Nghe An: More than 35,000 customers affected by the epidemic have their interest rates waived or reduced

(Baonghean.vn) - Implementing solutions to remove difficulties, promote production and business, and respond to the Covid-19 epidemic, Nghe An has 35,819 customers exempted or reduced interest and interest rates with a total debt value exempted or reduced of VND 46,901.5 billion.

Good growth in outstanding loans

In the first 6 months of 2021, Nghe An achieved growthmobilized capitaland good debt balance, continue to control the ratio of bad debt to total debt below the allowed level.

Total mobilized capital in the area is estimated at 168,163 billion VND, an increase of 8,008 billion VND compared to the beginning of the year, equal to 5%; compared to the same period last year, an increase of 15,406 billion VND, equal to 10.09%.

Total outstanding debt of credit institutions and branches in the area is estimated at 235,995 billion VND, an increase of 9,964 billion VND compared to the beginning of the year, equal to 4.4%; compared to the same period last year, an increase of 11.6%.

|

| Mobilizing good capital resources is a condition for Nghe An to increase credit growth and develop the economy and society. Photo: Thu Huyen |

Thus, the estimated speedoutstanding loan growthThe whole area in the first 6 months of 2021 was 4.4% higher than the same period in 2020 (1.4%) because in the first 6 months of 2021, businesses gradually recovered after controlling the epidemic, and the decrease in interest rates stimulated increased demand for loans.

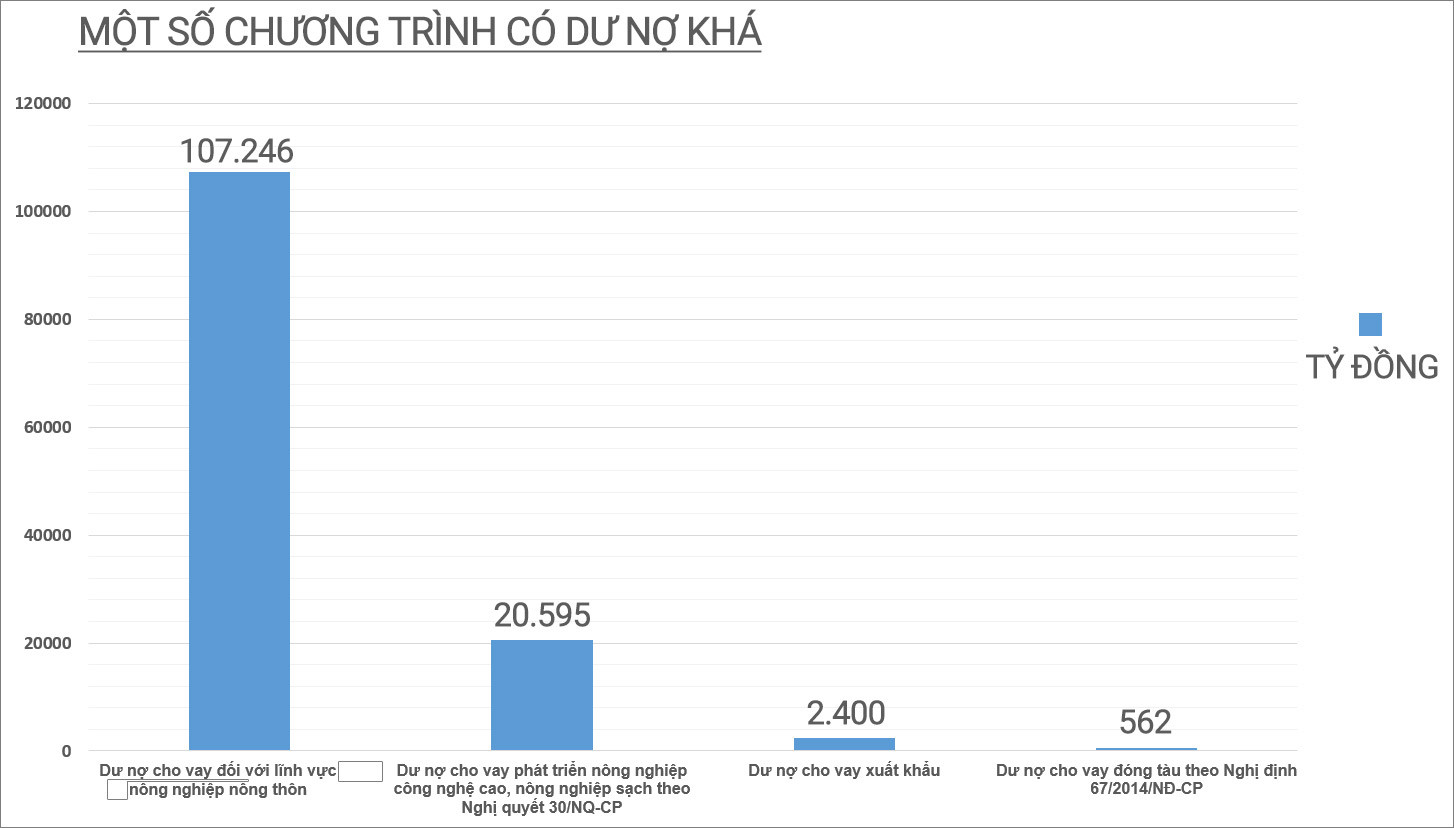

Some programs have good outstanding loans such as loans for rural agriculture estimated at 107,246 billion VND, up 4.8% compared to the beginning of the year. Outstanding loans for high-tech agricultural development and clean agriculture under Resolution 30/NQ-CP are estimated at 20,595 billion VND, up 2% compared to the beginning of the year; export loans are estimated at 2,400 billion VND; loans for shipbuilding under Decree 67/2014/ND-CP are estimated at 562 billion VND; loans to support housing under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 215 billion VND.

Credit for poor households and policy beneficiaries in the area has always been of interest and promoted by Nghe An Banking sector.By the end of June, outstanding loans for poor households and policy beneficiaries through the Policy Bank were estimated at VND9,588 billion, accounting for 4.06% of total outstanding loans in the whole area, up 6.7% over the beginning of the year.

|

| Graphics: Lam Tung |

11,466 customers have their debt repayment time restructured.

In particular, the local credit system continues to implement credit solutions to support businesses and people affected by the Covid-19 epidemic, and local banks actively restructure debt repayment terms.Exempt and reduce interest rates for customers affected by the Covid-19 epidemicThereby, temporarily solving difficulties for customers, helping customers stabilize production and business, creating revenue to repay debts to banks.

|

| Enterprises borrow capital to pay salary suspension for employees affected by the epidemic from the Vietnam Bank for Social Policies in November 2020. Photo: Thu Huyen. |

According to the State Bank of Vietnam, Nghe An branch, as of May 31, 2021, the results of implementing credit support measures for customers affected by the Covid-19 epidemic in the area are as follows: Restructuring debt repayment terms and maintaining debt groups for 11,466 customers with a total debt value of restructured debt repayment terms (accumulated from March 3, 2020) of VND 3,236.8 billion. Exempting and reducing interest and reducing interest rates for 35,819 customers with a total debt value exempted and reduced (accumulated from January 23, 2020) of VND 46,901.5 billion. New disbursements with preferential interest rates for 60,913 customers with disbursement turnover of VND 107,694.5 billion (accumulated from January 23, 2020).

The Vietnam Bank for Social Policies continues to disburse funds to customers who meet the loan conditions to pay for workers affected by the pandemic; To date, it has disbursed funds to 10 customers with a total disbursement amount of VND 1,159 million.

It is known that banks are continuing to receive, monitor, and handle difficulties and problems of people and businesses through the bank's hotline and satisfactorily resolve the Department of Transport's recommendations on continuing to support businesses and transport cooperatives in responding to the Covid-19 epidemic.