Vietnam's economic growth increasingly depends on foreign investment.

Continuing the impressive growth momentum of the second half of 2017, GDP in the first quarter of 2018 grew strongly by 7.38%, the highest in the past 10 years. However, the added value created in this industry mainly came from the FDI sector, showing the increasing dependence of Vietnam's economic growth on the foreign investment sector.

GDP growth continues to impress

According to Mr. Nguyen Duc Thanh - Director of the Vietnam Institute for Economic and Policy Research (VEPR), in 2017, recovery took place strongly in most major economies in the world. The US, EU, Japan and China all witnessed positive growth rates. Meanwhile, the UK continued to face difficulties after Brexit. The high demand for world goods contributed significantly to the economic recovery in emerging and developing economies, including Vietnam.

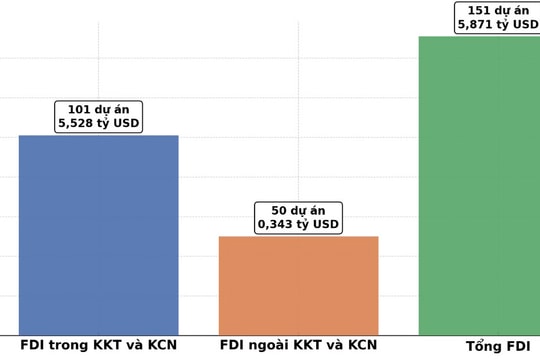

According to Mr. Thanh, continuing the impressive growth momentum of the second half of 2017, GDP in the first quarter of 2018 grew strongly by 7.38%, the highest in the past 10 years. The industrial production index increased dramatically by 11.6% compared to the same period last year. In particular, the industry considered the main driving force of growth - the processing and manufacturing industry - continued to grow strongly by 13.9%. However, the added value created in this industry mainly came from the FDI sector. This shows the increasing dependence of Vietnam's economic growth on the foreign investment sector.

Illustration photo |

The Director of VEPR also said that the signing of the CPTPP Agreement continues to strengthen Vietnam's deep integration process with the world. However, besides contributing to promoting economic development, this also creates difficulties for the State budget revenue when the balance of revenue from import-export activities is decreasing.

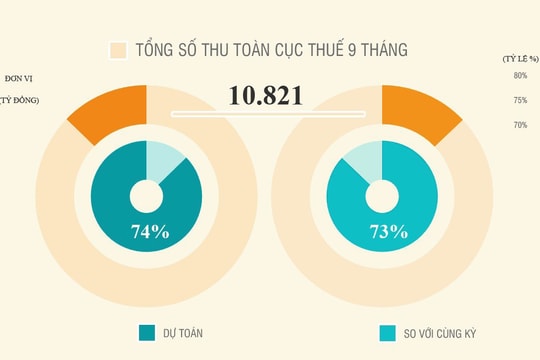

At the same time, the Government also determined to reduce the proportion of revenue from available natural resources such as crude oil. To attract private investment and FDI, the Government has continuously lowered corporate income tax rates in recent years, so the proportion of revenue from this type of tax has also gradually decreased. To compensate for the decline in total budget revenue, the Government is forced to increase other domestic revenues.

Recently, the Ministry of Finance has proposed a draft to increase VAT rates. However, the Director of VEPR said that increasing VAT rates on the one hand increases the tax burden on people, indirectly pushing a part into the informal economic sector. On the other hand, it does not guarantee an increase in the proportion of VAT revenue in total budget revenue.

To ensure a balance between revenue and expenditure, VEPR believes that it is necessary to improve revenue sources through increasing the efficiency of collection of existing taxes and current tax rates, instead of hastily imposing new taxes or increasing tax rates. This requires reform within the tax sector. An accompanying solution is to maintain efforts to control budget expenditure, especially recurrent expenditure.

Need to effectively manage foreign loans

Also related to the issue of the state budget, Mr. Nguyen Duc Thanh shared that the budget deficit and public debt are always the top concerns of the people. Accordingly, recently, the idea of including the "underground economy" in GDP calculations has created a heated debate.

According to VEPR, estimating the informal economy is necessary for the Government to develop appropriate development strategies. However, including the underground economy in GDP is not appropriate because total GDP may increase nominally, but it may cause inconsistencies in international comparisons according to practice.

In addition, it is important that national indicators such as budget expenditure and public debt may increase correspondingly, but they do not serve the informal sector, which has not been effectively and appropriately managed. At the same time, the ability to mobilize revenue has not increased correspondingly for the same reason. This distorts the warning signals about the state of Vietnam’s budget and public debt.

"We believe that the urgent task is not to calculate the informal sector into the total GDP but to effectively manage foreign loans to improve socio-economic efficiency, or minimize waste and misuse. If foreign debt and budget balance are not well controlled, the public debt ceiling will certainly be broken in the near future and Vietnam will sink deeper into debt before it can take off," the Director of VEPR expressed his opinion.