The Provincial People's Council pointed out 15 shortcomings in budget collection work in the area.

(Baonghean.vn) - Through the program to monitor budget collection in the province for the period 2016 - 2018 of the 17th Provincial People's Council, at the 9th Session, the Standing Committee of the Provincial People's Council reported to clarify 7 achieved results, 15 shortcomings and 19 proposals and recommendations in budget collection work.

|

| Scene of the opening session of the 9th session of the Provincial People's Council. Photo: Thanh Cuong |

At the opening session of the 9th meeting, delegates listened to Vice Chairman of the Provincial People's Council Hoang Viet Duong report on the results of monitoring the State budget collection in Nghe An province, period 2016 - 2018 with 7 results achieved, 15 shortcomings and 19 proposals and recommendations.

7 results achieved

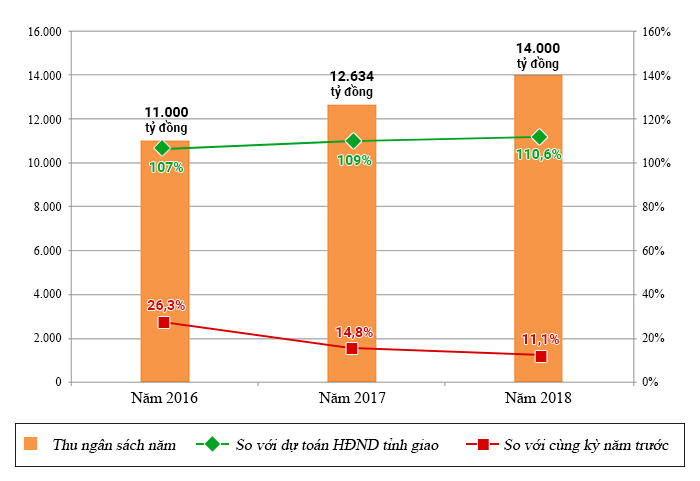

Total State budget revenue in the three years 2016 - 2018 all met the estimate and had a good growth rate. Some revenues such as: revenue from land use fees, registration fees, environmental protection tax, personal income tax, etc. achieved quite high annual revenue.

|

| Chart of budget collection speed in the 3 years 2016 - 2018 of the province. Graphics: Huu Quan |

The Provincial People's Committee has issued a project to increase budget revenue and a plan to develop State budget revenue sources in Nghe An province until 2020; directed the Tax sector to implement many measures to prevent revenue loss in a number of areas that are likely to cause large revenue losses such as: petroleum business, hotels and restaurants, motorbike business; the Customs sector has implemented solutions to prevent revenue loss through price, quantity, file code, origin of goods right at the customs clearance stage, strengthening the fight against smuggling, trade fraud and counterfeit goods.

The Provincial People's Committee directed the competent authorities to step up the inspection and examination of tax payment and collection, refund and sanction of violations with a total amount of more than 440 billion VND; associated with urging the collection and enforcement of tax debt in 3 years reaching 1,347 billion VND.

15 existence, limitations

The growth rate of budget revenue is not commensurate with the economic growth rate. If land use fees are excluded, domestic revenue in 2017 and 2018 did not meet the assigned estimate. Specifically, in 2017 it reached VND8,328 billion, equal to 96.5% of the estimate, and in 2018 it reached VND8,947 billion, equal to 94.9% of the estimate.

The leadership and direction of budget revenue development in some localities has not received due attention. Most localities only pay attention and strive to complete the revenue within the local budget balance and strive to increase revenue from land use rights.

Business management still faces many difficulties. Some businesses do not account for costs and revenues in accordance with the Accounting Law, especially accounting for increased costs to reduce profits to reduce the amount of corporate income tax payable. There are still some businesses reporting negative pre-tax profits for many consecutive years, but still expanding production and business or making insignificant contributions to the budget.

|

| Vice Chairman of the Provincial People's Council Hoang Viet Duong reported on the results of monitoring the State budget collection in Nghe An province, period 2016 - 2018. Photo: Thanh Cuong |

The determination of annual taxable revenue according to Decision No. 2371/QD-TCT dated December 18, 2015 of the General Department of Taxation is not close to the actual situation or has a "leveling" situation such as: the same business field of motels and hotels on the same street with different scales but determining the same fixed revenue level; determining the fixed revenue lower than the actual business of the taxpayer (the listed hotel room prices are much lower than the actual prices, especially the prices on holidays).

The current revenue management for business households using the revenue contract method is generally still low compared to actual revenue. The management of individual business households is not strict, and there is still a large difference in data with the Statistics Office.

|

| Delegates attending the meeting. Photo: Thanh Cuong |

According to the 2017 economic census, the whole province has 158,921 business households, of which 69,172 have revenue of over 100 million VND (taxable). However, according to the Tax Department's report, the whole province has over 48,000 business households and only 27,032 taxable households have been put under management.

The tax arrears situation in the whole province in the period of 2016 - 2018 is still large and tends to increase over the years, in which bad debt increases rapidly, accounting for nearly 50% of the total tax arrears.

19 recommendations and proposals

Based on the monitoring results, the Provincial People's Council proposed and recommended 19 issues to the Provincial People's Committee and branches, districts, cities, towns and grassroots.

The Provincial People's Council proposed that the Provincial People's Committee direct the review of the State budget revenue targets set out in the Resolution of the 18th Provincial Party Congress for the 2015-2020 term; the 5-year socio-economic development plan for 2015-2020; the province's revenue increase projects and revenue loss prevention projects to continue perfecting solutions to strengthen management and revenue exploitation, striving to increase budget revenue to the highest level compared to the targets of the Provincial Party Congress for the 2015-2020 term.

Perfect the mechanism for decentralizing revenue sources among local budget levels (provincial, district, and commune levels) in the direction of both ensuring the leading role of the provincial budget and promoting the proactiveness of localities in striving to increase State budget revenue; ensuring stability of additional budget balance at district and commune levels during the period of budget stabilization, in order to encourage localities to strive to increase State budget revenue.

|

| The Provincial People's Council proposed that the Provincial People's Committee direct a comprehensive review of individual business households to include them in tax management, avoiding omission of tax-setting entities. Photo: Mai Hoa |

The Provincial People's Committee needs to advise the Provincial Party Committee to have a coordination mechanism between grassroots Party committees (districts, cities, towns) and the Party Committee of the Tax sector to strengthen the leadership and direction of Party committees at all levels in the work of collecting state budget; associated with the issuance of a coordination mechanism between branches and levels of the Tax and Customs sectors in directing and urging the implementation of state budget collection work.

Improve the quality of communication and innovate propaganda forms towards enhancing education and persuasion so that taxpayers are fully aware of their responsibilities in fulfilling their tax obligations; associated with developing services and supporting taxpayers in tax declaration and payment.

Directing a comprehensive review of individual business households to include them in tax management, avoiding omission of tax-paying entities; at the same time, reviewing all enterprises operating in the province, strictly controlling tax-paying entities to manage and monitor in accordance with legal regulations, ensuring transparency and fairness among taxpayers, and preventing tax losses.

Strengthen supervision, inspection and examination of tax declarations of taxpayers, focusing on key areas, as well as enterprises that have declared losses for many consecutive years but still expanded production and business; enterprises that generate large revenues but do not incur taxes or insignificant ones; enterprises with financial capacity but long-term tax debts; enterprises with large production and business scale but low tax declaration and payment. Strictly handle violations detected through inspection, examination and supervision and publicize the handling results; strengthen anti-transfer pricing inspections for FDI enterprises that have related-party transactions.

Classify tax debts to have appropriate management and collection solutions; publicly post on mass media cases of prolonged tax debts according to the provisions of the Law on Tax Administration; resolutely implement measures to urge and enforce tax debts according to the provisions of the Law; strive to reduce tax arrears, limit tax debts arising...

.png)

.jpg)

.jpg)