USD exchange rate today August 15, 2024: USD slightly increased

USD exchange rate today August 15: The State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 4 VND, currently at 24,260 VND.

Domestic USD exchange rate on August 15

USD exchange rate today, August 15, the State Bank of Vietnam announced the central exchange rate between the Vietnamese Dong and the US dollar, with a slight increase of 4 VND compared to the previous session, reaching 24,260 VND.

At the same time, the reference exchange rate at the State Bank's Transaction Office for buying and selling remains stable, with the buying rate at 23,400 VND and the selling rate at 25,450 VND.

USD exchange rate today August 15, 2024, USD VCB decreased by 100 VND, meanwhile, USD decreased in value compared to the euro when inflation data showed that it was cooling down.

| 1.VCB- Updated: 08/15/2024 05:59 - Time of the website providing the source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| Australian Dollar | AUD | 16,174.45 | 16,337.83 | 16,862.36 |

| Canadian Dollar | CAD | 17,800.63 | 17,980.44 | 18,557.70 |

| SWISS FRANC | CHF | 28,263.23 | 28,548.71 | 29,465.27 |

| YUAN RENMINBI | CNY | 3,432.24 | 3,466.91 | 3,578.75 |

| DANISH KRONE | DKK | - | 3,628.60 | 3,767.64 |

| EURO | EUR | 26,878.57 | 27,150.07 | 28,353.01 |

| Sterling Pound | GBP | 31,327.03 | 31,643.46 | 32,659.38 |

| HONG KONG DOLLAR | HKD | 3,132.25 | 3,163.89 | 3,265.47 |

| INDIAN RUPEE | INR | - | 297.39 | 309.28 |

| YEN | JPY | 165.02 | 166.69 | 174.66 |

| Korean Won | KRW | 15.97 | 17.74 | 19.36 |

| KUWAITIAN DINAR | KWD | - | 81,595.55 | 84,859.59 |

| MALAYSIAN RINGGIT | MYR | - | 5,608.69 | 5,731.15 |

| NORWEGIAN KRONER | NOK | - | 2,298.64 | 2,396.29 |

| Russian Ruble | RUB | - | 264.36 | 292.66 |

| SAUDI RIAL | SAR | - | 6,649.99 | 6,916.01 |

| SWEDISH KRONA | SEK | - | 2,356.50 | 2,456.61 |

| SINGAPORE DOLLAR | SGD | 18,547.74 | 18,735.09 | 19,336.58 |

| THAILAND BAHT | THB | 633.37 | 703.75 | 730.71 |

| US DOLLAR | USD | 24,820.00 | 24,850.00 | 25,190.00 |

| 2.Agribank- Updated: 01/01/1970 08:00 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24,930.00 | 24,940.00 | 25,280.00 |

| EUR | EUR | 27,054.00 | 27,163.00 | 28,292.00 |

| GBP | GBP | 31,614.00 | 31,805.00 | 32,794.00 |

| HKD | HKD | 3,159.00 | 3,172.00 | 3,277.00 |

| CHF | CHF | 28,443.00 | 28,557.00 | 29,452.00 |

| JPY | JPY | 166.40 | 167.07 | 174.73 |

| AUD | AUD | 16,356.00 | 16,422.00 | 16,929.00 |

| SGD | SGD | 18,697.00 | 18,772.00 | 19,348.00 |

| THB | THB | 699.00 | 702.00 | 733.00 |

| CAD | CAD | 17,975.00 | 18,047.00 | 18,589.00 |

| NZD | NZD | 15,005.00 | 15,513.00 | |

| KRW | KRW | 17.66 | 19.46 | |

| 3.Sacombank- Updated: 07/04/2008 07:16 - Time of website supply | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24900 | 24900 | 25240 |

| AUD | AUD | 16394 | 16444 | 16947 |

| CAD | CAD | 18063 | 18113 | 18564 |

| CHF | CHF | 28779 | 28829 | 29382 |

| CNY | CNY | 0 | 3468.2 | 0 |

| CZK | CZK | 0 | 1037 | 0 |

| DKK | DKK | 0 | 3670 | 0 |

| EUR | EUR | 27334 | 27384 | 28087 |

| GBP | GBP | 31904 | 31954 | 32606 |

| HKD | HKD | 0 | 3230 | 0 |

| JPY | JPY | 168.13 | 168.63 | 173.14 |

| KHR | KHR | 0 | 6.2261 | 0 |

| KRW | KRW | 0 | 17.9 | 0 |

| LAK | LAK | 0 | 0.98 | 0 |

| MYR | MYR | 0 | 5800 | 0 |

| NOK | NOK | 0 | 2305 | 0 |

| NZD | NZD | 0 | 14842 | 0 |

| PHP | PHP | 0 | 412 | 0 |

| SEK | SEK | 0 | 2386 | 0 |

| SGD | SGD | 18824 | 18874 | 19426 |

| THB | THB | 0 | 675.8 | 0 |

| TWD | TWD | 0 | 765 | 0 |

| XAU | XAU | 7800000 | 7800000 | 8000000 |

| XBJ | XBJ | 7200000 | 7200000 | 7570000 |

World USD exchange rate on August 15

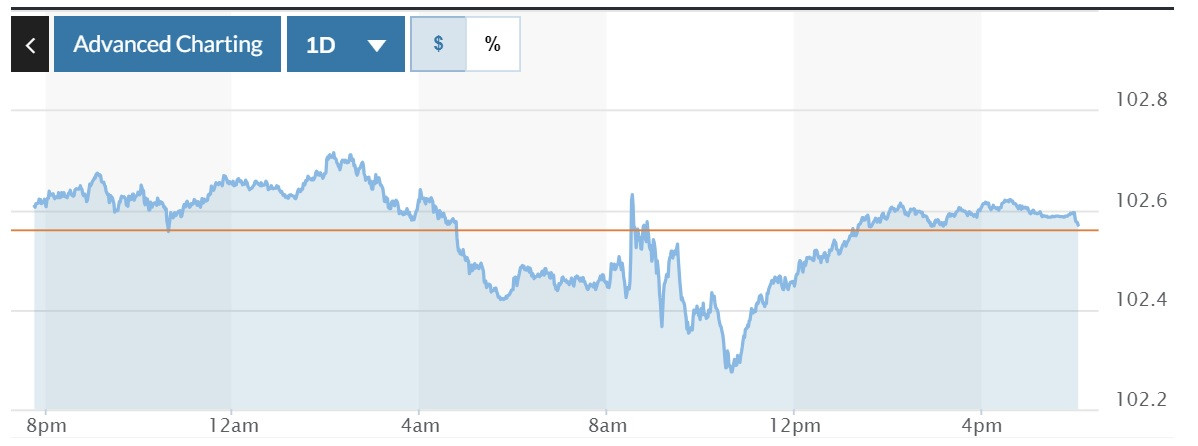

The US Dollar Index (DXY), which measures the US dollar's performance against six other major currencies, edged down 0.03% to 102.57.

The euro rose against the US dollar to its highest in nearly eight months, reflecting cooling US inflation, raising hopes that the US Federal Reserve (Fed) could soon cut interest rates.

The US consumer price index (CPI) for July rose only slightly, and the annual inflation rate fell below 3% for the first time since early 2021, raising expectations of a Fed rate cut next month.

The report also showed that producer prices rose slightly in July, along with a downward trend in inflation, which could allow the Fed to focus more on the labor market and ease concerns about an economic recession.

The new data has dampened expectations for a 50 basis point rate cut by the Fed in September, according to Amo Sahota, director at Klarity FX in San Francisco.

CME Group's FedWatch tool shows that before the producer price data was released, there was a general expectation that interest rates would be cut in September.

After the producer price data came out, expectations for a deeper rate cut of up to 50 basis points jumped from 53% to 56% in just one day.