Domestic gold price increased 48.62% over the same period last year

Domestic gold prices increased 48.62% year-on-year to VND134.4 million/tael amid the Fed's expected interest rate cut and a weakening USD.

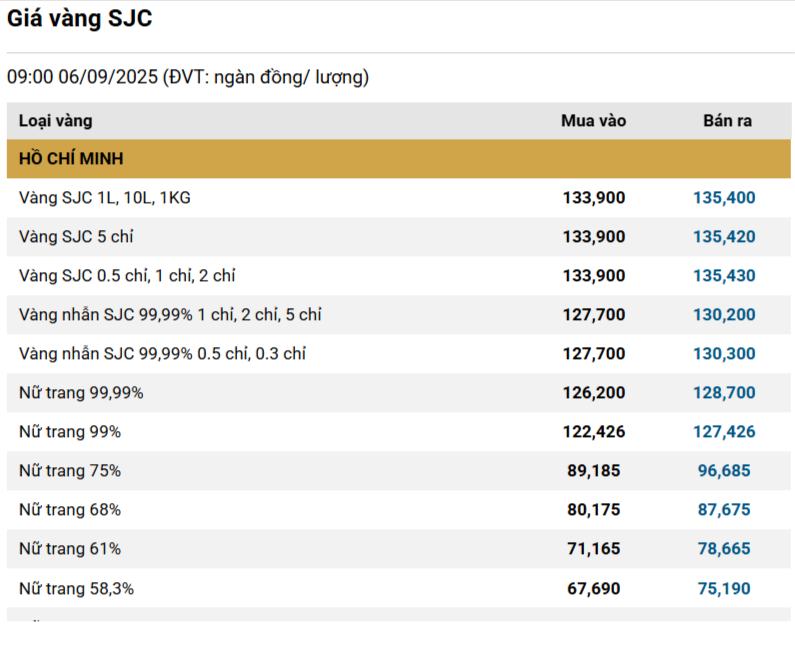

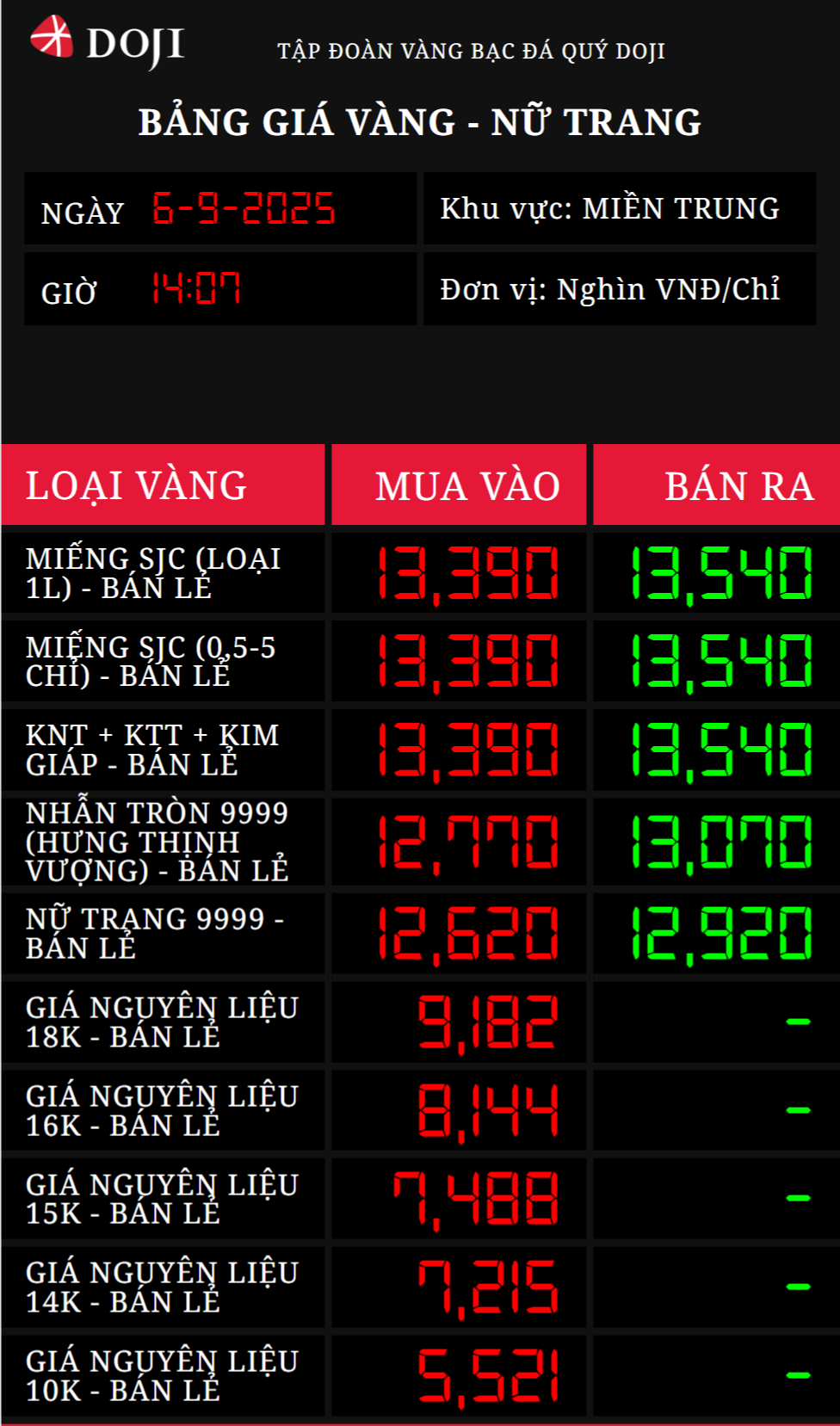

According to newly released data from the General Statistics Office, the domestic gold price in August 2025 increased by 48.62% compared to the same period in 2024. As of September 6, 2025, the world gold price reached 3,589.87 USD/ounce, up 4.07% compared to the previous month. Domestically, the SJC gold price closed the session on September 6 at 135.4 million VND/tael for the selling price.

Three main factors affecting the rise in gold prices include: expectations of interest rate cuts by the US Federal Reserve (Fed), a weakening US dollar, and global geopolitical instability. Central bank purchases and strong demand for gold in Asian markets also contributed to the price increase.

As of the close of September 6, the SJC gold price had increased sharply by 1 million VND in selling price compared to yesterday, reaching 135.4 million VND/tael. The buying price also increased sharply by 1 million VND/tael, listed at 133.9 million VND/tael. This increase reflects the general trend of the global gold market.

The Consumer Price Index (CPI) in August 2025 increased by 0.05% compared to the previous month. Compared to December 2024, the CPI increased by 2.18% and increased by 3.24% compared to the same period last year. Core inflation increased by 3.19%, while the average CPI in the first 8 months of 2025 increased by 3.25%.

Housing, electricity and water group increased by 0.21% due to demand for rental housing during the school year and hot weather.

Education increases 0.21% due to tuition adjustment for new school year 2025-2026

Garment and footwear increased by 0.17% thanks to shopping demand in preparation for the new school year.

In contrast, the post and telecommunications group decreased by 0.04% and the food group decreased by 0.06%.

Gasoline prices fell slightly, with diesel down 2.06% and gasoline down 0.2%.

Experts predict that gold prices may continue to increase in the last months of 2025, mainly due to the Fed's monetary policy and geopolitical factors. However, inflation and domestic macroeconomic policies will continue to affect the general price level.