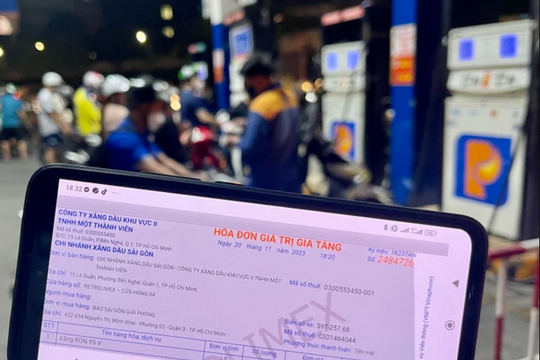

Electronic invoices with authentication codes will protect businesses

Along with Hanoi, Ho Chi Minh City has been allowed by the Ministry of Finance to pilot the use of electronic invoices with authentication codes from tax authorities (authenticated invoices). According to Ms. Tran Thi Le Nga, Deputy Director of the Ho Chi Minh City Tax Department, by using authenticated invoices, businesses are better protected than with other types of invoices.

|

| Ms. Tran Thi Le Nga, Deputy Director of Ho Chi Minh City Tax Department |

- Electronic invoices have been deployed since mid-2011, why not promote their use instead of piloting authenticated invoices, madam?

Currently, businesses are allowed to use 4 types of invoices: printed, self-printed, purchased from the tax authority and electronic invoices. Electronic invoices are the most advanced and superior type, used by many countries in the world. In Vietnam, this type of invoice has been put into use since mid-2011, but is not popular. Right in Ho Chi Minh City, there are currently only about 10 large-scale enterprises that use a lot of invoices such as electricity, water, telecommunications... that use electronic invoices.

In general, electronic invoices are only suitable for large-scale enterprises that use many invoices because they must meet many conditions such as having information transmission lines, information networks, and communication equipment that meet the requirements for exploiting, controlling, processing, using, preserving, and storing electronic invoices; having a team of qualified and capable human resources to create, create, and use electronic invoices; having a process for backing up data, restoring data, and storing data, etc.

Since there are currently very few businesses that meet the conditions for using electronic invoices, the Ministry of Finance is piloting the use of authenticated invoices from June 2015 to December 2016 in Hanoi and Ho Chi Minh City, and will then expand nationwide.

Compared with electronic invoices, what are the advantages of authenticated invoices?

Authenticated invoice is also a type of electronic invoice, so authenticated invoice has all the advantages and advances of electronic invoice.

To put it simply, an electronic invoice is a collection of electronic data messages about the sale of goods and provision of services, which are initiated, created, sent, received, stored and managed by electronic means. When businesses and economic organizations have transactions, they create invoices on computers and send them directly to each other via the Internet. Meanwhile, an authenticated invoice is a type of electronic invoice, with all the advantages of an electronic invoice, the only difference is that when selling goods or providing services, businesses cannot send them directly to customers, but must send them via the tax authority's electronic information portal. After being confirmed by the tax authority, the business will transfer the invoice to the customer via the Internet.

For large-scale enterprises, using electronic invoices is superior, and for small and medium-sized enterprises, using authenticated invoices is superior, because it does not need to meet very high conditions like using electronic invoices.

Instead of sending invoices directly to each other via the Internet, why do we have to send them through the tax authority for authentication?

In dialogues with businesses as well as in the media, businesses often complain about purchasing goods and services with full invoices, but the tax authorities do not accept them, do not allow deductions, and do not refund taxes. The reason is that businesses receive invoices from businesses that have fled, disappeared, or due to operating losses, have closed down, ceased operations, or even received invoices from "ghost businesses".

Businesses do have their reasons because when receiving an invoice, they cannot know who provided the goods and services to them. But using an authenticated invoice, before transferring the invoice to the customer, the seller creates an invoice with full information and sends it via the Internet to the General Department of Taxation's invoice authentication code system. This system immediately automatically checks whether the seller has sufficient legal basis, is actually operating, has tax debts, etc. and authenticates the invoice, then transfers it back to the seller so that the seller can deliver the invoice to the buyer.

Thus, with authentic invoices, buyers can be completely assured and not worry about fake or illegal invoices because the seller's "identity" has been authenticated by the tax authority. This is the most effective measure to protect businesses in the context of fake invoices, illegal invoices, and "ghost businesses" still being quite common.

So to use authenticated invoices, what conditions must businesses meet?

The only conditions required are that the business has been granted a tax code and is operating; the digital certificate must have tax code information; and it operates in an area with Internet access and usage. Most businesses meet these conditions.

To use authenticated invoices, businesses need to access the General Department of Taxation's invoice processing software to register for use and register for a digital certificate. Within 3 working days, the tax authority will send a notification via email to the business about whether or not to accept the registration to use authenticated invoices.

Everything seems so simple, why not apply it widely, but only pilot in Hanoi and Ho Chi Minh City, each place about 100 businesses?

Putting authentic invoices into use is to simplify administrative procedures in using invoices, create conditions for businesses to check and protect their invoices; improve efficiency in tax management. However, this is a very new type of invoice, it needs to be piloted before being widely deployed.

Furthermore, the current tax authority authentication system does not allow authentication of multiple invoices at the same time. If expanded further, invoice authentication will take a long time, businesses will have to wait, leading to reduced operational efficiency. After the pilot period, the upgraded authentication system will gradually expand the subjects and locations for using authenticated invoices.

According to Investment

.jpeg)