Nghe An: Estimated budget revenue in the first two months of the year was nearly 2,800 billion VND

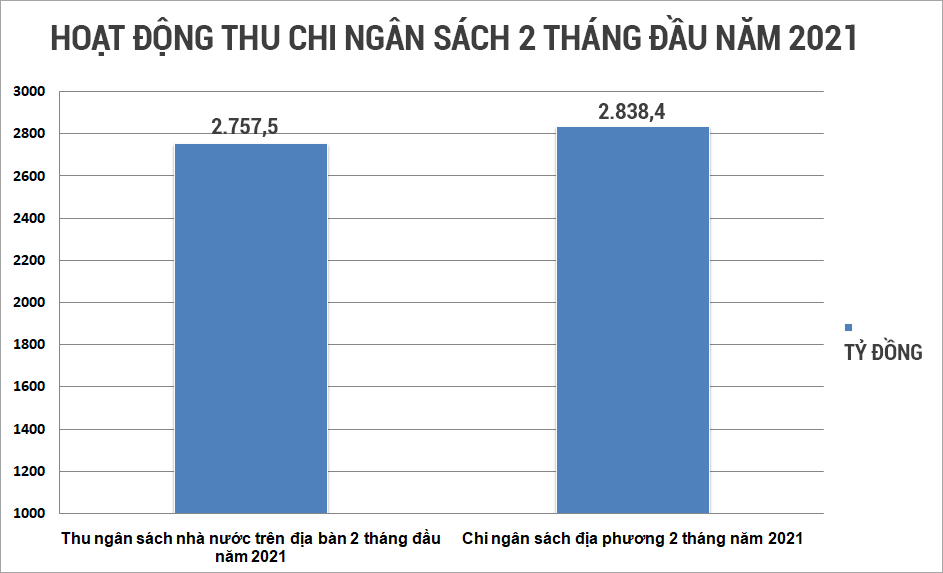

(Baonghean.vn) - Nghe An's budget revenue in the first two months of 2021 is estimated at 2,757 billion VND, while budget expenditure in the first two months is estimated at 2,838 billion VND.

The 2021 Nghe An budget estimate assigned by the Provincial People's Council is 14,032.3 billion VND. The Department of Finance's report said: State budget revenue in the area in the first two months of 2021 is estimated at 2,757.5 billion VND, reaching 19.7% of the estimate assigned by the Provincial People's Council and equal to 88.8% compared to the same period in 2020.

Of which: Domestic revenue is estimated at 2,556.7 billion VND, reaching 20% of the estimate and equal to 87.3% compared to the same period in 2020. If land use fees and lottery revenue are deducted, the remaining domestic revenue is 1,899 billion VND, reaching 19.5% of the estimate and equal to 99.8% of the same period in 2020.

Revenue from import and export activities200.8 billionVND, reaching 16.1% of the estimate and equal to 114.1% over the same period in 2020.

Thus, the estimated budget collection for the first two months of 2021 exceeded the schedule assigned by the Provincial People's Council.

Regarding budget expenditure, the estimate assigned by the Provincial People's Council is 25,716.56 billion VND. Local budget expenditure in the first two months of 2021 is estimated at 2,838.4 billion VND, reaching 11.0% of the estimate assigned by the Provincial People's Council.

|

| Signing of the project for a new electronic components factory in Hoang Mai 1 Industrial Park (Hoang Mai town). Photo: Document |

Preside over and coordinate with departments, branches, sectors, and district-level People's Committees to: implement directive documents, manage budget collection in 2021; Continue to innovate and promote propaganda, support, and legal advice on tax policies to help organizations and individuals access policies promptly and effectively. Proactively resolve difficulties and problems and increase dialogue with businesses.

|

| Chart of revenue and expenditure of Nghe An's budget in the first two months of 2021. Graphics: Lam Tung |

Resolutely direct the collection and exploitation of revenue sources, strengthen management against revenue loss; review and evaluate factors affecting the State budget revenue in the area, clarify revenue shortfalls and potential revenue sources; propose specific solutions to recommend the Provincial People's Committee to direct sectors and levels to coordinate implementation.

To preside over and closely coordinate with departments, branches, sectors, and district-level People's Committees to review and grasp the subjects and sources of budget revenue; control to collect correctly and fully; and promptly collect taxes, fees, charges, and receivables according to audit and inspection results, etc. into the State budget.

The Tax Department closely coordinates with the Department of Natural Resources and Environment and the District People's Committee to urge the collection of land use fees and land rents for real estate business projects that have been allocated land, and determine land prices to fully and promptly collect the amount payable to the State budget. At the same time, strengthen the inspection of project implementation progress to propose land recovery for projects that are slow to implement and do not fulfill tax obligations as prescribed.

|

| Many businesses are facing difficulties due to Covid-19. Photo: Tien Dong |

In addition, the relevant authorities will strengthen tax inspection and examination, and at the same time, based on the actual situation, consider continuing to implement support policies on taxes, fees and charges to help businesses overcome difficulties caused by the Covid-19 pandemic and restore production and business.

.png)

.jpg)

.jpg)