Houses worth over 700 million will have to pay tax.

At the press conference announcing the draft Law on Property Tax on the afternoon of April 13, Mr. Pham Dinh Thi - Director of the Tax Policy Department, Ministry of Finance said that in the future, houses will be subject to property tax.

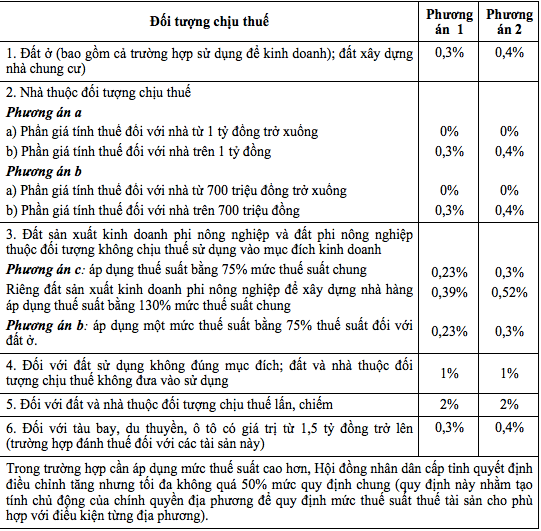

According to Mr. Thi, the Ministry of Finance proposed two options for taxing houses.

Option one is housing; houses and commercial and service buildings.Option 2 is housing. The taxable area of the house is the total usable area.

Houses worth over 700 million VND must pay tax

Regarding the tax rate for houses, the Ministry of Finance said that it will tax according to the value of the house. There are two options proposed: taxing the house value exceeding 700 million VND or over 1 billion VND.

Based on this threshold, Mr. Thi said that according to the National Housing Development Strategy to 2020 and vision to 2030 approved by the Prime Minister, the average housing area is 25m2/person. Thus, for a family of 4 people, the average area for a household is about 100m2, so the area under 100m2 will not have to pay tax, but over 100m2 will have to pay tax.

|

| Illustration photo |

However, according to this principle, many low-income rural households will have to pay tax. Therefore, the Ministry of Finance determines to calculate the house tax based on value so as not to affect people in rural areas and low-income.

Based on construction prices, the average investment capital for housing construction is about 7.3 million VND/m2. Thus, the average construction price of a new 100m2 house is about 730 million VND.

"The Ministry of Finance has proposed two options for calculating tax on houses with a value of 700 million VND or over 1 billion VND, but we are inclined towards the option of taxing houses with a value of 700 million VND or more to be subject to tax. For example, a house with a construction value of 1.2 billion VND will only be subject to tax of 500 million VND.

According to the initial estimate of the drafting committee, most rural houses will not have to pay tax" - Mr. Thi affirmed.

Tax rate 0.3 - 0.4%

Regarding the house tax rate, the Ministry of Finance proposed two options, option 1 0.3% and option 2 0.4%.

Mr. Thi explained that according to international experience, the lowest property tax rate is 0.2%. However, most countries apply high property tax rates, including some countries in the region such as Indonesia at 0.5%, Philippines at 1% and 2%.

|

| Housing tax options proposed by the Ministry of Finance |

According to the representative of the Ministry of Finance, many countries have taxed houses, including houses used for business purposes, because they believe that those who benefit from the use of transport infrastructure and social welfare will have obligations to the state.

In addition, some countries also tax houses used for business purposes, such as Korea, Taiwan, Singapore...

"In Vietnam, imposing property tax on houses and commercial and service buildings will impact the production and business activities of enterprises. Therefore, it is expected that in 2020, the draft will be submitted to the National Assembly for discussion and comments," said Mr. Thi.