Many business directors in Nghe An have their exit from the country temporarily suspended.

(Baonghean.vn) - These people are legal representatives of enterprises that are being forced to execute administrative decisions on tax management because they have not fulfilled their tax payment obligations in Nghe An.

Mr. Nguyen Dinh Duc, Acting Director of Nghe An Tax Department, has just signed notices on temporaryDeparture postponementFor legal representatives of enterprises that are being forced to execute administrative decisions on tax management and have not fulfilled their tax payment obligations, such as: Joint Stock Company 482, Vinh Chemical Joint Stock Company... In addition, some branches also signed notices on temporary suspension of exit for some business owners in the districts.

|

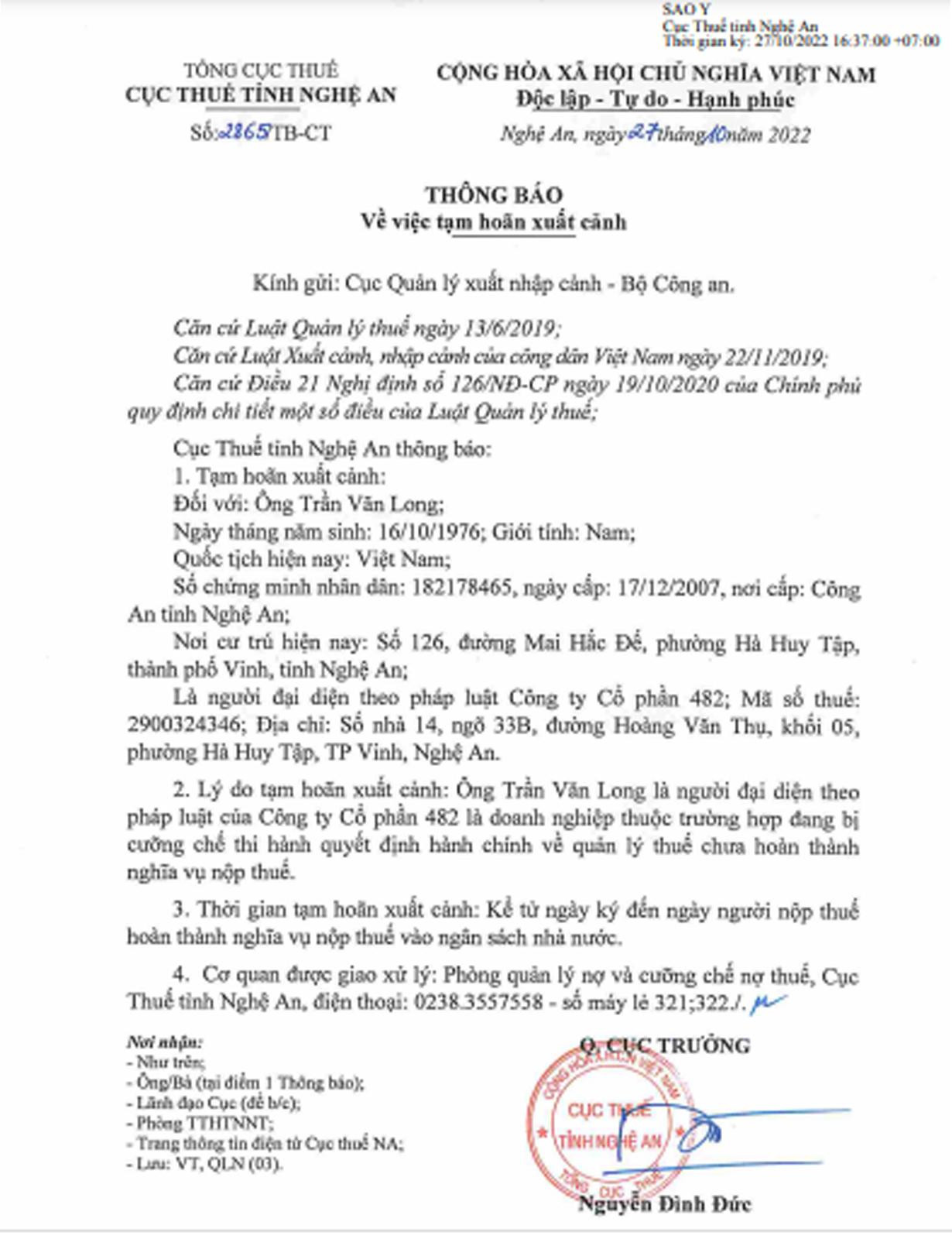

Notice of exit suspension for Mr. Tran Van Long, legal representative of 482 Joint Stock Company. Photo: PV |

Accordingly, on October 27, Mr. Nguyen Dinh Duc signed Notice No. 2865/TB-CT on the temporary suspension of exit for Mr. Tran Van Long (born in 1976 - Vinh City). Mr. Long is the legal representative of Joint Stock Company 482. Mr. Long was temporarily suspended from exiting the country because Joint Stock Company 482 is under the enforcement of administrative decisions on tax management and has not yet fulfilled its tax payment obligations. The period of temporary suspension of exit is from October 27, 2022 until the completion of tax payment obligations to the State budget.

On the same day, Acting Director of Nghe An Tax Department Nguyen Dinh Duc also signed Notice No. 2866/TB-CT on the temporary suspension of exit for Mr. Nguyen Hong Son (born 1956 - Vinh City). Mr. Son is the legal representative of Vinh Chemical Joint Stock Company.

Mr. Son was temporarily suspended from leaving the country because Vinh Chemical Joint Stock Company is an enterprise that is being forced to execute an administrative decision on tax management and has not yet fulfilled its tax payment obligations. The period of temporary suspension of exit is from the date of signing until the date the taxpayer completes his tax payment obligations to the state budget.

|

Enterprises and business households carry out procedures at Vinh Tax Department. Photo: Quang An |

In addition, on October 27, the Bac Nghe II Tax Department (Nghe An Tax Department) also announced the temporary suspension of exit for many business leaders such as: Temporary suspension of exit for Mr. Tran Van Noan (born in 1959 - Vinh City), Director of Tuong Nguyen Company Limited; Mr. Vu Van Hoang (born in 1972 - Yen Thanh District), Director of Hoang Hung Construction Materials Production and Trading Joint Stock Company; Mr. Phan Xuan Hai (born in 1963 - Yen Thanh District), Director of Cuong Thinh Garment Import-Export Company Limited; Mr. Hoang Quoc Hung (born in 1984 - Yen Thanh District), Director of Ly Hung Company Limited.

The reason for the temporary suspension of exit for the above-mentioned enterprise directors is that the enterprise is being forced to execute an administrative decision on tax management and has not yet fulfilled its tax payment obligations. The temporary suspension of exit is from October 27, 2022 until the taxpayer fulfills its tax payment obligations to the State budget.

On October 26, the Song Lam 1 Regional Tax Department also announced the temporary suspension of entry and exit for two business leaders, including: Mr. To Anh Phuong (Kieu Phuong Company, Tan Ky District) and Mr. Tran Dinh Hai, Director of Quy Van Construction Company Limited (Tan Ky).

Exit suspension period: From October 26, 2022 until the taxpayer completes tax obligations to the State Budget.

As for foreigners, their exit from Vietnam may be temporarily suspended if they have not fulfilled their tax obligations (according to Clause 1,2, Article 28 of the Law on Entry, Exit, Transit and Residence of Foreigners in Vietnam 2014).

Law on Tax Administration No. 38/2019/QH14 (Article 6) and Decree No. 126/2020/ND-CP guiding this Law (Article 21) have added provisions on temporary suspension of exit for taxpayers who are subject to compulsory enforcement of administrative decisions on tax administration and procedures for coordinating the implementation of this work. Accordingly, the authority to decide on temporary suspension of exit, extension of temporary suspension of exit, cancellation of temporary suspension of exit is the Head of the tax administration agency directly managing the taxpayer, who has the authority to decide on the selection of cases of temporary suspension of exit for the cases specified in Clause 1, Article 21 of Decree 126/2020/ND-CP based on the actual situation and tax administration work in the area.