Increasing environmental tax on gasoline: a burden on people's shoulders

The price of gasoline is burdened by many taxes and fees. If the tax on gasoline continues to increase, the price level will increase, and the burden will fall on the people.

The Ministry of Finance is seeking comments on the draft Resolution on environmental protection tax for gasoline and oil. If approved, from July 1, 2018, the environmental protection tax on gasoline will increase by VND1,000, to the maximum level of VND4,000/liter; on diesel oil by VND2,000/liter, an increase of VND500/liter; on fuel oil, lubricants, and greases by VND900 to the maximum level of VND2,000/liter (kg).

The reason given by the Ministry of Finance is that import tax has decreased, domestic gasoline prices are lower than some neighboring countries, increasing revenue.

|

| The Ministry of Finance proposed to drastically increase the environmental protection tax on gasoline. Illustration photo: KT |

Taxes and fees account for about 50% of the price of each liter of gasoline.

According to statistics, 1 liter of gasoline is currently subject to 7 types of taxes and fees such as: import tax, special consumption tax, value added tax, environmental protection tax; standard costs, standard profits, and stabilization fund expenditure. The total of taxes and fees accounts for about 8,500 VND/liter of gasoline. If the environmental protection tax on gasoline is raised to the maximum level, the increase in gasoline price will cause many people to face difficulties.

Mr. Tran Van Nghia (in Tran Khat Chan, Hai Ba Trung District, Hanoi) said that his family has 5 4-7 seater cars for transporting passengers on the Hanoi - Hai Duong route and 2 trucks for transporting goods for hire. On average, each month consumes about 3,000 liters of gasoline.

“If the price of gasoline increases, we will have to increase the fare because if we don't increase the price, we won't make a profit. If we increase the price, it will be difficult because if the price increases, our competitiveness will also decrease,” said Mr. Nghia.

According to Associate Professor Dr. Ngo Tri Long - former Director of the Institute for Price Research (Ministry of Finance), in the context that each liter of gasoline currently has to "carry" many types of taxes and fees, increasing environmental protection tax to the maximum level to increase budget revenue is unreasonable.

According to Mr. Long, currently, each liter of gasoline has to "carry" many types of taxes and fees, sometimes taxes and fees account for nearly 50% of the price of each liter of gasoline. Moreover, the problem that makes people upset now is that the interests of businesses, consumers and the state are not reasonable, especially environmental protection tax.

In the world, not all countries impose this tax, only a few countries apply it, including Vietnam. Vietnam not only applies this tax but also applies it at increasingly high rates, in a way that is exhaustive. This is really unreasonable.

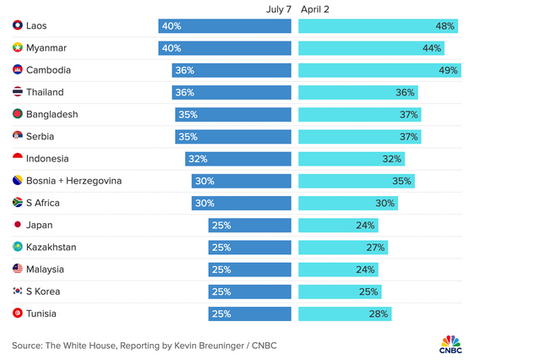

“Why doesn’t the Ministry of Finance compare with Malaysia (in the same region) but the gasoline price is lower than Vietnam? Why doesn’t the Ministry of Finance compare gasoline prices with the US, whose income is dozens of times higher than Vietnam’s but gasoline prices are still lower? Why does the Ministry of Finance only compare with Laos and Cambodia, countries that don’t have oil to exploit, while Vietnam has crude oil?”, Mr. Long raised a series of questions.

According to Mr. Long, in the context of restructuring both revenue and expenditure, the Ministry of Finance focusing on revenue is not enough. The function of the Ministry of Finance is to control expenditure sources and set a target of gradually reducing regular expenditure each year.

Vegetables and eggs increase in price

Assessing the impact of increasing environmental protection tax on gasoline, economic expert Le Dang Doanh said that it will increase transportation costs. “Vegetables and eggs will also increase in price. This will increase costs and people will have to bear it. Therefore, increasing environmental protection tax on gasoline needs to be carefully considered,” said Mr. Doanh.

|

| The increase in environmental protection tax on gasoline will put the burden of rising commodity prices on the people. Illustration photo: KT |

Sharing the same view, Mr. Ngo Tri Long said that petroleum is an important commodity, strongly affecting all production and consumption items, affecting people's lives. In the current context, the competitiveness of the industry and domestic products is weak, if the environmental protection tax is so high, it will certainly affect the competitiveness of businesses, because petroleum is a very important material for all industries in the national economy.

“Invisibly, imposing high environmental taxes will reduce the competitiveness of businesses while their competitiveness is still very weak. In addition, it also affects people's income. Although our country's average income is currently at the average level, it is still low in the world. If we impose taxes while people's living standards are still low, it is not advisable," said Mr. Long.

Mr. Long himself does not agree with increasing taxes and fees to solve budget difficulties. According to him, taxes are a very important tool, which is to stimulate or limit production. If taxes are used to increase revenue, this is a viewpoint that goes against the development of the tax industry.

“According to the Ministry of Finance’s calculations, increasing the environmental protection tax on gasoline will not cause the price level to increase much and will not affect the poor much (because they already have social security policies). But this is only a theory predicted by the Ministry of Finance and has not fully considered all the impacts. We need to let reality answer the consequences of this price increase,” said Mr. Long.

Recalling the previous story, when the Ministry of Finance proposed to increase the environmental tax on gasoline from 1,000 VND/liter to 3,000 VND/liter, National Assembly delegates raised the question, if the increase is proposed, will gasoline prices increase? The Ministry of Finance's leaders replied that the price would not increase, but in reality, increasing the environmental protection tax immediately causes gasoline prices to increase.

“In the past two years, our country has controlled inflation thanks to the sharp decrease in gasoline prices. If gasoline prices increase, inflation will increase. I think the Ministry of Finance should be cautious and find other options to replace the option of increasing environmental tax on gasoline,” Mr. Long suggested.