Gold price today February 23: Domestic and world gold prices increased for the 8th consecutive week

Gold price today February 23, 2025: Domestic gold price is still close to 92 million VND/tael after a strong increase in the first 3 days of the week. World gold price increased slightly and increased for the 8th consecutive week.

Domestic gold price today February 23, 2025

At the time of survey at 4:30 a.m. on February 23, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 89.4 million VND/tael for buying and 91.7 million VND/tael for selling. No change in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 90.4-91.6 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for buying and increased by 200 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 89.6-91.7 million VND/tael (buying - selling, increased 100 thousand VND/tael in buying direction - unchanged in selling direction compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 89.6-91.7 million VND/tael (buy - sell), a slight increase of 100 thousand VND/tael in buying - unchanged in selling compared to yesterday.

The latest gold price list today, February 23, 2025 is as follows:

| Gold price today | February 23, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 89.4 | 91.7 | - | - |

| DOJI Group | 89.4 | 91.7 | - | - |

| Mi Hong | 90.4 | 91.6 | +400 | +200 |

| PNJ | 89.4 | 91.7 | - | - |

| Vietinbank Gold | 92.3 | - | ||

| Bao Tin Minh Chau | 89.6 | 91.7 | +100 | - |

| Phu Quy | 89.6 | 91.7 | +100 | - |

| 1.DOJI- Updated: 23/2/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 89,400 | 91,700 |

| AVPL/SJC HCM | 89,400 | 91,700 |

| AVPL/SJC DN | 89,400 | 91,700 |

| Raw material 9999 - HN | 90,000 | 90,800 |

| Raw materials 999 - HN | 89,900 | 90,700 |

| AVPL/SJC Can Tho | 89,400 | 91,700 |

| 2.PNJ- Updated: 23/2/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 90,100 | 91,700 |

| HCMC - SJC | 89,400 | 91,700 |

| Hanoi - PNJ | 90,100 | 91,700 |

| Hanoi - SJC | 89,400 | 91,700 |

| Da Nang - PNJ | 90,100 | 91,700 |

| Da Nang - SJC | 89,400 | 91,700 |

| Western Region - PNJ | 90,100 | 91,700 |

| Western Region - SJC | 89,400 | 91,700 |

| Jewelry gold price - PNJ | 90,100 | 91,700 |

| Jewelry gold price - SJC | 89,400 | 91,700 |

| Jewelry gold price - Southeast | PNJ | 90,100 |

| Jewelry gold price - SJC | 89,400 | 91,700 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 90,100 |

| Jewelry gold price - Jewelry gold 999.9 | 89,000 | 91,500 |

| Jewelry gold price - 999 jewelry gold | 88,910 | 91,410 |

| Jewelry gold price - 99 jewelry gold | 88,190 | 90,690 |

| Jewelry gold price - 916 gold (22K) | 81,410 | 83,910 |

| Jewelry gold price - 750 gold (18K) | 66,280 | 68,780 |

| Jewelry gold price - 680 gold (16.3K) | 59,870 | 62,370 |

| Jewelry gold price - 650 gold (15.6K) | 57,130 | 59,630 |

| Jewelry gold price - 610 gold (14.6K) | 53,470 | 55,970 |

| Jewelry gold price - 585 gold (14K) | 51,180 | 53,680 |

| Jewelry gold price - 416 gold (10K) | 35,710 | 38,210 |

| Jewelry gold price - 375 gold (9K) | 31,960 | 34,460 |

| Jewelry gold price - 333 gold (8K) | 27,850 | 30,350 |

| 3. SJC - Updated: 23/2/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 89,400 | 91,700 |

| SJC 5c | 89,400 | 91,720 |

| SJC 2c, 1C, 5 phan | 89,400 | 91,730 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 89,300 | 91,400 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 89,300 | 91,500 |

| 99.99% Jewelry | 89,300 | 91,100 |

| 99% Jewelry | 87,198 | 90,198 |

| Jewelry 68% | 59,104 | 62,104 |

| Jewelry 41.7% | 35,142 | 38,142 |

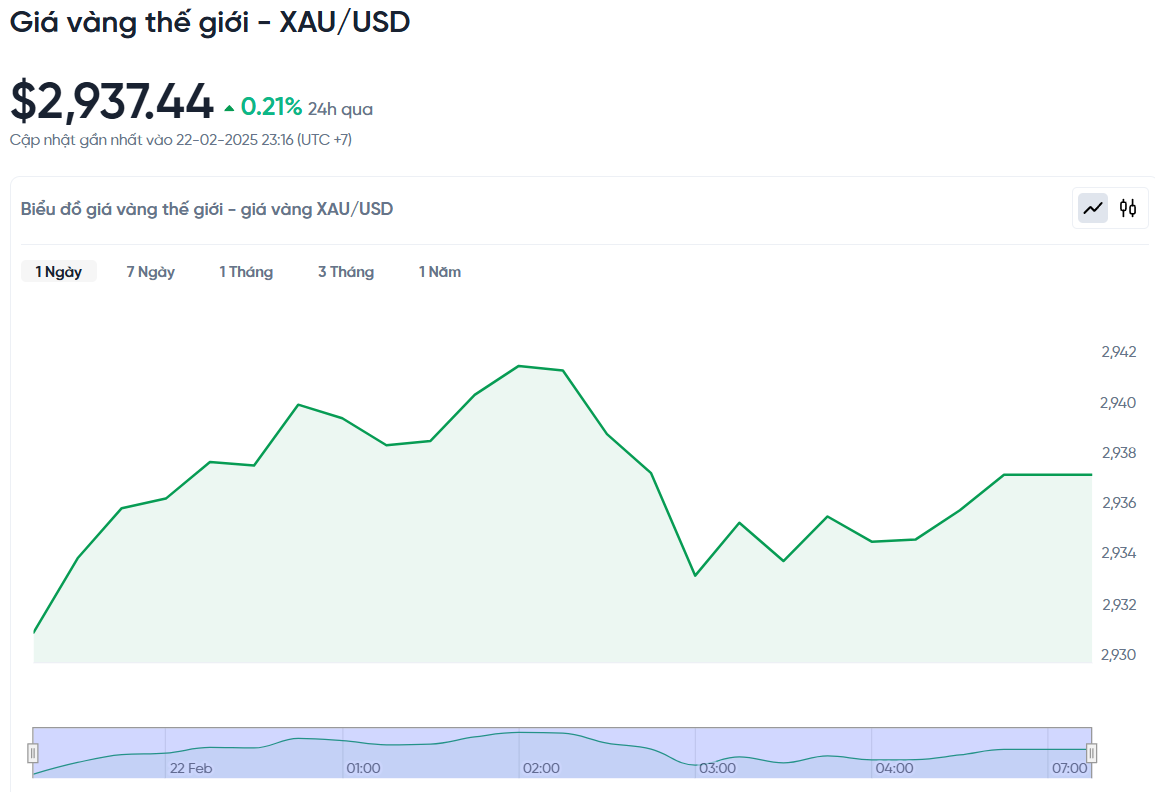

World gold price today February 23, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. today, Vietnam time, was 2,937.44 USD/ounce. Today's gold price increased by 6.27 USD compared to yesterday. Converted to the USD exchange rate, on the free market (25,750 VND/USD), the world gold price is about 92.19 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 490 thousand VND/tael lower than the international gold price.

Gold prices rose slightly after investors booked profits after hitting a record high in the previous session. However, gold prices are still on track to rise for the eighth consecutive week, thanks to demand for gold as a safe-haven asset amid concerns about US President Donald Trump's tax plans.

Alex Ebkarian, CEO of Allegiance Gold, said: 'This is just a normal correction after gold prices hit record highs and investors took profits... However, the fundamentals supporting gold prices remain very strong.'

Gold prices broke two records this week and traded above $2,950 an ounce, as uncertainty about global economic growth and political instability prompted investors to seek safe havens. Gold prices have risen 11.5% since the start of 2025.

'Current gold demand is mainly driven by Western investors and central banks. ETF (exchange-traded fund) investors are also joining the trend,' said analysts from Commerzbank.

This week, President Trump announced plans to impose new tariffs on timber and forest products, in addition to previous plans to impose tariffs on imported cars, semiconductors and pharmaceuticals. This comes after the US imposed an additional 10% tariff on goods imported from China and 25% tariffs on steel and aluminum.

According to Ebkarian, gold's role as a safe haven asset has yet to be fully realized, as money flows are still on the sidelines and there has not been a strong shift from risky assets to safer ones.

Investors are also closely watching the US Federal Reserve's interest rate path, as Trump's policies are seen as inflationary. If inflation rises, the Fed may be forced to maintain high interest rates, which could reduce the appeal of gold, a non-yielding asset.

Meanwhile, silver fell 0.9% to $32.64 an ounce, and palladium fell 0.7% to $970.45. Both metals were still on track for the week. Platinum fell 1.1% to $967.40 and could end the week lower.

Gold price forecast

CEO at Bannockburn Global Forex Marc Chandler also predicts that gold prices will have a correction in the coming time.

'Gold hit a record high of nearly $2,955 on February 20. However, technically, gold prices are starting to show signs of decline,' he said.

'Spot gold has risen more than 13% year-to-date. The rapid rise could slow investor buying. Technical charts are showing bearish indicators. Initial support could be around $2,875-$2,880 an ounce,' Chandler predicted.

Seventeen Wall Street analysts participated in the Kitco News Gold Survey this week. However, Wall Street’s bullish sentiment remains tempered. Nine experts, or 53%, see gold prices rising next week. Four analysts, or 24%, see the precious metal falling. The remaining four see prices moving sideways next week.

Meanwhile, 144 retail investors, or 71%, of the 204 Main Street investors who participated in Kitco News' online poll are optimistic that gold prices will move higher next week. Only 34 investors, or 17%, predict the precious metal will trade lower. The remaining 26 investors, or 13%, are neutral.

Carsten Fritsch, commodity analyst at Commerzbank, advises investors to wait for buying opportunities on the next corrections.

Gold prices hit a new record high on continued momentum and safe-haven demand in response to Trump’s surprise move, with the market heading towards the next major psychological level of $3,000 an ounce, Saxo Bank analysts said.

Citigroup forecast in early February that gold prices were expected to reach $3,000 an ounce within the next three months, as geopolitical tensions and the US-led trade war boosted demand for safe-haven assets.

Goldman Sachs sees the potential for gold to surge to $3,300 an ounce by year-end due to lingering speculative positions.