Nghe An: More than 40,000 policy beneficiaries receive preferential loans

(Baonghean.vn) - In the first 6 months of 2020, the Nghe An Provincial Branch of the Bank for Social Policies has provided preferential credit capital to 40,813 poor households and other policy beneficiaries to borrow preferential loans and policy credit, continuing to make important contributions to the socio-economic development achievements of the province.

On the morning of July 9, the Board of Directors of the Vietnam Bank for Social Policies held its 64th regular meeting to discuss the third quarter 2020 operation plan. Comrade Le Hong Vinh - Member of the Provincial Party Committee, Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors' Representative Board chaired.

|

| Members of the Board of Directors of the Provincial Social Policy Bank attended the 64th regular meeting. Photo: Thu Huyen |

Closely following the Resolutions of the Provincial Board of Directors in the meetings, the Executive Board of the Provincial Bank for Social Policies Branch has advised the Board of Directors and coordinated with relevant units and organizations to effectively implement key tasks.

The provincial Social Policy Bank branches and district-level transaction offices have actively advised the Representative Board to effectively implement the direction of the Provincial People's Committee on assigning budget allocation targets for entrusted lending. In the first 6 months of the year, the entire province's budget at all levels has transferred 24 billion 367 million VND, completing 97.47% of the Central's plan for the whole year.

|

| The staff of the Bank for Social Policies suggested that the Department of Labor, Invalids and Social Affairs should properly implement Circular 17 in reviewing and updating poor and near-poor households as a basis for these subjects to have timely access to policy credit capital. Photo: Thu Huyen |

By June 30, 2020, the total policy capital reached VND 8,882 billion, an increase of VND 506 billion compared to 2019, achieving a growth rate of 6.04%. Loan turnover was VND 1,653 billion, equivalent to the same period in 2019. Debt collection turnover reached VND 1,147 billion, accounting for 69.4% of loan turnover, contributing significantly to creating a stable and proactive revolving loan source at the local level, meeting the borrowing needs of poor households and policy beneficiaries in the context of difficulties in capital allocation from the Central Government.

|

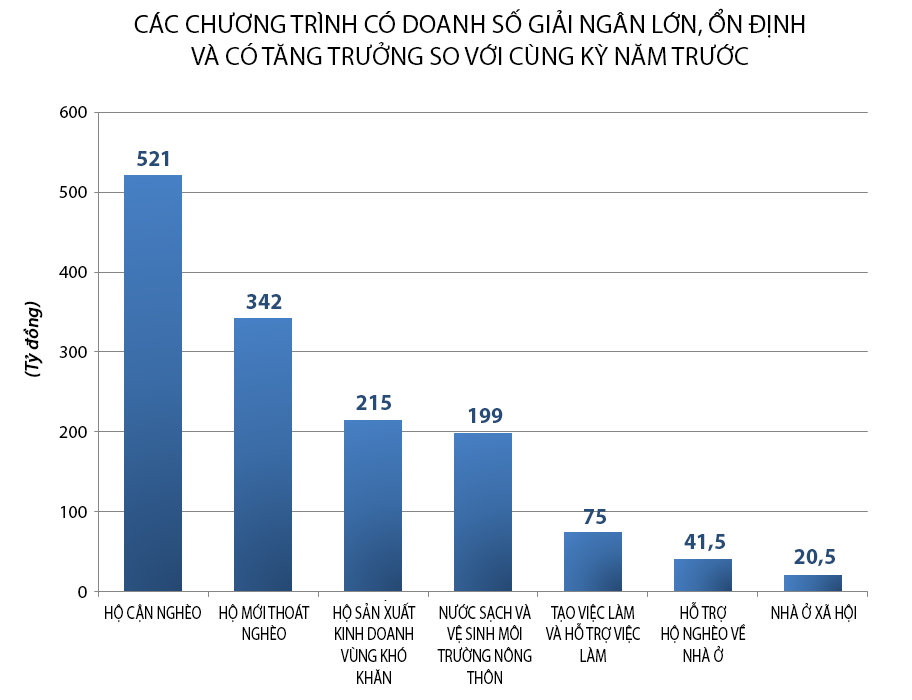

| Graphics: Huu Quan |

As of June 30, 2020, the total outstanding debt reached VND 8,865 billion, an increase of VND 504 billion compared to the beginning of the year, achieving a growth rate of 6.03% (an increase of 5.7% compared to the same period last year). Programs assigned to supplement capital and programs allowing growth in outstanding debt according to demand have all been promoted to disburse and increase outstanding debt compared to the beginning of the year. Some programs have good outstanding debt growth rates such as: social housing loans, loans to support poor households with housing, loans to support employment, job creation, loans for newly escaped poverty households, loans for production and business households in difficult areas...

|

| Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh spoke at the meeting. Photo: Thu Huyen |

Concluding the meeting, Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh acknowledged and highly appreciated the results achieved by the Board of Directors of the Bank for Social Policies. In the first six months of 2020, the Bank for Social Policies Nghe An Branch provided preferential credit to 40,813 poor households and other policy beneficiaries; policy credit continued to make important contributions to the socio-economic development achievements of the province. Despite the difficult economic conditions due to the negative impact of the Covid-19 pandemic and drought, bad debt continued to be tightly controlled and decreased compared to the beginning of the year.

|

| Shrimp farming model on sand using loans from the Vietnam Bank for Social Policies in Dien Trung commune (Dien Chau). Photo: Thu Huyen |

The Head of the Board of Directors' Representative Board suggested that in the coming time, it is necessary to take advantage of capital sources from the Central Government; actively and effectively mobilize deposit capital and revolving debt collection capital to focus on disbursement to meet the loan needs of poor households and other policy subjects, especially loans to restore production after the pandemic.

The organizations entrusted with directing and implementing the loan evaluation work well ensure publicity, democracy and accuracy. Focus on directing the collection and settlement of debts due; advise the Party Committee and the government on more drastic measures to deal with cases where there are conditions to repay the debt but deliberately delay, and subjects who misuse capital...

.jpg)

.jpg)