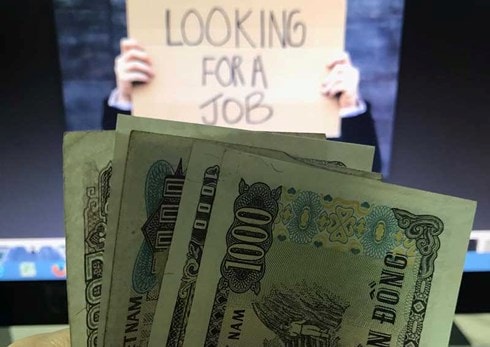

Unemployment insurance benefits, workers should know

Recently, many workers have lost their jobs or quit their jobs but do not know their rights.

Many units and businesses, taking advantage of workers' lack of knowledge, have appropriated this money by "owing" or delaying payments to workers, or even misappropriating it.

|

From January 1, 2018, the revised Penal Code officially took effect. One of the notable contents is that criminal proceedings will be taken against acts of fraud and evasion of social insurance, unemployment insurance (UI), and health insurance with penalties of up to VND 3 billion or 10 years in prison. Therefore, employers and employees need to clearly understand their rights and obligations to avoid violating the law.

1. Subjects participating in social insurance

Workers

a) Employees participate in unemployment insurance when working under a labor contract or work contract as follows:

+ Labor contract (LC) or Employment contract (ICC) of indefinite term;

+ Labor contract or employment contract with fixed term;

+ Seasonal labor contract or labor contract for a specific job with a term from 3 months to less than 12 months.

b) People receiving monthly pensions and allowances for loss of working capacity; domestic workers who have signed labor contracts with the units specified in Clause a above are not eligible to participate in unemployment insurance.

Units participating in social insurance

Units participating in unemployment insurance are those specified in Clause 3, Article 4 of Decision No. 595/QD. Accordingly, employers participating in compulsory social insurance include: state agencies, public service units, people's armed forces units; political organizations, socio-political organizations, socio-political-professional organizations, socio-professional organizations, other social organizations; foreign agencies, organizations, international organizations operating in Vietnam; enterprises, cooperatives, individual business households, cooperative groups, other organizations and individuals that hire and use labor under labor contracts.

2. Social insurance contribution level:

+ Employees contribute 1% of monthly salary;

+ Employers contribute 1% of the monthly salary fund of employees participating in unemployment insurance;

+ The State supports up to 1% of the monthly salary fund for unemployment insurance contributions of employees participating in unemployment insurance and is guaranteed by the central budget.

3. Monthly salary for social insurance contribution

a). For employees subject to the salary regime prescribed by the State, the monthly salary used to pay unemployment insurance is the salary used as the basis for paying compulsory social insurance.

b). For employees paying unemployment insurance according to the salary regime decided by the unit, the monthly salary used as the basis for paying compulsory social insurance is the salary stated in the labor contract.

+ From January 1, 2016, the monthly salary for social insurance contribution is the salary and salary allowance according to the provisions of labor law.

+ From January 1, 2018 onwards, the monthly salary for social insurance contribution is the salary, salary allowances and other supplements according to the provisions of labor law.

In case the employee's monthly salary is higher than twenty times the regional minimum wage, the monthly salary for social insurance contribution is equal to twenty times the regional minimum wage (effective from January 1, 2015).

4. Closing method

- Monthly payment: Every month, no later than the last day of the month, the unit shall deduct compulsory social insurance contributions from the monthly salary fund of employees participating in compulsory social insurance, and at the same time deduct from the monthly salary of each employee the compulsory social insurance contributions according to the prescribed rate, and transfer them at the same time to the specialized collection account of the social insurance agency opened at a bank or the State Treasury.

- Pay every 3 months or 6 months: Units that are enterprises, cooperatives, individual business households, and cooperative groups operating in the fields of agriculture, forestry, fishery, and salt production that pay wages based on products or contracts must pay monthly, every 3 months, or every 6 months. By the last day of the payment period at the latest, the unit must transfer the full amount to the Social Insurance Fund.

- Closed by location

+ Units with headquarters in which province must register to participate in social insurance in that province according to the decentralization of the provincial social insurance agency.

+ Branches of enterprises pay social insurance at the location where the business license is issued to the branch.

5. Conditions for receiving unemployment insurance:

According to Article 49 of the Law on Employment, employees paying unemployment insurance are entitled to unemployment benefits when they meet the following conditions:

+ Termination of employment contract or work contract.

+ Have paid unemployment insurance for 12 months or more.

+ Have submitted an application for unemployment benefits to the employment service center within 03 months from the date of termination of the labor contract or work contract.

+ Haven't found a job after 15 days.

Monthly unemployment benefit levelequal to 60% of the average monthly salary for unemployment insurance contributions of the 6 consecutive months before unemployment, but not exceeding 5 times the basic salary for employees subject to the salary regime prescribed by the State or not exceeding 5 times the regional minimum wage as prescribed by the Labor Code for employees paying unemployment insurance according to the salary regime decided by the employer at the time of termination of the labor contract or employment contract.

- The period of unemployment benefits is calculated based on the number of months of unemployment insurance contributions. For every 12 to 36 months of contributions, you will receive 03 months of unemployment benefits. After that, for every additional 12 months of contributions, you will receive 01 additional month of unemployment benefits, but not more than 12 months.

In addition, according to the Law on Employment, employees are also entitled to health insurance benefits during the period of unemployment benefits;

+ Free job consultation and referral;

+ Supported with vocational training costs.

Within 03 months from the date of termination of the labor contract or employment contract, unemployed employees who need to receive unemployment benefits must directly submit 01 set of application documents for unemployment benefits to the local employment service center where the employee wants to receive unemployment benefits.

Within 20 days from the date the employment service center receives complete documents, the competent state agency shall issue a decision on unemployment benefits./.

.jpg)

.jpg)