Gold price this afternoon July 25, 2025: Gold price slightly decreased due to profit taking

Gold price this afternoon 7/25/2025: Domestic gold price and world gold price decreased slightly after a period of price increase. Buyers sold quickly due to pressure of loss.

Gold pricedomestic today 7/25/2025

Update on gold price information as of 13:30 on July 25, 2025, domestic gold bar prices remain high following the trend of world gold prices. Specifically:

DOJI Group listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.7-121.7 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.7-121.7 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.7-121.7 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.2-121.7 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 1:30 p.m. on July 25, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119.7 million VND/tael (buy - sell); the gold price remained unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, July 25, 2025 is as follows:

| Gold price today | July 25, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 119.7 | 121.7 | - | - |

| DOJI Group | 119.7 | 121.7 | - | - |

| Mi Hong | 120.7 | 121.7 | +200 | - |

| PNJ | 119.7 | 121.7 | - | - |

| Bao Tin Minh Chau | 119.7 | 121.7 | - | - |

| Phu Quy | 119.2 | 121.7 | - | - |

| 1.DOJI- Updated: 7/25/2025 1:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,700 | 121,700 |

| AVPL/SJC HCM | 119,700 | 121,700 |

| AVPL/SJC DN | 119,700 | 121,700 |

| Raw material 9999 - HN | 10,900 | 11,000 |

| Raw materials 999 - HN | 10,890 | 10,990 |

| 2.PNJ- Updated: 7/25/2025 1:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 999.9 gold bar | 11,970 | 12,170 |

| PNJ 999.9 Plain Ring | 11,600 | 11,880 |

| Kim Bao Gold 999.9 | 11,600 | 11,880 |

| Gold Phuc Loc Tai 999.9 | 11,600 | 11,880 |

| PNJ Gold - Phoenix | 11,600 | 11,880 |

| 999.9 gold jewelry | 11,510 | 11,760 |

| 999 gold jewelry | 11,498 | 11,748 |

| 9920 gold jewelry | 11,426 | 11,676 |

| 99 gold jewelry | 11,402 | 11,652 |

| 916 Gold (22K) | 10,532 | 10,782 |

| 750 Gold (18K) | 8,085 | 8,835 |

| 680 Gold (16.3K) | 7,262 | 8,012 |

| 650 Gold (15.6K) | 6,909 | 7,659 |

| 610 Gold (14.6K) | 6,439 | 7,189 |

| 585 Gold (14K) | 6,145 | 6,895 |

| 416 Gold (10K) | 4,157 | 4,907 |

| 375 Gold (9K) | 3,675 | 4,425 |

| 333 Gold (8K) | 3,146 | 3,896 |

| 3.SJC- Updated: 7/25/2025 1:30 PM - Source website time - ▼/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,700 | 121,700 |

| SJC gold 5 chi | 119,700 | 121,720 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,700 | 121,730 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 | 117,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 | 117,600 |

| 99.99% jewelry | 115,000 | 116,900 |

| 99% Jewelry | 111,242 | 115,742 |

| Jewelry 68% | 72,750 | 79,650 |

| Jewelry 41.7% | 42,002 | 49,902 |

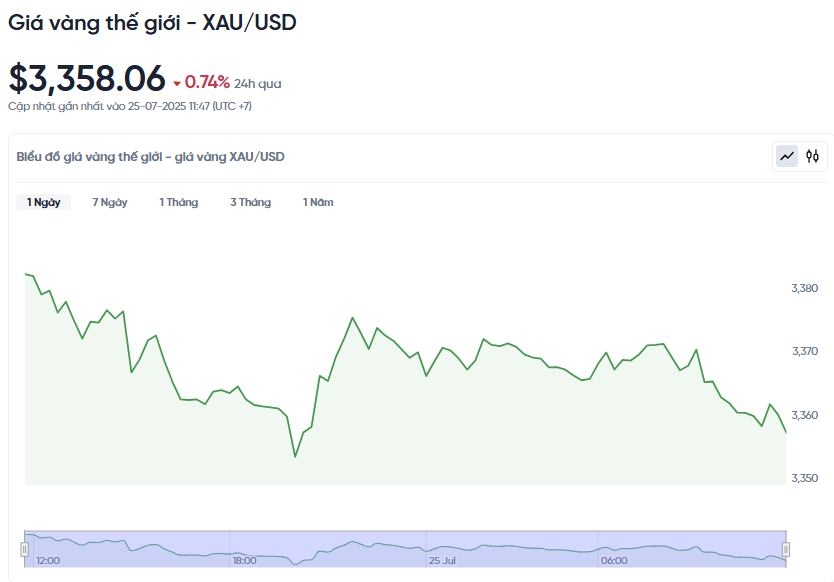

World gold price today July 25, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 7:30 p.m. on July 25, Vietnam time, was 3,358.06 USD/ounce. Today's gold price decreased by 24.99 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,310 VND/USD), the world gold price is about 110 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.7 million VND/tael higher than the international gold price.

World gold prices fell slightly as trade tensions between the US and its partners showed signs of easing, reducing demand for gold as a safe haven. However, a weaker US dollar helped limit the decline of this precious metal.

Specifically, spot gold prices fell 0.74% but still increased 0.4% this week. Meanwhile, US gold futures prices also decreased 0.2% to 3,365.50 USD.

According to Kelvin Wong, senior market analyst at OANDA, the decline in gold prices was mainly due to profit-taking by speculators following optimism about the possibility of a trade deal. However, he also commented that the weakening US dollar, along with expectations of a rate cut by the US Federal Reserve in the near future, is supporting gold prices to maintain around $3,360.

Trade negotiations between the US and the European Union (EU) are looking positive. According to EU diplomacy, the two sides could reach an agreement with a 15% tariff on EU goods imported into the US, similar to the agreement the US signed with Japan.

This optimism also helped the US stock market rise, with the S&P 500 and Nasdaq hitting new records. As trade tensions ease, investors tend to move to riskier assets instead of gold.

The dollar continued to fall this week, making gold cheaper for investors using other currencies. U.S. economic data showed a surprise drop in the number of people filing for unemployment benefits, but the labor market remained sluggish, making it harder for the unemployed to find work.

Although the Fed is expected to keep interest rates unchanged at its meeting in late July, it is likely to cut in September, which continues to support gold prices.

Besides gold prices, silver prices increased 0.2% to 39.14 USD/ounce, platinum decreased slightly 0.2% to 1,407.10 USD, and palladium increased 0.9% to 1,238.73 USD.

Gold price forecast

Currently, the domestic gold bar price is always 10-12 million VND/tael higher than the world price, making short-term investment risky. Experts recommend that investors should consider more flexible forms such as gold rings or gold accounts on international exchanges instead of buying SJC gold bars, which are greatly affected by domestic policies and scarcity.

Gold prices suddenly fell sharply as short-term investors simultaneously took profits after a period of price increase. Many gold buyers had to sell quickly because they could not bear the pressure of losses. Gold contracts for August delivery fell $30.60 to $3,366.90 an ounce, while silver contracts for September delivery also fell $0.143 to $39.35 an ounce.

While gold prices have fallen, Asian and European stock markets have been on an upward trend. US stock indexes are expected to open flat or slightly higher in the upcoming trading session. This shows that investors are gradually returning to riskier investment channels instead of gold.

According to Ms. Ipek Ozkardeskaya, senior analyst at Swissquote Bank, the greatest strength of the US Federal Reserve (Fed) is its independence in monetary policy. If this is affected, the USD and the US bond market could suffer serious consequences. The ability of the Fed to intervene in the market by buying government debt depends on global confidence. Losing this confidence, the Fed will lose its most effective tool to stabilize the economy.

Thu Lan Nguyen, head of FX and commodities research at Commerzbank, said gold prices are being supported by dovish signals from the Fed. Governor Christopher Waller recently reiterated his view that the Fed should cut interest rates as early as July. He suggested a cut of 125-150 basis points to bring interest rates to a neutral level of around 3%.

Although gold prices are adjusting down, experts say this is only a short-term decline and the medium-term upward trend is still maintained. Gold prices in the coming time will depend on US economic data and the Fed's policy decisions.

In the long term, factors such as geopolitical tensions (Middle East, US-China, Russia-Ukraine) continue to be the driving force supporting gold prices. Many large organizations such as Citi and UOB forecast that gold prices could approach 3,500-3,600 USD/ounce in 2025 if the Fed cuts interest rates.

Experts advise investors to be cautious, avoid buying when prices are at their peak or selling when prices fall sharply. Instead, if gold prices correct to the $3,330-$3,340/ounce range, this could be a good opportunity to buy with a medium-term target.