Gold price this afternoon August 11: Gold price drops but there was a warning before

Gold price this afternoon August 11, 2025: Domestic and world gold prices both fell from their historical peak. The reason for this decrease comes from high profit-taking selling pressure.

Gold pricedomestic this afternoon 11/8/2025

As of 4:00 p.m. today, August 11, 2025,gold priceDomestic gold prices fell by 500,000 VND/tael after reaching the highest peak in April. Specifically:

DOJI Group listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122.7-123.9 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to the closing price on August 8 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 123-123.9 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 600 thousand VND/tael for buying and 500 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 122.7-123.9 million VND/tael (buying - selling), a decrease of 500 thousand VND/tael in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 121.9-123.9 million VND/tael (buy - sell), gold price decreased 300 thousand VND/tael in buying - decreased 500 thousand VND/tael in selling compared to yesterday.

As of 4:00 p.m. on August 11, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117-119.5 million VND/tael (buy - sell); the price decreased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell); down 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Phu Quy listed the price of Phu Quy 9999 round gold rings at 116.5-119.5 million VND/tael (buy - sell); down 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list this afternoon, August 11, 2025 is as follows:

| Gold price this afternoon | August 11, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 122.7 | 123.9 | -500 | -500 |

| DOJI Group | 122.7 | 123.9 | -500 | -500 |

| Mi Hong | 123 | 123.9 | -600 | -500 |

| PNJ | 122.7 | 123.9 | -500 | -500 |

| Bao Tin Minh Chau | 122.7 | 123.9 | -500 | -500 |

| Phu Quy | 121.9 | 123.9 | -300 | -500 |

| 1.DOJI- Updated: 11/8/2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 122,700▼500K | 123,900▼500K |

| AVPL/SJC HCM | 122,700▼500K | 123,900▼500K |

| AVPL/SJC DN | 122,700▼500K | 123,900▼500K |

| Raw material 9999 - HN | 109,500▼500K | 110,500▼500K |

| Raw materials 999 - HN | 109,400▼500K | 110,400▼500K |

| 2.PNJ- Updated: 11/8/2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 122,700 | 123,900 |

| PNJ 999.9 Plain Ring | 117,000 | 119,500 |

| Kim Bao Gold 999.9 | 117,000 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 117,000 | 119,500 |

| PNJ Gold - Phoenix | 117,000 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 11/8/2025 16:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,700▼500K | 123,900▼500K |

| SJC gold 5 chi | 122,700▼500K | 123,920▼500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,700▼500K | 123,930▼500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500▼700K | 119,100▼700K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500▼700K | 119,200▼700K |

| 99.99% jewelry | 116,500▼700K | 118,500▼700K |

| 99% Jewelry | 112,826▼693K | 117,326▼693K |

| Jewelry 68% | 73,538▼476K | 80,738▼476K |

| Jewelry 41.7% | 42,369▼292K | 49,569▼292K |

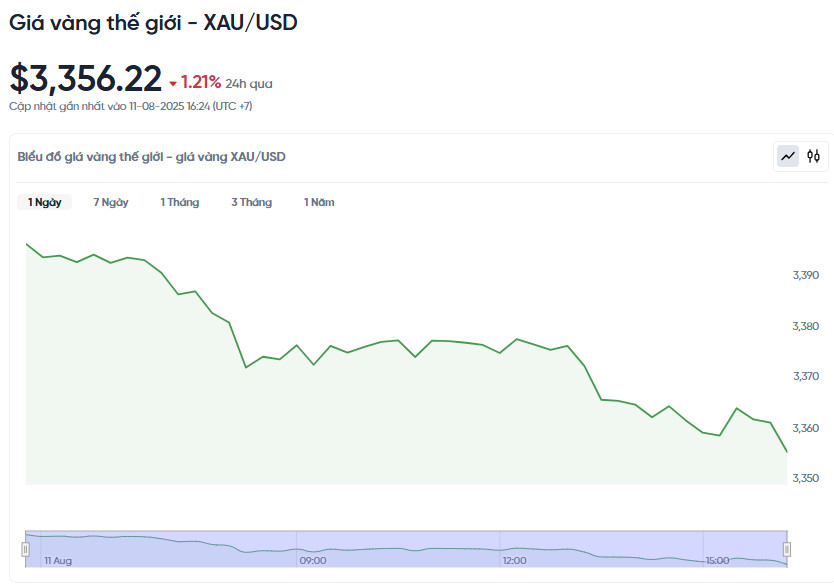

World gold price this afternoon August 11, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 p.m. on August 11, Vietnam time, was 3,356.22 USD/ounce. This afternoon's gold price decreased by 41.04 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,400 VND/USD), the world gold price is about 110.21 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.69 million VND/tael higher than the international gold price.

World gold prices fell more than 1% in the first session of the week as investors waited for the White House to clarify information on import tariffs on gold bars. At the same time, the market focused on the upcoming US inflation data to predict the Fed's interest rate roadmap.

Specifically, spot gold prices fell 1.21% after hitting their highest level since July 23 last weekend. US gold futures for December delivery fell 2.1% to $3,417.30, despite previously setting a record of $3,534.10.

Gold prices fell sharply as the market reacted to the threat of US tariffs disrupting global gold flows, according to expert Han Tan from Nemo.Money. The White House is expected to make an official announcement on the matter.

The market is paying special attention to the US consumer price index (CPI) for July, which will be released on Tuesday. Core inflation is forecast to increase by 0.3%, pushing the annual rate to 3%, above the Fed's 2% target.

According to Mr. Tan, if CPI is lower than expected and reinforces expectations of Fed rate cuts, gold prices could recover above the psychological threshold of 3,400 USD. The recent weaker-than-expected US employment report has led the market to believe that the Fed will cut interest rates in September by 90%.

Reuters sources revealed that the US Treasury Secretary is looking for a replacement for Fed Chairman Jerome Powell, raising concerns about the Fed's independence after months of pressure from President Trump to lower interest rates.

Meanwhile, the deadline for imposing tariffs on Chinese goods is expected to be extended. President Trump will also meet his Russian counterpart Putin in Alaska to discuss the conflict in Ukraine.

Besides gold prices, silver prices fell 1.1% to $37.89/ounce, platinum fell 1.3% to $1,314.73, while palladium edged up 0.4% to $1,131.55.

Gold price forecast

Gold prices plunged after a sharp rally last weekend, and were pressured by the White House's denial of a tariff on gold bullion imports from Switzerland. A Trump administration spokesman said a new policy would be in place to ensure that gold bullion is not subject to the tax.

Darin Newsom (Barchart.com) and James Stanley (Forex.com) are both bullish on gold. Stanley sees $3,435 an ounce as a key level, and a break above $3,500 could see further gains. However, he warns that the rally needs to be gradual to avoid a sudden reversal.

Rich Checkan of Asset Strategies International said the market needed time to assess the impact of the tariff news. Meanwhile, Michael Moor of Moor Analytics noted that today's gold price drop below some technical levels could signal a sell-off.

A Kitco News survey found that experts continue to expect higher prices, while retail investors maintain a positive short-term view. "Trump's trade policy has always been unpredictable, but that is no longer a surprise," Newsom stressed.

Eugenia Mykuliak, head of B2PRIME Group, said the new tariffs on gold were just the latest factor supporting gold prices. She explained that tariffs increase uncertainty, driving money into safe-haven assets like gold.

The backdrop of rising US inflation and a slowing labor market has further strengthened gold’s position. In particular, expectations of a Fed rate cut in September have made gold more attractive by reducing the opportunity cost of holding it.

In Vietnam, gold prices are affected by both the international market and domestic supply and demand. Limited supply and an unconnected market often cause domestic gold prices to be higher than world prices, sometimes with a difference of up to 16-17 million VND/tael.

The government is studying the establishment of a gold trading floor and amending Decree 24/2012 to narrow the gap and increase transparency. At that time, the “price difference” strategy will be difficult to apply, forcing investors to pay more attention to global gold price trends.