In 6 months, Nghe An leads the North Central region in mobilization and lending.

In the first 6 months of the year, Nghe An Banking sector led in mobilization and lending results in the North Central region; effectively implemented monetary, credit and banking activities in the area.

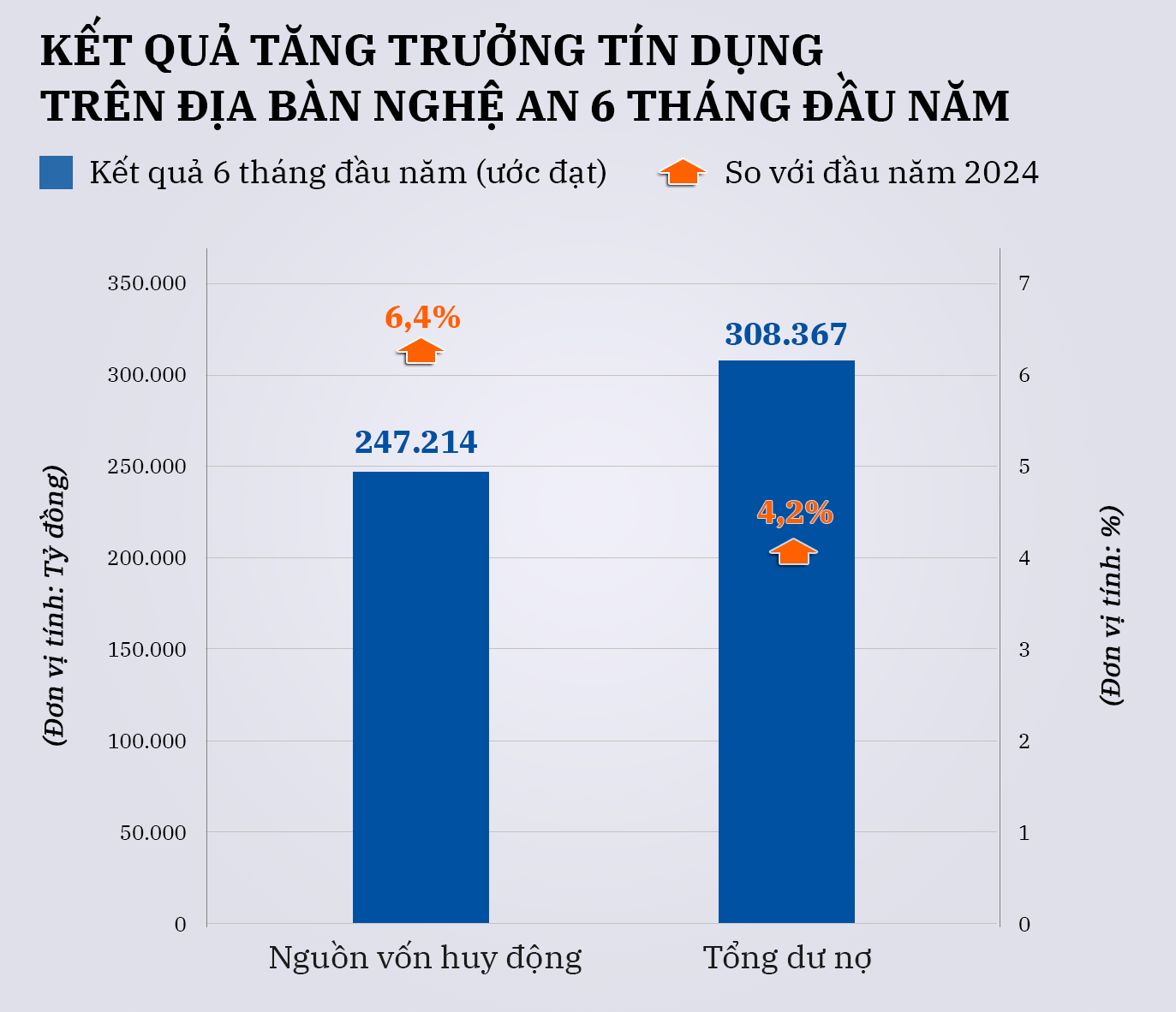

According to the State Bank of Vietnam, Nghe An branch, by June 30, 2024, mobilized capital is estimated at VND 247,214 billion, an increase of 6.4% (an increase of VND 14,870 billion) compared to the beginning of the year.

Total outstanding debt in the whole area is estimated at 308,367 billion VND, up 4.2% (up 12,588 billion VND) compared to the beginning of the year, higher than the same period last year (the same period last year was 2.7%).

Specifically: Outstanding loans for the agricultural and rural sectors and rural areas in the whole area are estimated at 139,102 billion VND, up 5% compared to the beginning of the year, accounting for 45% of outstanding loans in the whole area.

+ Outstanding loans for high-tech agricultural development and clean agriculture according to Resolution 30/NQ-CP are estimated at VND 20,313 billion, accounting for 6.6% of total outstanding loans in the whole area.

+ Export loan balance is estimated at 2,655 billion VND, down 7.1% compared to the beginning of the year.

+ Outstanding loans under Decree 67/2014/ND-CP are 110 billion VND, down 12.9% compared to the beginning of the year; outstanding loans to support housing under Resolution 02/NQ-CP are 105 billion VND, down 3.8% compared to the beginning of the year.

Recently, banks have continued to implement support loans for priority areas such as loans for rural agricultural development; loans to encourage the development of high-tech agriculture and clean agriculture and credit programs under the direction of the Government and the Prime Minister; loans for major provincial projects; and support debt collection for loans for aquaculture development.

Credit for poor households and policy beneficiaries in the area has always been of interest and promoted by the banking sector. Outstanding loans for poor households and policy beneficiaries through the Social Policy Bank account for 4% of the total outstanding loans in the area.

The leader of the State Bank of Nghe An branch said: In the first 6 months of 2024, the banking sector will increase capital mobilization and expand safe, effective and sustainable credit investment, promptly meeting the production, business and consumption needs of people and businesses in the area.

From now until the end of the year, continue to promote the lending program for poor households and policy beneficiaries through the Vietnam Bank for Social Policies; strive to reduce lending interest rates by 1-2%/year, especially for traditional growth drivers, emerging industries, green transformation, circular economy, social housing, etc.