Vinh City Tax Department publicly announced 196 people who still owe 442 billion VND in taxes.

(Baonghean.vn) - Vinh City Tax Department (Nghe An) has just issued Decision No. 8598/TB-CCT dated October 13, 2023 on publicizing the list of taxpayers owing taxes and other revenues to the State budget.

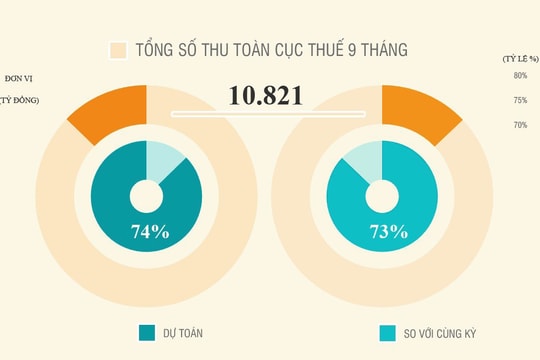

Accordingly, as of September 30, 2023, there were 196 taxpayers who still owed taxes and other revenues to the State budget, with a total amount of VND 442,009 billion. The above units and individuals violated Point a, Clause 1, Article 29 of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government and "Tax authorities publicly disclose information about taxpayers in cases of tax evasion, abetting tax evasion, appropriation of tax money, violations of tax laws and then fleeing from business headquarters; illegal issuance and use of invoices".

According to the list published by Vinh Tax Department, at the top of the tax debt list isMinh Khang Trading Company Limitedat 9-11E Tran Phu Street, Ward 4, District 5, Ho Chi Minh City, with an amount of 332,086 billion VND; followed by BMC Trading Construction and Materials Company Limited at 455-457 Tran Hung Dao Street, Cau Kho Ward, District 1, Ho Chi Minh City, with a tax debt of 60,040 billion VND; Thanh Vinh Production and Trade Investment Joint Stock Company at Nguyen Quoc Tri Street, Hung Phuc Ward, Vinh City, with an amount of 8,170 billion VND...

In the list of tax debts, there are also the following units with less tax debts, including Truong Thanh Company Limited, Nghe An Investment and Development Joint Stock Company, Lilama 5 Joint Stock Company, Ngoc Ha Trading and Service Joint Stock Company Branch in Nghe An, Ruby Nghe An Glove Factory, Dien Loc Viet Company Limited Branch, Saigon Post and Telecommunications Service Joint Stock Company Branch in Nghe An, Phu Cuong Company Limited on Vo Thi Sau Street, Truong Thi Ward, Vinh City...

According to the provisions of the Tax Law, after notificationpublic list of large tax debtsWithin 90 days, if the taxpayer still does not comply, the Tax Department will have to apply coercive measures to collect tax arrears into the State budget. In case the enforcement decision expires and the taxpayer has not paid or has not paid the full amount of tax arrears to the State budget, it must promptly switch to applying appropriate, in accordance with regulations./.