Gold price today 5/5/2025: Domestic and world gold prices are expected to continue to decrease

Gold price today 5/5/2025: Domestic and world gold prices are forecast to continue to have a third consecutive week of sharp decline. The reason is that US-China trade tensions show signs of cooling down.

Domestic gold price today 5/5/2025

At the time of survey at 4:30 a.m. on May 5, 2025, domestic gold prices went through a week of April 30 - May 1 holidays with mixed increases and decreases compared to the previous week. Specifically:

The price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. Compared to last week, the gold price increased by 300 thousand VND/tael in both buying and selling directions.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday but increased by 300 thousand VND/tael in both buying and selling directions compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price decreased by 1 million VND/tael for buying and 1.5 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.3-121 million VND/tael (buying - selling, unchanged in both buying and selling directions compared to yesterday. Decreased 700 thousand VND/tael in buying direction - unchanged in selling direction compared to last week.

SJC gold price in Phu Quy is traded by businesses at 118.3-121.3 million VND/tael (buying - selling), gold price is unchanged in both buying and selling directions compared to yesterday. Gold price decreased 200 thousand VND/tael in buying direction - increased 300 thousand VND/tael in selling direction compared to last week.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; unchanged in both buying and selling directions compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116.6-119.7 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; down 400 thousand VND/tael in buying direction - down 300 thousand VND/tael in selling direction compared to last week.

The latest gold price list today, May 5, 2025 is as follows:

| Gold price today | May 5, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 119.3 | 121.3 | - | - |

| DOJI Group | 119.3 | 121.3 | - | - |

| Mi Hong | 118 | 119.5 | - | - |

| PNJ | 119.3 | 121.3 | - | - |

| Vietinbank Gold | 121.3 | - | ||

| Bao Tin Minh Chau | 118.3 | 121 | - | - |

| Phu Quy | 118.3 | 121.3 | - | - |

| 1.DOJI- Updated: 5/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,300 | 121,300 |

| AVPL/SJC HCM | 119,300 | 121,300 |

| AVPL/SJC DN | 119,300 | 121,300 |

| Raw material 9999 - HN | 113,800 | 115,600 |

| Raw materials 999 - HN | 113,700 | 115,500 |

| 2.PNJ- Updated: 5/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 114,000 | 117,000 |

| HCMC - SJC | 119,300 | 121,300 |

| Hanoi - PNJ | 114,000 | 117,000 |

| Hanoi - SJC | 119,300 | 121,300 |

| Da Nang - PNJ | 114,000 | 117,000 |

| Da Nang - SJC | 119,300 | 121,300 |

| Western Region - PNJ | 114,000 | 117,000 |

| Western Region - SJC | 119,300 | 121,300 |

| Jewelry gold price - PNJ | 114,000 | 117,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Southeast | PNJ | 114,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Jewelry gold 999.9 | 114,000 | 116,500 |

| Jewelry gold price - 999 jewelry gold | 113,880 | 116,380 |

| Jewelry gold price - 9920 jewelry gold | 113,170 | 115,670 |

| Jewelry gold price - 99 jewelry gold | 112,940 | 115,440 |

| Jewelry gold price - 750 gold (18K) | 80,030 | 87,530 |

| Jewelry gold price - 585 gold (14K) | 60,800 | 68,300 |

| Jewelry gold price - 416 gold (10K) | 41,110 | 48,610 |

| Jewelry gold price - 916 gold (22K) | 104,310 | 106,810 |

| Jewelry gold price - 610 gold (14.6K) | 63,720 | 71,220 |

| Jewelry gold price - 650 gold (15.6K) | 68,380 | 75,880 |

| Jewelry gold price - 680 gold (16.3K) | 71,870 | 79,370 |

| Jewelry gold price - 375 gold (9K) | 36,340 | 43,840 |

| Jewelry gold price - 333 gold (8K) | 31,100 | 38,600 |

| 3. SJC - Updated: 5/5/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,300 | 121,300 |

| SJC gold 5 chi | 119,300 | 121,300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,300 | 121,300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 | 116,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 | 116,600 |

| 99.99% jewelry | 114,000 | 115,900 |

| 99% Jewelry | 110,752 | 114,752 |

| Jewelry 68% | 72,969 | 78,969 |

| Jewelry 41.7% | 42,485 | 48,485 |

World gold price today 5/5/2025 and world gold price fluctuation chart in the past 24 hours

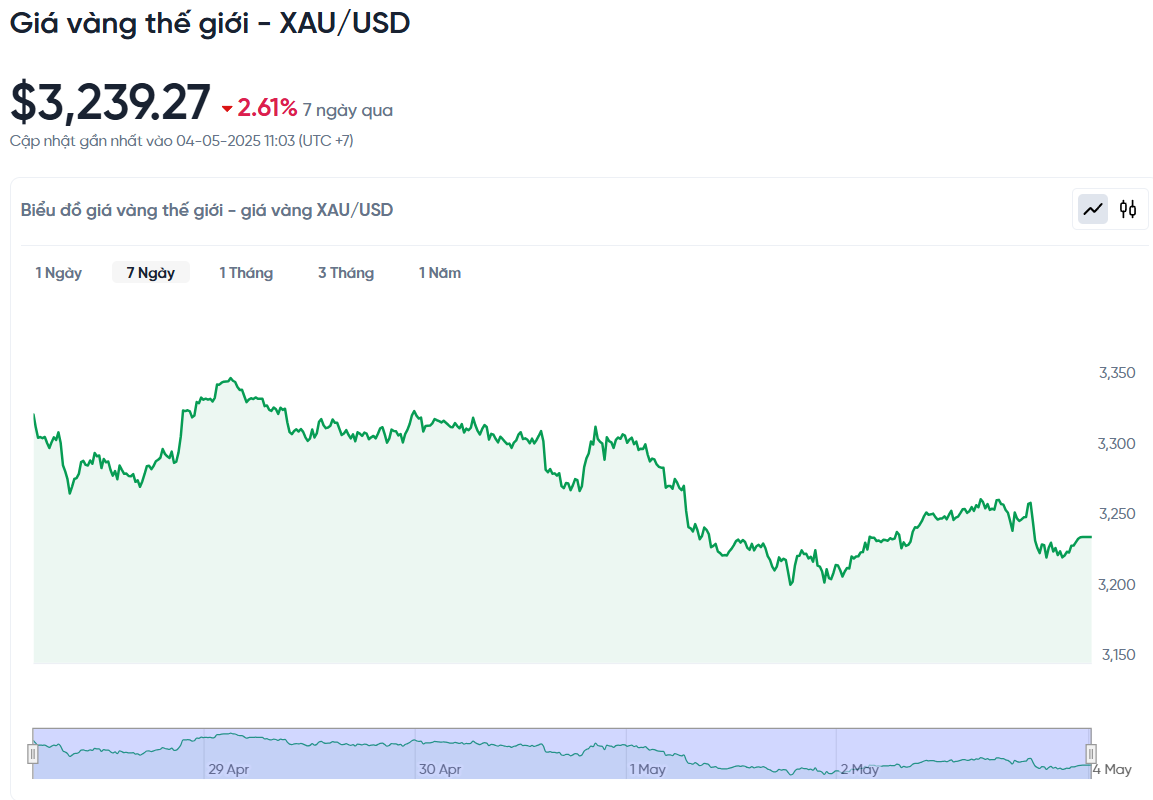

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,239.27 USD/ounce. Today's gold price is unchanged from yesterday and down 75.2 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,180 VND/USD), the world gold price is about 103.27 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.03 million VND/tael higher than the international gold price.

World gold prices faced a second consecutive week of decline, down 2.61% from the beginning of the week. It is understandable that there was strong profit-taking after prices increased too quickly in a short period of time. However, according to experts, the current correction is just a temporary pause in the upward trend and will not cause serious damage to the long-term upward momentum of gold.

Despite ending the week down nearly $100, gold is still well above its low of $3,200 an ounce. At one point during the week, gold fell as much as 8.5%, a similar correction to the one that occurred after the 2020 US presidential election, when prices fell 9% in just three weeks after peaking at $2,800 an ounce.

This correction is happening faster but is not outside the rules of the market. In the past five weeks, the price of gold has climbed from 3,000 to 3,500 USD/ounce, an increase too fast and easily leading to profit-taking psychology of investors. Therefore, this correction is considered a natural reaction after a period of overheating.

Many experts still see this as a long-term buying opportunity. While concerns about President Trump’s tariffs have eased somewhat, the fact remains that no definitive trade deal has been announced. Some economists say that even if a deal is signed, the damage to the US economy and its global trade reputation has already been done and will not be easily repaired.

Pressure on gold prices now comes mainly from expectations that US interest rates will remain high in the short term. In addition, the strong recovery in the stock market, with the S&P 500 up more than 17% from its April low, has reduced demand for gold as a haven.

Mr. Joseph Cavatoni, senior strategist at WGC, said that the increase in gold demand is due to three main factors: individual investors continue to accumulate physical gold, strong capital flows into gold ETFs and regular gold purchases from central banks around the world.

The current demand for gold investment is not just for short-term speculation but is becoming a fundamental trend, in the context of growing concerns about public debt and the safety of US government bonds. According to him, gold is asserting its position as a key defensive channel in the context of an uncertain global economy.

Mr. Ole Hansen, Director of Commodity Strategy at Saxo Bank, said that gold prices are still being supported sustainably by the global trend of de-dollarization, as well as concerns about the impact of tax policies from the US. According to him, these are long-term factors that help maintain the attraction of gold, even when the market has short-term fluctuations.

Gold price forecast

The World Bank recently raised its gold price forecast significantly. While last year it said prices would stabilize after a 20% increase, this year the new forecast suggests prices could remain around current levels, which is about 36% higher than the average of the previous year.

According to World Bank experts, safe-haven demand for gold will remain in the short term due to geopolitical uncertainty and concerns about global financial volatility. They also stressed that if these risks increase, gold prices could even exceed current forecasts.

One factor that could act as a catalyst next week is the Federal Reserve’s monetary policy meeting. Although the US economy is slowing, recent data has shown considerable resilience. GDP fell 0.3% in the first quarter due to a surge in imports, while the labor market, while struggling in some areas, has remained stable, with 177,000 new jobs added last month, exceeding forecasts.

Many investors are expecting the Fed to signal more easing. Recent data has weakened the case for keeping interest rates higher, said Naeem Aslam of Zaye Capital Markets. He said the current correction makes gold more attractive in terms of valuation.

However, Aslam also warned that the market will be sensitive to both the Fed’s monetary policy and global trade developments. He said the cooling signals from tariff tensions are positive, but could also limit gold’s gains in the short term.

Some other experts such as Carsten Fritsch of Commerzbank said that market expectations for the Fed to cut interest rates by up to 90 basis points this year are too high. If the Fed does not do this, gold prices may face the risk of further correction due to re-adjusted expectations.

Some experts such as Michael Moor and Fawad Razaqzada warn that gold prices could fall to $3,000/ounce. However, CPM Group believes that gold prices are approaching a short-term bottom in May. They recommend that investors consider buying when gold corrects to the range of $3,000 to $3,150/ounce.

Investors will be closely watching key economic events in the coming week: Monday’s ISM services PMI, Wednesday’s Fed rate decision, the Bank of England meeting and Thursday’s weekly jobless claims report. These will be key factors that could have a strong impact on the direction of gold prices.