Gold prices rise, which country holds the most gold in the world?

As world gold prices continue to rise sharply, countries will continue to diversify their reserves by buying gold to preserve their assets, according to the World Gold Council.

The World Gold Council (WGC) considers gold a national reserve asset due to its safety, liquidity and profitability characteristics. Over the years, countries have increased their gold reserves.

In particular, central banks have been buying gold at an ever-increasing rate. Central banks now hold about 20% of all the gold ever mined.

Central banks bought 483 tonnes of gold in the first half of 2024, a new record high. Türkiye was the biggest buyer in the first half of this year with 45 tonnes, followed by India with 37 tonnes.

Other countries such as Jordan, Qatar, Uzbekistan, and Iraq have also joined the wave. Central banks in emerging markets maintain a positive view on the future of gold in foreign exchange reserves.

China is usually the world's top buyer of gold, but has recently halted purchases. The People's Bank of China (PBOC) recently issued new quotas to some domestic banks to import gold. If Chinese demand picks up again, gold prices could continue to rise.

As of the end of July, the PBOC's gold holdings were 72.8 million ounces. In 2023, the PBOC will be the world's largest buyer of gold, with a net purchase of 7.23 million ounces, according to WGC data.

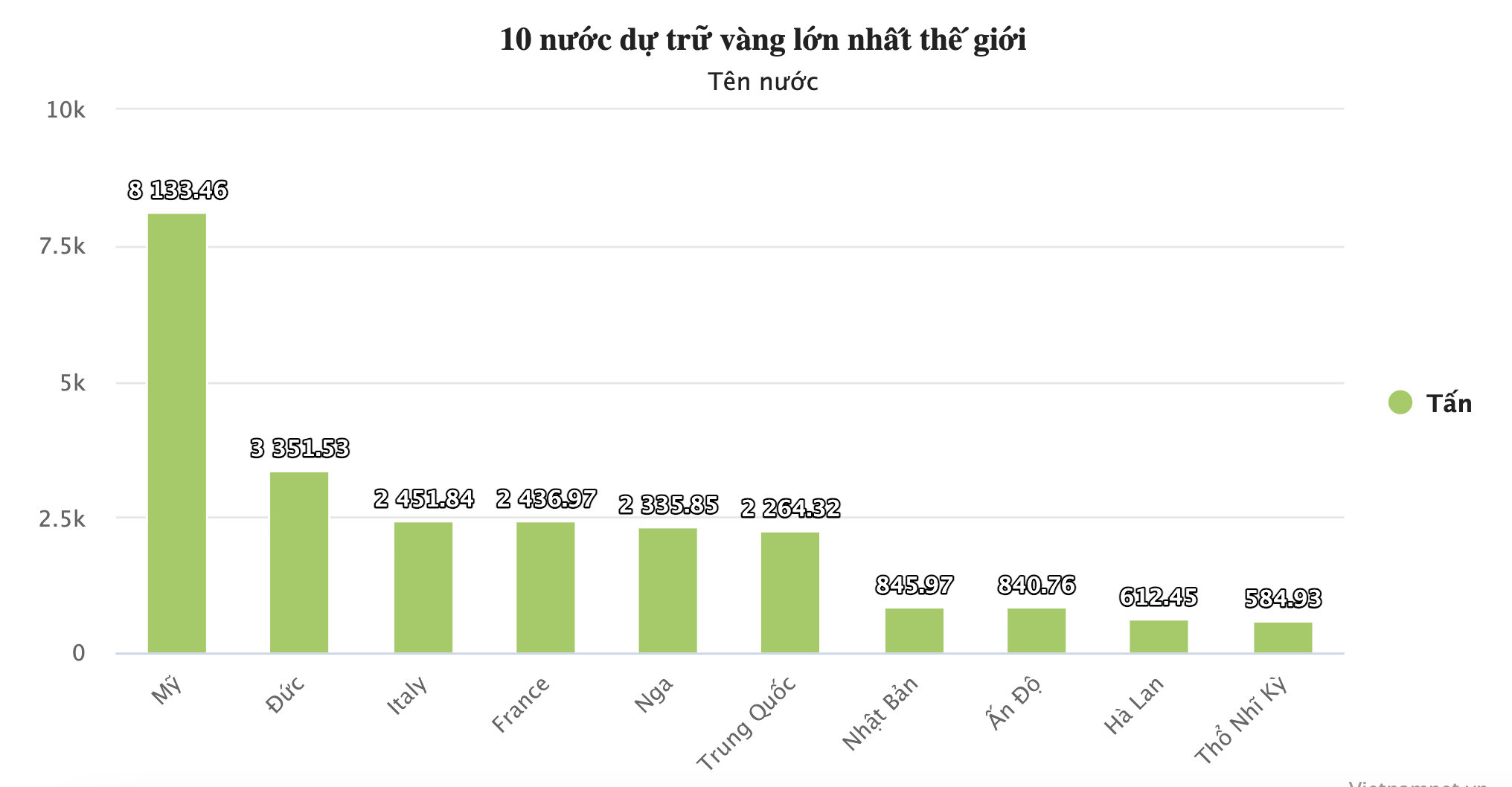

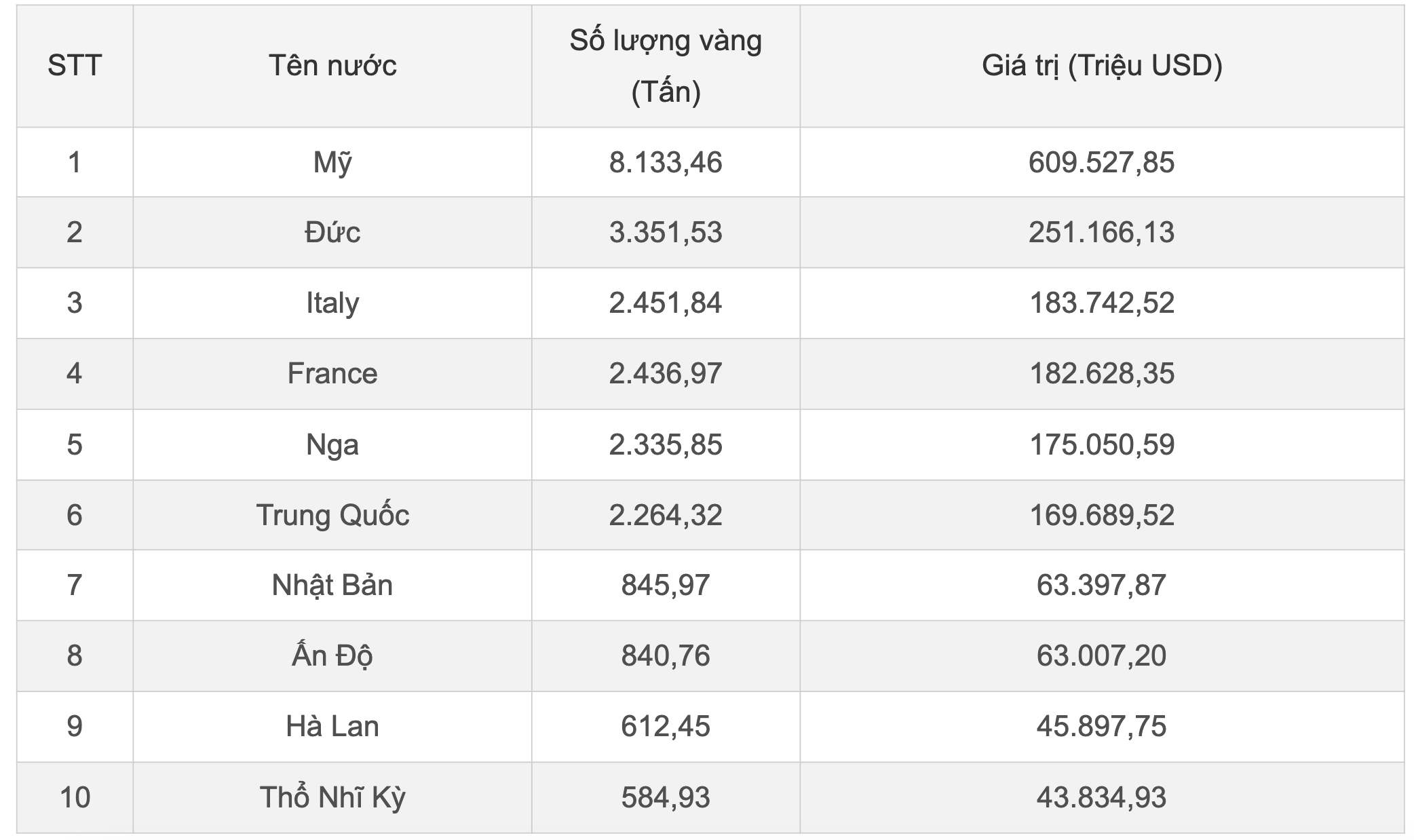

According to WGC estimates, below is the ranking of gold reserves by country in Q2/2024.

According to WGC, central banks around the world believe that official global gold reserves will increase over the next year. Gold price forecastwill continue to remain high, prompting other central banks to increase their gold reserves.