Silver price today March 7, 2025: Domestic silver price increases, world price decreases

Silver price today March 7, 2025: Domestic silver price continued to increase slightly, fluctuating in the range of 1,000 - 2,000 VND/tael in both buying and selling directions. Meanwhile, world silver price recorded a slight decrease in selling direction.

Domestic silver price

According to a survey on the morning of March 7, Phu Quy Gold and Gemstone Group listed the silver price at VND1,200,000/tael (buy) and VND1,237,000/tael (sell) in Hanoi, remaining stable compared to the previous session.

In Hanoi, silver prices increased by VND2,000/tael for buying and VND1,000/tael for selling, currently listed in the range of VND1,052,000 - VND1,082,000/tael.

Similarly, in Ho Chi Minh City, silver prices also increased slightly by VND1,000 - 2,000/tael, currently fluctuating between VND1,053,000 - 1,084,000/tael.

Domestic silver price list today

| Silver type | Unit | Hanoi | Ho Chi Minh City | ||

| Buy | Sell | Buy | Sell | ||

| Silver 99.9 | 1 amount | 1,041,000 | 1,071,000 | 1,043,000 | 1,077,000 |

| 1 kg | 27,771,000 | 28,569,000 | 27,823,000 | 28,720,000 | |

| Silver 99.99 | 1 amount | 1,049,000 | 1,079,000 | 1,051,000 | 1,081,000 |

| 1 kg | 27,977,000 | 28,781,000 | 28,019,000 | 28,832,000 | |

| PRODUCT | UNIT | BUY PRICE | SELLING PRICE |

|---|---|---|---|

| SILVER BAR 999 1 TALE | VND/Amount | 1,216,000 | 1,254,000 |

| SILVER BAR 999 10 TAI, 1KILO | VND/Amount | 1,216,000 | 1,254,000 |

| 999 RICH ARTISTIC SILVER COIN | VND/Amount | 1,216,000 | 1,431,000 |

| SILVER BAR 999 1KILO | VND/Kg | 32,426,586 | 33,439,916 |

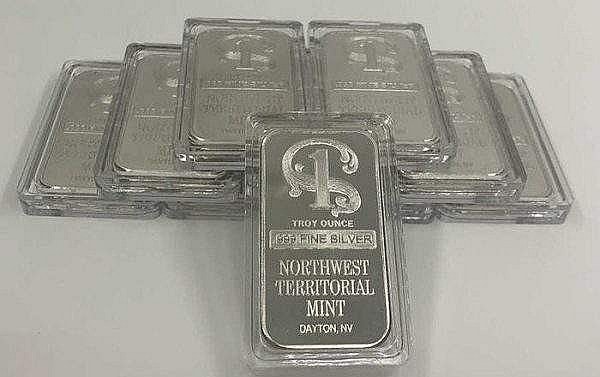

World silver price

In the world market, at 07:25 on March 7, 2025, the spot silver price was recorded at 32.87 USD/ounce, up slightly by 0.01%. The listed silver price was in the range of 833,000 - 838,000 VND/ounce, unchanged at the buying price and slightly down 1,000 VND/ounce at the selling price.

.png)

At the close of trading on March 6, silver prices rose 0.61% to $32.88/ounce, bringing the increase since the beginning of 2025 to 8.66%. The main reason is the trade tension between the US and major economic partners, which could affect the total trade turnover worth $2,200 billion, causing money to flow into safe assets such as precious metals.

In addition, concerns about rising inflation may cause the US Federal Reserve (FED) to maintain high interest rates. This may reduce the attractiveness of precious metals in the near future.