Monthly bonus is subject to social insurance contribution?

Ms. Ngo Thi Hai Ch. works at a company, in the contract it is stated that the basic salary including insurance is 4 million VND/month, the incentive bonus is 2 million VND. Every month she receives this bonus.

Ms. Chien asked, from January 1, 2018, will this incentive bonus be included in the insurance premium?

On this issue, according toPoints 2.1, 2.2, 2.2, Clause 2, Article 6 of Decision 595/QD-BHXH dated April 14, 2017 of the General Director of Vietnam Social Security stipulates:

From January 1, 2016 to December 31, 2017, the monthly salary subject to compulsory social insurance is the salary and salary allowance as prescribed in Clause 1 and Point a, Clause 2, Article 4 of Circular No. 47/2015/TT-BLDTBXH dated November 16, 2015 of the Ministry of Labor - Invalids and Social Affairs guiding the implementation of a number of articles on labor contracts, labor discipline, and material responsibility of Decree No. 05/2015/ND-CP dated January 12, 2015 of the Government detailing and guiding the implementation of a number of contents of the Labor Code.

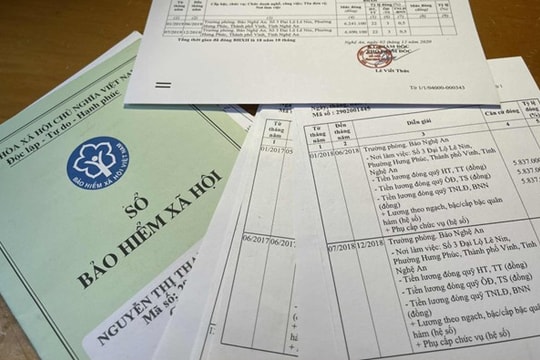

|

| Illustration. Photo source |

Salary allowances as prescribed in Point a, Clause 2, Article 4 of Circular No. 47/2015/TT-BLDTBXH are salary allowances to compensate for factors related to working conditions, complexity of work, living conditions, and labor attraction that the agreed salary in the labor contract has not been taken into account or has not been fully taken into account, such as position and title allowances; responsibility allowances; allowances for heavy, toxic, dangerous work; seniority allowances; regional allowances; mobility allowances; attraction allowances and allowances of similar nature.

From January 1, 2018 onwards, the monthly salary subject to compulsory social insurance is the salary, salary allowance as prescribed in Point 2.1 of this Clause and other supplements as prescribed in Point a, Clause 3, Article 4 of Circular No. 47/2015/TT-BLDTBXH.

Monthly salary for compulsory social insurance does not include other benefits and welfare.such as bonuses as prescribed in Article 103 of the Labor Code, initiative bonuses; mid-shift meal allowances; allowances for gasoline, telephone, travel, housing, childcare, and childcare; support when a worker has a relative who dies, a worker has a relative who gets married, a worker's birthday, subsidies for workers in difficult circumstances due to work accidents, occupational diseases, and other support and subsidies recorded as separate items in the labor contract according to Clause 11, Article 4 of Decree No. 05/2015/ND-CP.