Good capital mobilization, creating momentum for economic growth

In 2025, the economy recorded many positive signals, banks in Nghe An are accelerating capital mobilization to meet credit needs. Thereby, helping to ensure stable liquidity and playing an important role in promoting economic growth, supporting production and business.

Mobilizing good growth

At the beginning of the year, many banks in Nghe An maintained the same deposit interest rates as during the year, with abundant mobilized capital.

HDBank Nghe An maintains interest rates at 3.35-3.45%/year for 3-5 month terms; 4.6%/year for 7-11 month terms. Many joint stock banks such as Vietbank, VIB,... have 12-month term interest rates of 6.1%/year, 24-month term up to 6.3%/year. Of which, Eximbank raised the highest mobilization interest rate to 6.8%/year for 24-36 month terms, maintaining its leading position in the market.

Mr. Nguyen Manh Ha - Director of HDBank Nghe An said, after Spring, the demand for loans is not much, but the source of deposits from the people is abundant, capital mobilization is good, in 1 month our bank mobilizes several hundred billion VND, achieving a growth rate of more than 3%.

However, large banks such as Vietcombank, BIDV, Vietinbank, and Agribank still maintain interest rates lower than the general level, fluctuating around 4.7-5%/year for a 12-month term.

A representative of Vietinbank Nghe An said that at the beginning of the year, mobilization increased well, idle money was abundant, while loan demand was not high, so mobilization interest rates decreased slightly compared to the period before Tet. Since the beginning of the year, Vietinbank Nghe An alone has increased mobilization by 7.2%, spread evenly across the residential sector, organizations and businesses; loans increased by 3%. In 2024, Vietinbank Nghe An achieved positive business results, which created momentum for this year's target of 19% increase in mobilization and over 20% increase in loans in 2025.

At the beginning of the year, banks need large capital to serve the yearly credit plan. The interest rate difference between banking groups shows that the large banking group has the advantage of State prestige and relationships with large corporations, so it is easier to mobilize capital, thereby stabilizing capital sources and system liquidity. On the contrary, the group of small-scale joint stock banks depends more on savings mobilization activities. For this group, the mobilization interest rate is higher to attract capital, ensure liquidity, and serve business plans.

The State Bank's leaders said that they have directed credit institutions to stabilize deposit interest rates and continue to strive to reduce lending interest rates. Recently, the maximum interest rate for deposits in VND with terms of less than 6 months, non-term deposits and terms of less than 1 month is 0.5%/year, deposits with terms from 1 to less than 6 months is 4.75%/year. The maximum short-term lending interest rate in VND for some priority sectors is 4%/year... In 2025, the State Bank of Vietnam will continue to implement regulations on interest rates.

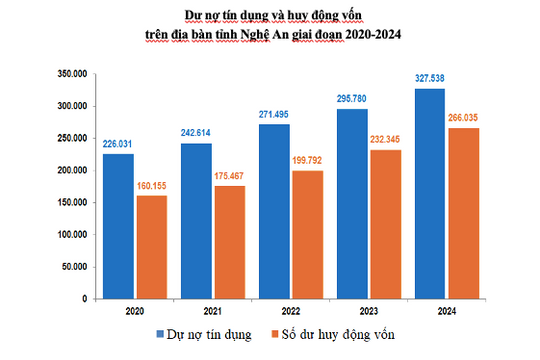

As of January 31, 2024, the mobilized capital in the area is estimated at VND 271,112 billion, an increase of VND 1,349 billion compared to the previous month, or 0.5%. Total outstanding debt is estimated at VND 326,734 billion, an increase of VND 1,496 billion compared to the previous month, or 0.46%. Excluding the Development Bank, outstanding debt is VND 318,734 billion, an increase of VND 1,586 billion compared to the previous month, or 0.5%. Of which, outstanding medium and long-term debt is estimated at 38.7% of total outstanding debt, outstanding debt in VND is estimated at 99% of total outstanding debt.

Outstanding balance of some credit programs estimated as of January 31, 2025:

+ Outstanding loans for agriculture, rural areas and rural areas in the whole area are estimated at 142,400 billion VND, accounting for 43.6% of outstanding loans in the whole area.

+ Outstanding loans for high-tech agricultural development and clean agriculture according to Resolution 30/NQ-CP are estimated at 19,829 billion VND, accounting for 6% of total outstanding loans in the whole area.

+ Outstanding export loans are estimated at 2,420 billion VND, up 5.4% compared to the beginning of the year.

+ Outstanding loans for housing support under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 65 billion VND, down 2.4% compared to the beginning of the year.

+ Outstanding loans for shipbuilding under Decree 67/2014/ND-CP are estimated at 76 billion VND, down 2% compared to the beginning of the year.

Implementing well monetary policy management solutions

In January 2025, closely following the direction of the State Bank of Vietnam, the People's Committee of Nghe An province and the State Bank of Nghe An branch promptly implemented mechanisms, policies, and solutions on State management related to currency, credit, and banking activities. Promote the implementation of credit programs for the forestry and fishery sectors. For the 120,000 billion VND credit program (to date, this package has increased to 145,000 billion VND with 9 registered banks) for loans for social housing, workers' housing, renovation and reconstruction of old apartments according to Resolution 33/NQ-CP of the Government, the Provincial People's Committee announced a list of 3 projects that meet the legal conditions to access loans according to Resolution 33. Commercial bank branches in the area have been actively approaching and receiving loan requests from investors.

The State Bank continues to direct credit institutions in the area to maintain stable deposit interest rates, reduce costs to reduce lending interest rates in time to support people and businesses in the area. Resolutely implement solutions to remove difficulties for businesses and people, especially extending the debt restructuring period and maintaining the debt group. Accumulated from April 24, 2023 to December 31, 2024, debt repayment terms have been restructured and debt groups have been maintained for 207 customers, with a total restructured debt value (principal and interest) of VND 2,583.6 billion.

The State Bank leader said that this year, the State Bank has set a credit growth target of about 16% for the economic growth target of 8%. If economic growth reaches 10%, credit growth must be at 18-20%.

Currently, the banking industry is cutting costs, reducing lending interest rates; increasing access to capital for businesses and people. Deploying credit packages that adequately and promptly meet capital needs for production and business, serving the living needs and legitimate consumption of people and businesses, striving to increase credit growth while controlling credit quality. Continuing to promote digital transformation in banking activities to meet the requirements for new business models and products and services on the basis of information technology, digital banking, digital payments...

The Governor of the State Bank of Vietnam has just issued Directive No. 01/CT-NHNN, dated January 20, 2025, on organizing the implementation of key tasks of the banking sector in 2025. Accordingly, implementing Resolution No. 158/2024/QH15 dated November 25, 2024 of the National Assembly on the socio-economic development plan for 2025, Resolution No. 01/NQ-CP dated January 8, 2025 of the Government on the main tasks and solutions to direct and manage the implementation of the socio-economic development plan and the State budget estimate for 2025, closely following the direction of the Party Committee of the State Bank of Vietnam on policies and orientations for key tasks of the banking sector in 2025, the Governor of the State Bank of Vietnam requires its units and credit institutions, foreign bank branches to well implement solutions for managing monetary policy and banking activities in 2025. 2025, contributing to prioritizing strong economic growth associated with maintaining macroeconomic stability, controlling inflation, and ensuring major balances of the economy.

.jpg)