Gold price update on the morning of May 16: Gold ring and gold bar prices increased by 3 million VND as soon as the market opened

Gold price update on the morning of May 16: Gold ring and gold bar prices increased by 3 million VND as soon as the market opened. The reason was that the world gold price reversed and increased sharply after a series of economic reports were released last night.

Gold bar price today 5/16/2025

At the time of survey at 9:30 a.m. on May 16, 2025, domestic gold prices increased sharply compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 118.5-120.8 million VND/tael (buy - sell), an increase of 3 million VND/tael for buying - an increase of 2.6 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.5-120.8 million VND/tael (buy - sell), an increase of 3 million VND/tael in buying price - an increase of 2.6 million VND/tael in selling price compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.5-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 2.7 million VND/tael for buying and increased by 2.5 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.5-120.8 million VND/tael (buy - sell), the price increased by 3 million VND/tael in buying direction - increased by 2.6 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.5-120.8 million VND/tael (buy - sell), gold price increased by 3 million VND/tael in buying - increased by 2.6 million VND/tael in selling compared to yesterday.

Gold ring price today 5/16/2025

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 112.5-115.2 million VND/tael (buy - sell); the price increased by 2 million VND/tael for buying - increased by 1.7 million VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell); an increase of 1.5 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 16, 2025 is as follows:

| Gold price today | May 16, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 118.5 | 120.8 | +3000 | +2600 |

| DOJI Group | 118.5 | 120.8 | +3000 | +2600 |

| Mi Hong | 118.5 | 120.5 | +2700 | +2500 |

| PNJ | 118.5 | 120.8 | +3000 | +2600 |

| Vietinbank Gold | 120.8 | +2600 | ||

| Bao Tin Minh Chau | 118.5 | 120.8 | +3000 | +2600 |

| Phu Quy | 117.5 | 120.8 | +3000 | +2600 |

| 1.DOJI- Updated: 16/5/2025 09:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,500▲3000K | 120,800▲2600K |

| AVPL/SJC HCM | 118,500▲3000K | 120,800▲2600K |

| AVPL/SJC DN | 118,500▲3000K | 120,800▲2600K |

| Raw material 9999 - HN | 109,700▲2000K | 112,700▲1700K |

| Raw materials 999 - HN | 109,600▲2000K | 112,600▲1700K |

| 2.PNJ- Updated: 16/5/2025 09:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 112,500▲2000K | 115,500▲2000K |

| HCMC - SJC | 118,500▲3000K | 120,800▲2600K |

| Hanoi - PNJ | 112,500▲2000K | 115,500▲2000K |

| Hanoi - SJC | 118,500▲3000K | 120,800▲2600K |

| Da Nang - PNJ | 112,500▲2000K | 115,500▲2000K |

| Da Nang - SJC | 118,500▲3000K | 120,800▲2600K |

| Western Region - PNJ | 112,500▲2000K | 115,500▲2000K |

| Western Region - SJC | 118,500▲3000K | 120,800▲2600K |

| Jewelry gold price - PNJ | 112,500▲2000K | 115,500▲2000K |

| Jewelry gold price - SJC | 118,500▲3000K | 120,800▲2600K |

| Jewelry gold price - Southeast | PNJ | 112,500▲2000K |

| Jewelry gold price - SJC | 118,500▲3000K | 120,800▲2600K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 112,500▲2000K |

| Jewelry gold price - Kim Bao Gold 999.9 | 112,500▲2000K | 115,500▲2000K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 112,500▲2000K | 115,500▲2000K |

| Jewelry gold price - Jewelry gold 999.9 | 112,400▲1900K | 114,900▲1900K |

| Jewelry gold price - 999 jewelry gold | 112,290▲1900K | 114,790▲1900K |

| Jewelry gold price - 9920 jewelry gold | 111,580▲1880K | 114,080▲1880K |

| Jewelry gold price - 99 jewelry gold | 111,350▲1880K | 113,850▲1880K |

| Jewelry gold price - 750 gold (18K) | 78,830▲1430K | 86,330▲1430K |

| Jewelry gold price - 585 gold (14K) | 59,870▲1110K | 67,370▲1110K |

| Jewelry gold price - 416 gold (10K) | 40,450▲790K | 47,950▲790K |

| Jewelry gold price - 916 gold (22K) | 102,850▲1740K | 105,350▲1740K |

| Jewelry gold price - 610 gold (14.6K) | 62,740▲1160K | 70,240▲1160K |

| Jewelry gold price - 650 gold (15.6K) | 67,340▲1240K | 74,840▲1240K |

| Jewelry gold price - 680 gold (16.3K) | 70,780▲1290K | 78,280▲1290K |

| Jewelry gold price - 375 gold (9K) | 35,740▲710K | 43,240▲710K |

| Jewelry gold price - 333 gold (8K) | 30,570▲630K | 38,070▲630K |

| 3.SJC- Updated: 16/5/2025 09:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,500▲3000K | 120,800▲2600K |

| SJC gold 5 chi | 118,500▲3000K | 120,820▲2600K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,500▲3000K | 120,830▲2600K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 112,500▲2000K | 115,500▲2000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 112,500▲2000K | 115,600▲2000K |

| 99.99% jewelry | 112,500▲2000K | 114,900▲2000K |

| 99% Jewelry | 109,262▲1980K | 113,762▲1980K |

| Jewelry 68% | 71,789▲1360K | 78,289▲1360K |

| Jewelry 41.7% | 41,568▲834K | 48,068▲834K |

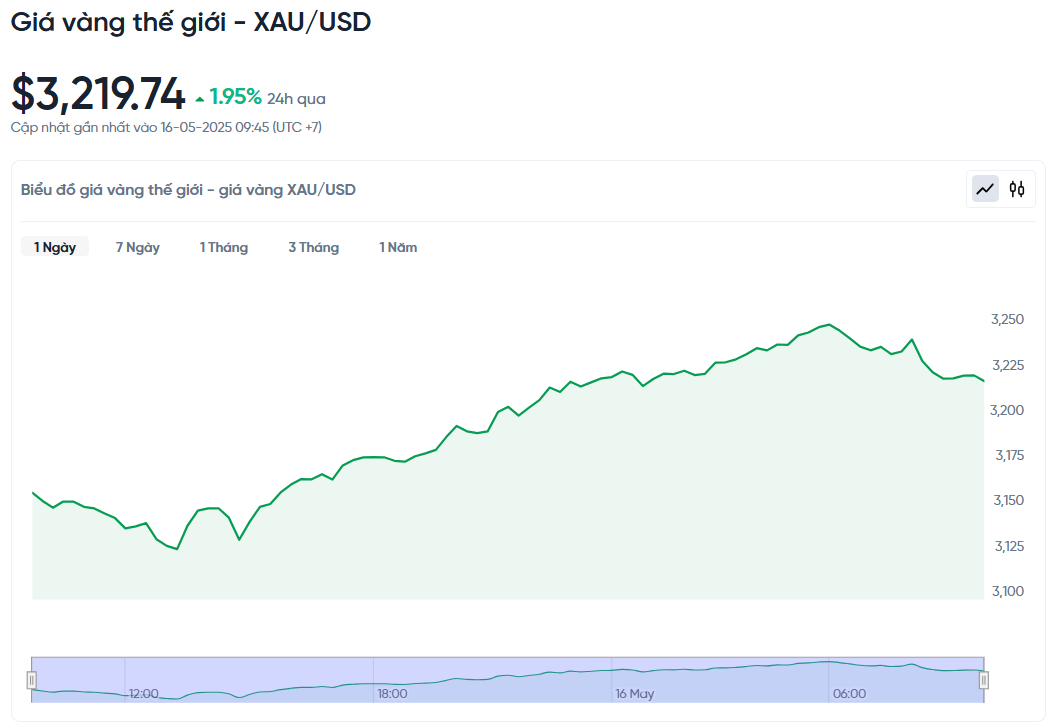

World gold price today May 16, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 9:30 am today, Vietnam time, was 3,219.74 USD/ounce. Today's gold price increased by 61.43 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,110 VND/USD), the world gold price is about 102.42 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.38 million VND/tael higher than the international gold price.

World gold prices increased sharply after a series of economic reports all tended to favor the increase in gold prices. Specifically:

Latest data showed US consumer spending was better than expected last month, according to the US Commerce Department.retail salesSales rose slightly by 0.1% in April, following a revised rise of 1.7% in March. The figure beat analysts' expectations, which predicted no growth in sales in April.

Compared to the same period last year, retail sales increased 5.2%, much higher than the forecast of 1.1% and continued the strong growth since March. However, if excluding the car factor (a big-ticket item), sales increased only 0.1%, lower than the expected 0.3%. This recovery shows that investors are still interested in gold despite signs of stability in the US economy.

Typically, strong consumer spending raises inflation expectations, which could prompt the Fed to consider keeping interest rates higher for longer. However, in this case, moderate retail sales growth was not enough to put pressure on monetary policy, helping gold maintain its appeal as a safe haven.

Meanwhile, US inflation has fallen sharply, creating an opportunity for gold prices to increase. According to data from the US Department of Labor,producer price index (PPI)In April, producer inflation fell 0.5%, following a 0.4% decline in March. This was much lower than analysts' forecasts for a 0.2% increase. Compared to the same period last year, producer inflation rose only 2.4%, lower than the expected 2.5%.

Excluding volatile factors such as food and energy prices, core inflation also fell 0.4% in April. This is a positive signal that price pressures are gradually easing.

World gold prices continued to increase slightly due to mixed signals from the US manufacturing industry. According to the latest reports from the branches of the Federal Reserve (Fed) in New York and Philadelphia.

In Philadelphia,manufacturing activity indexThe index improved to -4.0 in May from -26.4 in April. This improvement was much better than the -11.3 forecast by analysts. The New York region recorded the opposite, with the manufacturing index falling to -9.2 from -8.1 in the previous month, below expectations of remaining stable.

The regional disparity shows that the US manufacturing industry has not yet fully recovered. This makes many investors cautious and continue to seek gold as a safe investment channel. Usually, when the economy shows signs of slowing down, gold is often sought after more because of its stability.