Nghe An: 100% of gas and oil stores issue invoices after each retail sale.

(Baonghean.vn) - According to statistics from the Nghe An Provincial Tax Department, by the end of April 3, 100% of petrol and oil stores in the area had replaced and installed devices connecting to software to issue electronic invoices for each sale. Of these, 82 petrol and oil stores issued invoices via phone apps.

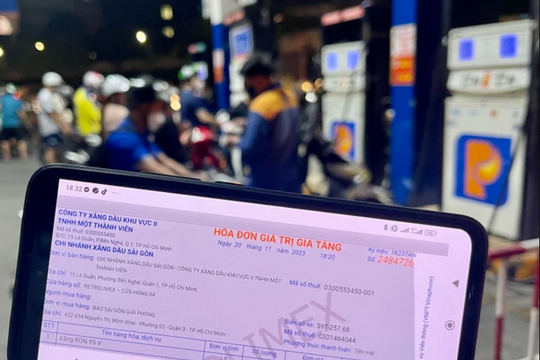

Specifically, by April 3, 100% of 539 stores with 1,622 fuel pumps in Nghe An province had implemented the policy.issue electronic invoicesfor each sale. Of which: The number of stores implementing the solution of automatically transmitting data from the pump column to the computer issuing electronic invoices is 93 stores, 333 pump columns. The number of stores implementing the solution of using handheld POS machines is 364 stores, 1,075 pump columns. The number of stores implementing the solution of transmitting data to issue invoices via phone applications (apps) is 82 stores, 214 pump columns.

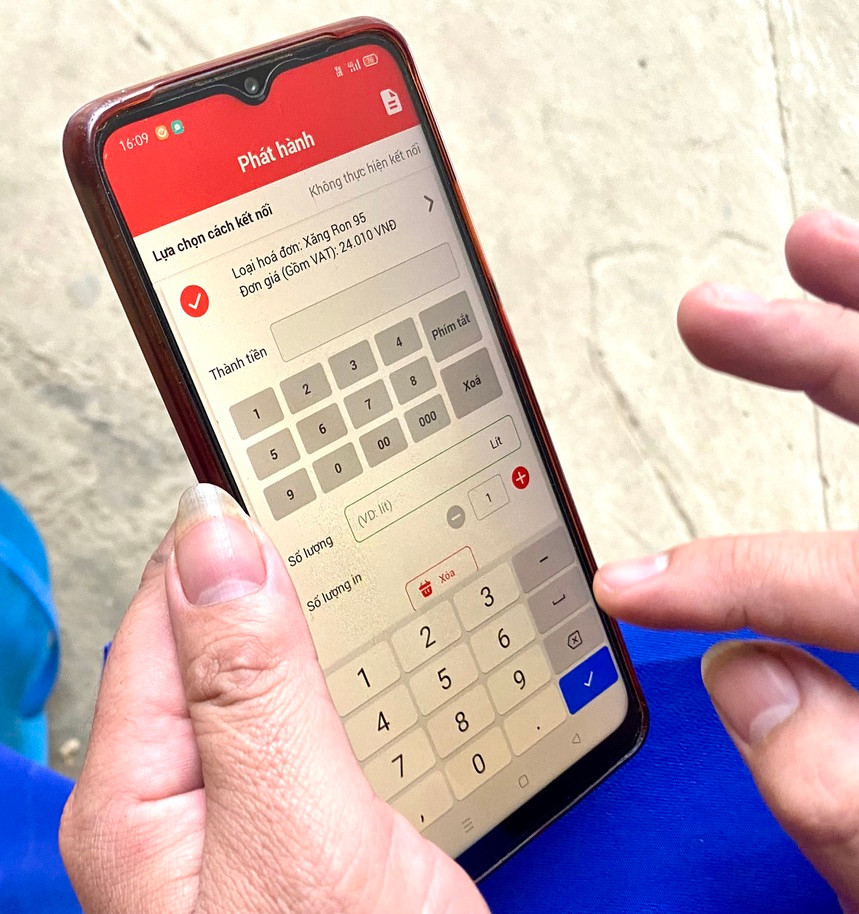

For data transmission of invoices via the app, stores mainly use Viettel's S-Invoice Electronic Invoice Service software installed on the phone. This is a paid software, with the function of creating, creating, sending, receiving, storing and managing invoices, signed with digital signatures, with legal value like regular paper invoices; can be converted to paper invoices when needed.

However, this software must be operated manually. Employees base on the number of liters on the pump to issue invoices and send them directly to the tax authority.

In recent times, Nghe An Tax Department has promoted propaganda and support for taxpayers; closely coordinated with relevant departments and branches to resolve arising problems and find the most optimal solutions during the implementation process. The Tax Department has coordinated with units providing electronic invoice software solutions to guide gasoline and oil businesses in installing, managing and using invoices.

The Tax Department requires petrol and oil businesses to issue electronic invoices for each sale at petrol and oil retail stores and connect data with tax authorities as prescribed. This will contribute to improving the efficiency of State management, preventing tax losses and protecting consumer rights.

In addition, Nghe An Tax Department also closely coordinates with relevant agencies to deploy inspection and supervision measures to detect and strictly handle violations in the business of gasoline and oil products, including compliance with the implementation of electronic invoices for each sale according to regulations.

.jpeg)