Director of Nghe An Department of Finance clarifies the cause of tax arrears of nearly 3,300 billion VND

The current tax arrears in Nghe An are still high at nearly 3,300 billion VND; of which more than 1,000 billion VND is land use fee arrears; more than 1,100 billion VND is late payment fees and more than 650 billion VND is environmental protection tax arrears for gasoline.

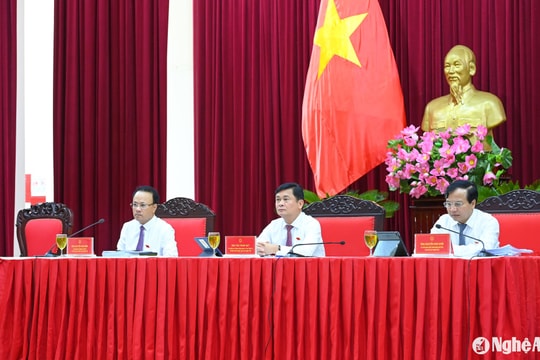

In the discussion session at the hall, based on the group discussion opinions of the Provincial People's Council delegates, Comrade Nguyen Nam Dinh - Member of the Provincial Party Standing Committee, Permanent Vice Chairman of the Provincial People's Council raised a number of issues requesting the head of the Finance sector to clarify the situation of high tax arrears; the allocation of resources to implement policies to support agricultural, rural and farmer development has not met the requirements; proposed to leave budget revenue from hydropower and mineral exploitation for localities to reinvest in infrastructure...

Director of the Department of Finance Trinh Thanh Hai affirmed: The work of tax collection and tax debt recovery continues to be implemented by the industry with many drastic solutions.

The results in the first 6 months of 2024 have reduced tax arrears by VND 2,300 billion compared to December 31, 2023; however, the total arrears are still high at nearly VND 3,300 billion.

The reason for the increase in tax arrears in the last 2 years is due to the way of accounting and synthesizing tax arrears, which are added to real estate debts, which were previously synthesized separately.

Of the nearly 3,300 billion VND in tax debt, more than 1,000 billion VND is land use fee debt; more than 1,100 billion VND is late payment fee and more than 650 billion VND is environmental protection tax debt for gasoline. The solution to this problem is to continue implementing solutions to collect tax arrears.

Regarding the proposal to leave budget revenue from hydropower and mineral exploitation for localities with hydropower and mineral exploitation projects to reinvest in infrastructure, the Director of the Department of Finance affirmed that the opinions of the localities have been accepted by the Provincial People's Committee and included in the content of the National Assembly's resolution on special mechanisms and policies for the development of Nghe An province, allowing Nghe An province to determine additional balance from the central budget without counting tax revenue from hydropower production facilities and mineral exploitation activities. This is an important legal basis for all levels and sectors to implement in the coming time.

Acknowledging the current reality that the budget to support the implementation of agricultural and rural development investment policies has not met the requirements, Director of the Department of Finance Trinh Thanh Hai said: The resources allocated to implement social security policies and support development investment issued by localities since the beginning of the term are quite large, more than 3,500 billion VND; meanwhile, the central budget has not been supplemented and the provincial budget is in the period of budget stabilization, so it is very difficult to increase the level of support. Therefore, based on the ability to balance the budget, localities need to arrange in order of priority in implementing policies with focus and key points.

The Director of the Department of Finance also responded to the opinion of delegate Ha Thi Phuong Thao (Nghia Dan district) regarding the conversion of the use of surplus facilities due to the rearrangement of administrative units.

Director Trinh Thanh Hai said: The development of a plan to handle surplus public assets due to the arrangement of commune-level administrative units and the merger of blocks, hamlets, villages and hamlets proposed by the commune and district levels is as follows: Currently, based on the proposals of localities, the Department of Finance has appraised and submitted to the Provincial People's Committee for approval, reaching 97%; when the plan has been approved, localities are required to properly implement the plan; and if it is not suitable for the function of the new purpose of use, it must be renovated and repaired with funding sources prescribed in Resolution No. 20 dated December 9, 2021 of the Provincial People's Council. This is an issue that needs attention to gain experience in developing a plan to handle surplus public assets for the merger period of 2023 - 2025.

.jpg)