Gold price today October 28, 2024: World gold price this week still increased strongly

Gold price today October 28, 2024: World gold is forecast to continue to increase this week due to strong support from safe haven demand.

Domestic gold price today October 28, 2024

At the time of survey at 5:00 a.m. on October 28, 2024, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 87.9 million VND/tael for buying and 89.9 million VND/tael for selling.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 88.3-89 million VND/tael (buy - sell).

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 87-89 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is being traded at 87-89 million VND/tael (buy in - sell out).

The latest gold price list today October 28, 2024 is as follows:

| Gold price today | October 28, 2024 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 87 | 89 | - | - |

| DOJI Group | 87 | 89 | - | - |

| Mi Hong | 88.3 | 89 | - | - |

| PNJ | 87 | 89 | - | - |

| Vietinbank Gold | 89 | - | - | |

| Bao Tin Minh Chau | 87 | 89 | - | - |

| Bao Tin Manh Hai | 87 | 89 | - | - |

| 1.DOJI- Updated: 10/28/2024 05:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 87,000 | 89,000 |

| AVPL/SJC HCM | 87,000 | 89,000 |

| AVPL/SJC DN | 87,000 | 89,000 |

| Raw material 9999 - HN | 87,800 | 88,200 |

| Raw materials 999 - HN | 87,700 | 88,100 |

| AVPL/SJC Can Tho | 87,000 | 89,000 |

| 2.PNJ- Updated: 10/28/2024 05:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 87,600 | 88,900 |

| HCMC - SJC | 87,000 | 89,000 |

| Hanoi - PNJ | 87,600 | 88,900 |

| Hanoi - SJC | 87,000 | 89,000 |

| Da Nang - PNJ | 87,600 | 88,900 |

| Da Nang - SJC | 87,000 | 89,000 |

| Western Region - PNJ | 87,600 | 88,900 |

| Western Region - SJC | 87,000 | 89,000 |

| Jewelry gold price - PNJ | 87,600 | 88,900 |

| Jewelry gold price - SJC | 87,000 | 89,000 |

| Jewelry gold price - Southeast | PNJ | 87,600 |

| Jewelry gold price - SJC | 87,000 | 89,000 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 87,600 |

| Jewelry gold price - Jewelry gold 999.9 | 87,500 | 88,300 |

| Jewelry gold price - 999 jewelry gold | 87,410 | 88,210 |

| Jewelry gold price - 99 jewelry gold | 86,520 | 87,520 |

| Jewelry gold price - 916 gold (22K) | 80,480 | 80,980 |

| Jewelry gold price - 750 gold (18K) | 64,980 | 66,380 |

| Jewelry gold price - 680 gold (16.3K) | 58,790 | 60,190 |

| Jewelry gold price - 650 gold (15.6K) | 56,150 | 57,550 |

| Jewelry gold price - 610 gold (14.6K) | 52,610 | 54,010 |

| Jewelry gold price - 585 gold (14K) | 50,410 | 51,810 |

| Jewelry gold price - 416 gold (10K) | 35,480 | 36,880 |

| Jewelry gold price - 375 gold (9K) | 31,860 | 33,260 |

| Jewelry gold price - 333 gold (8K) | 27,890 | 29,290 |

| 3. SJC - Updated: October 28, 2024 05:00 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 87,000 | 89,000 |

| SJC 5c | 87,000 | 89,020 |

| SJC 2c, 1C, 5 phan | 87,000 | 89,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 87,000 | 88,500 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 87,000 | 88,600 |

| 99.99% Jewelry | 86,900 | 88,200 |

| 99% Jewelry | 85,326 | 87,326 |

| Jewelry 68% | 57,631 | 60,131 |

| Jewelry 41.7% | 34,433 | 36,933 |

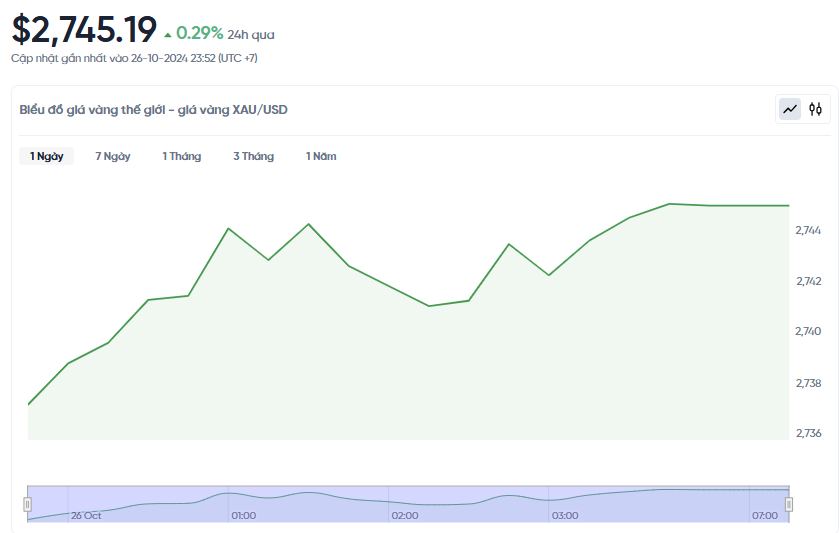

World gold price today October 28, 2024 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,745.19 USD/Ounce. Today's gold price increased by 22.84 USD/Ounce compared to the beginning of last week. Converted according to the USD exchange rate, on the free market (25,500 VND/USD), the world gold price is about 85.33 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.66 million VND/tael higher than the international gold price.

Dr. Nguyen Bich Lam, former General Director of the General Statistics Office, recommends that individual investors should be cautious when buying gold at this time because prices are fluctuating unpredictably.

"Currently, many governments are increasing their gold purchases for national reserves. On the contrary, investing in gold for profit purposes at this time is very risky. In the first and second quarters, the world gold price increased due to geopolitical conflicts, causing many governments to actively buy gold. However, this demand is no longer as high as before, and gold prices are currently mainly influenced by geopolitical conflicts," said Dr. Nguyen Bich Lam.

Economist Dinh Trong Thinh said that plain gold rings, which were previously mainly bought as gifts, are now being bought by many people to accumulate assets. However, because the price of gold is rising and unpredictable, he advised people not to buy and sell gold in large quantities.

Sharing the same view, expert Nguyen Tri Hieu advised that people should only buy gold when really necessary. Those who have bought gold before and have the desired profit should consider selling.

“Buying domestic gold at this time may run the risk of 'catching the peak' if the world gold price drops sharply in the short term. If you have already closed your profit but the price continues to increase, there is no need to regret, because the profit from gold rings since the beginning of the year has reached an attractive level of 25-30%,” Mr. Hieu shared.

Mr. Hieu also commented that the recent shortage of gold bars and gold rings may be due to people still holding on to gold, waiting for prices to rise before selling. At the same time, the State Bank has not yet allowed businesses to import gold, and the destruction of many gold smuggling rings has also contributed to the shortage of supply. If the "fever" for gold rings continues, the State Bank may intervene.

Currently, the country has 22 banks and 16 businesses licensed to trade in gold bars. Unlicensed gold jewelry businesses still trade gold bars with people, or people buy and sell with each other, which is against the law.

The most important report investors will be looking at next week is the core personal consumption expenditures (PCE) index, the Federal Reserve's preferred inflation measure, which will be released on Thursday.

Analysts expect gold prices to be volatile next week as the market digests a number of important data, including non-farm payrolls data on Friday.

In addition, the US September jobs report will also be released on Friday. Economists expect the report to show 140,000 new jobs, down from 254,000 in August. If the labor market weakens and inflation remains high, this could be favorable for gold prices, as rising fears could increase demand for the precious metal.

While the results of the US presidential election between Kamala Harris (Democrat) and Donald Trump (Republican) are still unclear, international investors are focusing their attention on the Fed, the world's most powerful central bank.

Gold price forecast

Gold prices have been rising steadily as international investors continue to see it as a safe haven amid tense geopolitical conflicts and the uncertain results of the upcoming US presidential election (November 5, 2024).

Mr. Kevin Grady, President of Phoenix Futures and Options in the US, predicts that the world gold price could reach 3,000 USD/ounce in the first quarter of 2025.

FxPro expert Alex Kuptsikevich believes that gold prices may have a short-term correction. After reaching $2,758/ounce, gold prices have decreased and are trading cautiously. Gold prices are expected to fluctuate between $2,670-2,700/ounce next week.

Marc Chandler, director of Bannockburn Global Forex, said that if gold prices break $2,700 an ounce, long-term investors could come under great pressure. He predicted that gold prices would fluctuate between $2,600 and $2,800 an ounce.

According to the weekly Kitco News gold survey, bullish sentiment among experts and traders is easing slightly. In the latest survey, nine analysts participated: two see gold prices rising, two see prices falling, and two are neutral on the short-term outlook.