Why does the Ministry of Finance propose to collect Property Tax?

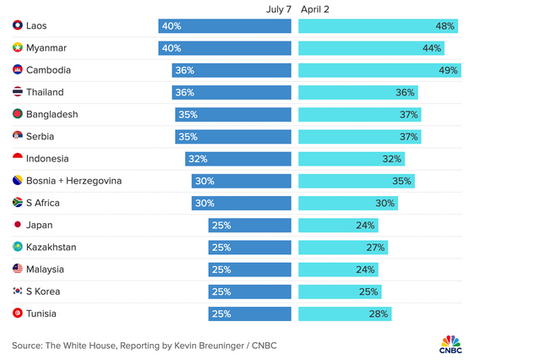

The Ministry of Finance said that currently, 174 out of 193 countries and territories collect property taxes annually.

At the press conference on April 13 regarding the proposed Property Law, to demonstrate the necessity of this law, the Ministry of Finance cited international experience showing that property tax is a type of tax that was introduced early in the tax systems of most countries, especially in places with developed market economies.

"Currently, 174 out of 193 countries and territories collect property tax (annual tax, during the use of property) under many different names. Countries use property tax as an effective financial tool to strengthen the management of the use of property by organizations and individuals, while at the same time having more resources to reinvest in land, regulating part of the income of organizations and individuals with many real estate assets; contributing to ensuring social justice", said Mr. Pham Dinh Thi, Director of the Tax Policy Department.

According to him, property tax in countries plays an important role in the total budget revenue of countries, accounting for an average of 3-4% in developed countries, some countries this rate is up to 8% like Japan. In developing and transition countries, this rate is lower. Considering the period 2005-2013, the rate of property tax collection compared to GDP in developed countries and some developing countries in Asia is about 2%.

|

An apartment project in Hanoi. Photo:Ngoc Thanh |

Meanwhile, according to Mr. Thi, in Vietnam, through assessment, it shows that taxes collected during the process of using assets (non-agricultural land use tax, agricultural land use tax) only account for about 0.036% of GDP and are only regulated for land.

Therefore, according to this agency,In order to restructure budget revenue sources, exploit property revenue sources well and "conform to international practices", the promulgation of the Property Tax Law is necessary.

In the proposal to build the Property Law project that the Ministry of Finance submitted to the Government, this agency proposed 3 main taxable subjects: land, houses - constructions on land and properties such as cars, airplanes and yachts.

In which, this agency also cited international experience showing that most countriesproperty tax on landIncluding residential land and land for production and business. For agricultural land, some countries and territories include it in tax-exempt subjects such as Bulgaria, England, Estonia, Armenia..., some do not tax agricultural land or include it in non-taxable subjects such as: Indonesia, Taiwan, Thailand, most African countries...

In accordance with international practice and the provisions of the law on land, this agency proposes that the subjects subject to property tax on land include residential land in rural and urban areas, non-agricultural production and business land such as industrial park land, industrial clusters, export processing zones, commercial and service land, non-agricultural production facility land, land used for mineral activities, production of construction materials, and making pottery. In addition, non-agricultural land used for business and residential purposes is also subject to tax.

Meanwhile, for the proposal to taxhouses and buildings on land,The Ministry of Finance explained that this has been implemented in many countries for many years.

"Taxing houses, including houses used for business purposes, is because it is believed that those who benefit from the use of transport infrastructure and social welfare will have obligations to the state," the Ministry explained.

This agency also cited a number of countries and territories that have specific regulations on taxing houses used for business. Specifically, in Korea, the types of houses subject to property tax include houses, houses for golf courses and luxury services, buildings used as factories in residential areas and buildings for other purposes. Taiwan regulates houses and houses, constructions for commercial purposes. Singapore collects taxes on houses and buildings, including commercial and industrial houses. The Philippines regulates the types of houses subject to tax including houses and business houses. Brunei only taxes houses, including commercial houses. Cambodia regulates taxes on houses, buildings and constructions on land....

A representative of the Ministry of Finance said that the proposed contents of the Property Tax Law have not yet been sent to ministries, branches, and local People's Committees for comments and widely posted on the website. The consultation with these agencies will take place in a few days. After that, based on the received comments, the agency will ask for the Ministry of Justice's appraisal and include it in the law-making program.

Nguyen Ha