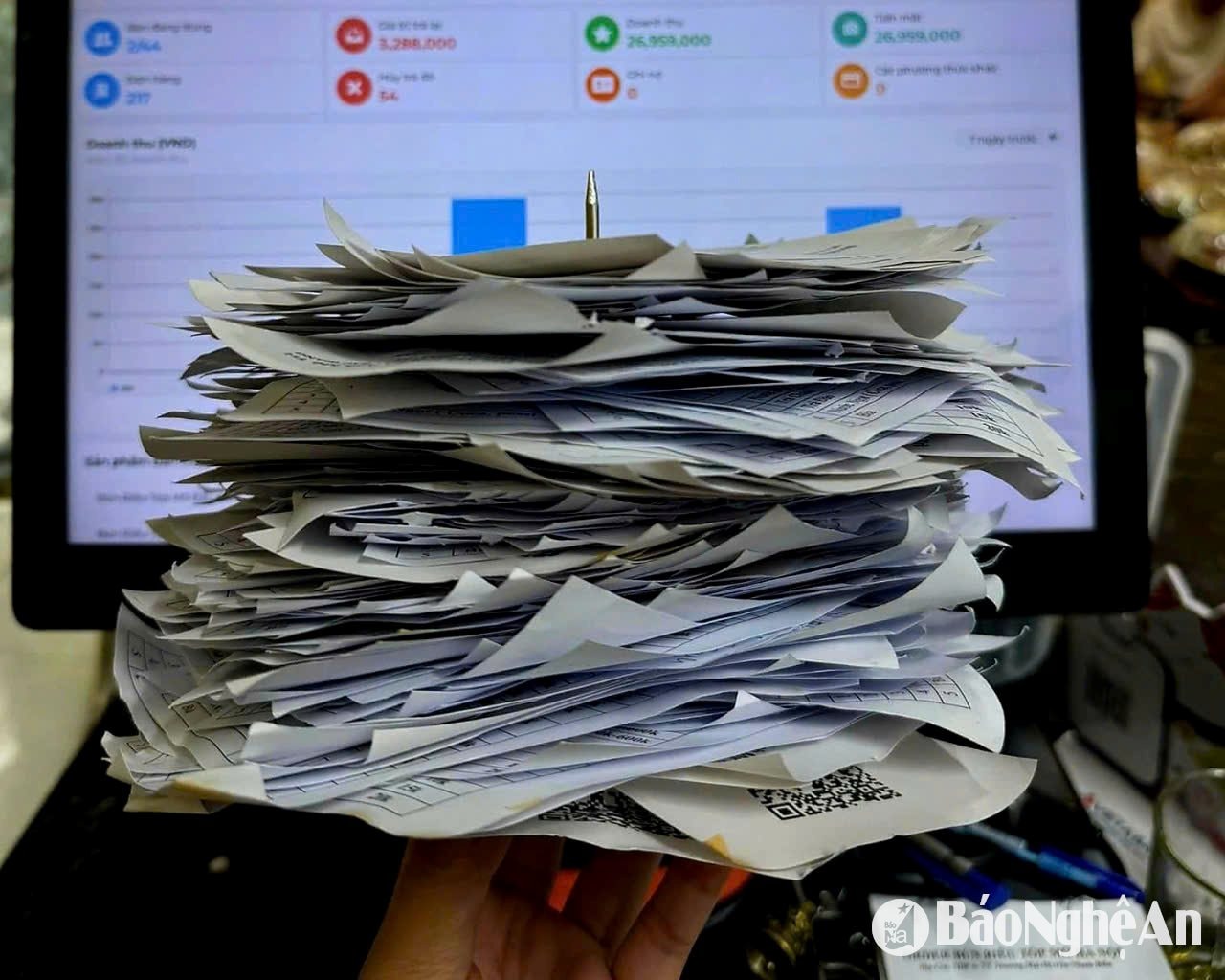

As a large-scale grocery store in Hung Loc (Vinh City), for many years now, Mr. Pham Van Tuan Anh has proactively equipped himself with computers, software to calculate money and issue invoices to customers upon request. However, before June 1, the calculation of money and issuance of invoices had not been thoroughly implemented.

“Previously, small, low-value items were added up using a calculator, while large, multi-item orders required software and invoices. Since June 1, we have entered the software into any order and issued a full invoice,” said Mr. Tuan Anh.

Not only big stores, some small businesses have also proactively changed. Mr. Tran Ngoc Hoang - owner of a popular restaurant on Le Viet Thuat Street (Vinh City) said: "The revenue is less than 1 billion but I still invested in a cash register. We do business seriously, long-term, so we must be transparent."

At the traditional markets, where many small traders gather, it is completely different. Ms. Nguyen Thi L., who sells clothes at Vinh Ga market, expressed concern: "It is difficult to earn 2.7-3 million VND in revenue every day, so we have not reached the 1 billion VND/year mark. Moreover, at our age, using machines and software is very complicated and cumbersome. In addition, no one asks for invoices from customers."

Some households give the excuse that they are not familiar with the technology and are waiting for further instructions. In reality, from investing in machinery, getting familiar with the software to daily operations, business people have to change and be “guided by the hand”.

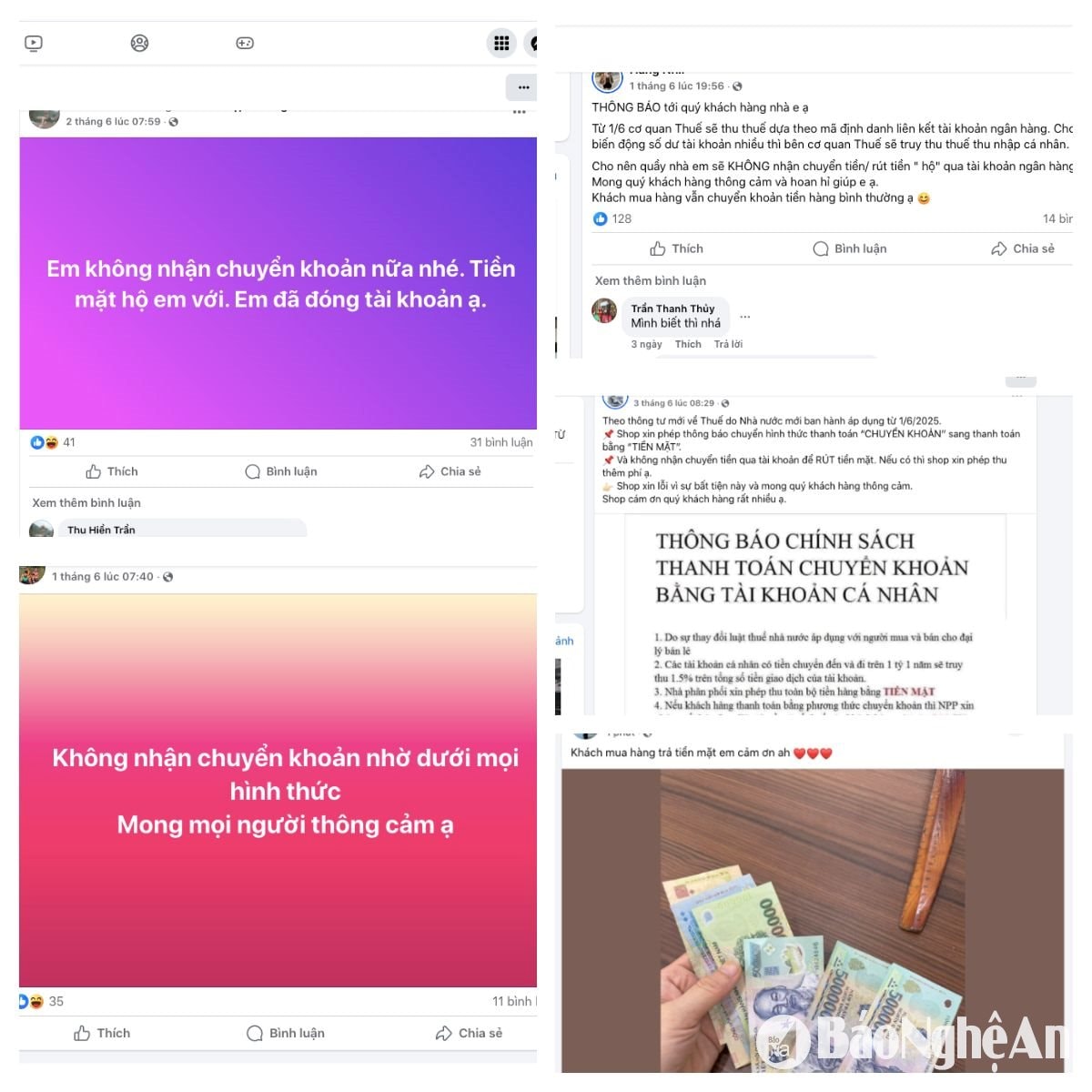

In addition, many tricks to avoid issuing electronic invoices are being applied sophisticatedly. Some households only declare a part of their revenue, the rest is handwritten or left out of the books. Some places install cash registers but do not transmit data, the printed invoices are just a formality... Many businesses even negotiate with customers not to transfer money, only accept cash or transfer money without recording the transfer content.

The most common situation is still not issuing invoices if customers do not request them. At a grocery store in front of Hung Dung market, where hundreds of transactions take place every day, invoices still seem to be an unfamiliar concept.

In addition to the compliance awareness of business owners, it is impossible not to mention the role of consumers in this story. Many people still consider invoices as “unnecessary” and the seller’s job. Ms. Tran Thi Hoa, a customer, frankly said: “I am used to buying from this dealer, I know the price of each item, I know the seller. Once I buy, it is done. What is the point of getting an invoice?”

This habit is aiding fraudulent behavior, distorting the market. According to Mr. Nguyen Van Thang - Chairman of the Consumer Protection Association of Nghe An province: "By not requiring invoices, consumers are depriving themselves of the right to protect themselves in case of disputes. At the same time, it creates opportunities for sellers to hide their revenue, and tax losses are inevitable."

No one denies that applying electronic invoices from cash registers is an inevitable step forward, but for the policy to become a reality, in addition to the involvement of functional sectors, it is necessary to have changes from consumers themselves - those who are playing the final role of "closing the deal" for a transparent transaction.

-Fine from 2 million to 4 million VNDfor the act of making the wrong type of invoice according to the provisions of law on invoices for selling goods and providing services and having delivered to the buyer or having declared tax;

-Fine from 2 million to 4 million VNDFor cases where business households have registered to use electronic invoices generated from cash registers but do not have connections, transfer electronic data with tax authorities or have not used or have not fully used electronic invoices generated from cash registers.

-Fine from 5 million to 10 million VNDfor the act of not issuing invoices when selling goods or providing services to buyers as prescribed.