Invoice lottery to combat tax loss?

The Ministry of Finance is researching the construction of a lottery to encourage consumers to get VAT invoices and monitor business activities.

Accordingly, in the draft revised Law on Tax Administration, the Ministry of Finance proposed to build a lottery solution to encourage organizations and individuals to get retail invoices when purchasing goods.

Vietnam currently has more than 100,000 business households with revenue of VND1 billion or more. However, tax revenue from business households accounts for a very small proportion of total state budget revenue (according to 2017 data, it was 1.56% of total state budget revenue excluding crude oil).

|

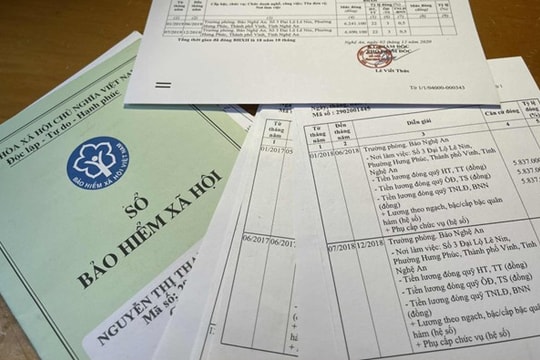

| People can use their purchase receipts to enter the lottery. |

According to the draft, this is an area that is assessed to have a loss of revenue, so it is necessary to have a solution to expand the tax base, thereby increasing state budget revenue without increasing taxes that affect the businesses under management.

Therefore, to encourage people to get invoices, another content proposed by the Ministry of Finance is: Building a lottery solution to encourage organizations and individuals to participate in monitoring the business revenue of taxpayers, including enterprises and business households.

Specifically, after purchasing goods, people take and keep the invoice. The authorities will periodically draw a lottery for customers. People can compare the retail invoice number with the lottery results. Through this form, tax authorities and people can monitor the business revenue of enterprises and business households.

|

| The situation of people not taking invoices is quite common in the retail market. |

According to the Ministry of Finance, in 2017, the number of business households with revenue of 1 billion VND or more was 102,095. Many business households using invoices regularly have revenue of up to several hundred billion VND/year. Tax revenue from this sector accounts for a very small proportion (1.56% in 2017). This is a sector that is assessed to have tax losses, so there needs to be a solution to expand the taxpayers, especially retail businesses, restaurants, food service stores, entertainment services, etc.

Previously, in early May 2018, former Chairman of the Hanoi Supermarket Association Vu Vinh Phu proposed this idea. Accordingly, Mr. Phu proposed that the Ministry of Finance must have detailed regulations on the sale of goods and services that must issue 100% VAT invoices, especially for business units with fixed locations and locations based on the serial numbers recorded on VAT invoices - which is the basis for drawing lottery tickets for customers on a monthly basis.

According to Mr. Phu, this is a very effective measure that developed countries have applied for a long time, bringing many benefits to consumers and the country.First, it stimulates social consumption, contributes to promoting domestic production development, increases social demand - one of the important factors to stimulate socio-economic development.Monday, the state will have a firm grasp of the revenue of each business organization or individual providing services as the basis for tax collection.TuesdayOnce service sales revenue is transparent, it will create a healthy competitive environment among businesses, reducing unwanted negative factors, including negative factors among some budget collection management staff in each locality.

On the basis of fully accounting for revenue and obligations to the budget, businesses will be proactive in planning, production, service business and operation in a proper and transparent manner in the market, and will certainly reduce inspections that cause trouble for the businesses themselves.

The bill lottery solution has been implemented in Taiwan since 1951. Accordingly, people's shopping bills will be drawn periodically every 2 months. The prize structure is diverse and the highest prize is up to 10 million NTD, equivalent to about 7 billion VND.

Not only locals but also foreign tourists can participate in the lottery when making purchases and have a valid visa. In addition, consumers can use these bills for charity (instead of giving money) by dropping the undrawn bills into boxes placed in public places and hotels.

The money collected from the bills will be transferred to where help is needed. This solution has helped Taiwan minimize the risk of tax evasion.