Gold price on August 12: Domestic and world gold prices have dropped sharply, many sellers cut losses

Gold price today August 12, 2025: Domestic and world gold ring prices have dropped sharply, rarely, after President Trump announced that gold will not be subject to import tax, many investors rushed to sell off to take profits.

Gold pricedomestic today 12/8/2025

As of 3:30 p.m. today, August 12, 2025,gold priceDomestic pieces are unchanged from yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 8 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 123-123.9 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 121.9-123.9 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 3:30 p.m. on August 12, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.8-119.3 million VND/tael (buy - sell); the price decreased by 200,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); down 300 thousand VND/tael in both buying and selling directions compared to yesterday.

Phu Quy listed the price of Phu Quy 9999 round gold rings at 116.5-119.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, August 12, 2025 is as follows:

| Gold price today | August 12, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 122.7 | 123.9 | - | - |

| DOJI Group | 122.7 | 123.9 | - | - |

| Mi Hong | 123 | 123.9 | - | - |

| PNJ | 122.7 | 123.9 | - | - |

| Bao Tin Minh Chau | 122.7 | 123.9 | - | - |

| Phu Quy | 121.9 | 123.9 | - | - |

| 1.DOJI- Updated: 12/8/2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 122,700 | 123,900 |

| AVPL/SJC HCM | 122,700 | 123,900 |

| AVPL/SJC DN | 122,700 | 123,900 |

| Raw material 9999 - HN | 109,500 | 110,500 |

| Raw materials 999 - HN | 109,400 | 110,400 |

| 2.PNJ- Updated: 12/8/2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 122,700 | 123,900 |

| PNJ 999.9 Plain Ring | 117,000 | 119,500 |

| Kim Bao Gold 999.9 | 117,000 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 117,000 | 119,500 |

| PNJ Gold - Phoenix | 117,000 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 12/8/2025 15:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,700 | 123,900 |

| SJC gold 5 chi | 122,700 | 123,920 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,700 | 123,930 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500▼100K | 119,000▼100K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500▼100K | 119,100▼100K |

| 99.99% jewelry | 116,100▼400K | 118,100▼400K |

| 99% Jewelry | 112,430▼396K | 116,930▼396K |

| Jewelry 68% | 73,266▼272K | 80,466▼272K |

| Jewelry 41.7% | 42,202▼167K | 49,402▼167K |

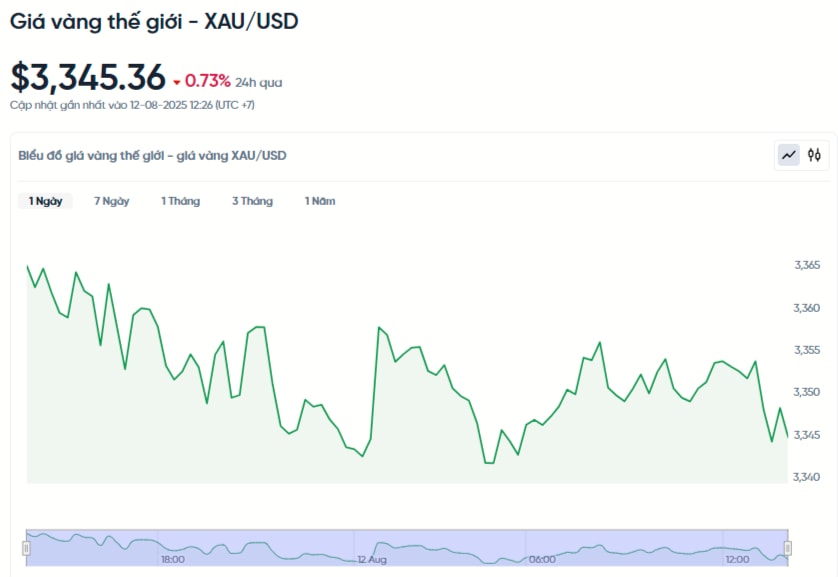

World gold price today August 12, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 3:30 p.m. on August 12, Vietnam time, was 3,345.36 USD/ounce. Today's gold price decreased by 24.8 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,430 VND/USD), the world gold price is about 106.6 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 17.3 million VND/tael higher than the international gold price.

In just 2 days, the price of gold witnessed a significant decline when the price of gold rings lost nearly 1 million VND/tael, falling faster than SJC gold bars. The main reason came from the unexpected announcement of US President Donald Trump on social media about exempting gold import tax. This information caused many investors to rush to sell off to take profits.

Specifically, spot gold prices fell 0.73% after hitting their highest level since July 23 at the end of last week. US gold futures for December delivery fell slightly 0.2% to $3,397.10/ounce.

After a steep fall, gold prices began to show signs of a slight recovery on Tuesday as investors focused on US inflation data, which is expected to provide important clues on the possibility of the Federal Reserve (Fed) adjusting interest rates in the near future.

"The market is now focused on the possibility of a Fed rate cut in September. If the core CPI comes in lower than expected, this could further strengthen expectations for a rate cut," said Kelvin Wong, senior analyst at OANDA.

"The rate cut will reduce the cost of holding gold. In addition, the 10-year US Treasury yield remains below a key resistance level, creating favorable conditions for gold prices," Mr. Wong added.

US consumer price index (CPI) data due at 15:30 GMT is drawing particular attention. Economists polled by Reuters expect the core CPI to rise 0.3% in July, pushing the annual inflation rate to 3%, well above the Fed's 2% target.

According to the CME FedWatch tool, there is now an 85% chance the Fed will cut interest rates next month. Gold tends to rise in times of economic uncertainty and when interest rates are low.

Besides gold prices, spot silver prices increased 0.7% to 37.89 USD/ounce. Platinum also increased slightly by 0.4% to 1,331.50 USD. Palladium recorded a gain of 0.8% to 1,145.03 USD.

Gold price forecast

After a series of strong increases exceeding the threshold of 3,400 USD/ounce last week, the world gold price has adjusted down back to the range of 3,350-3,400 USD. However, experts say this is just a technical adjustment in the long-term uptrend.

Gold prices are receiving strong support from the Fed's monetary policy. The US central bank's ability to cut interest rates at its meeting on September 17 is weakening the USD, creating favorable conditions for gold prices to grow. In particular, every time the gold price falls below $3,350, buying power from central banks and large investors immediately appears, pushing the price back up.

The gold market is also being heavily influenced by the US-China trade tensions, with investors waiting for news on whether the tariff truce will be extended before the deadline on Tuesday.

China is reportedly seeking concessions from the US on AI chip export controls as part of a trade deal. If trade tensions ease, gold’s appeal as a safe haven could wane.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said that despite short-term volatility, gold has maintained a key support level above $3,300 an ounce since April. He said the key factor helping gold break through the $4,000 mark could come from the correction in the US stock market, as the S&P 500 index is showing signs of slowing down at its historical peak.

“With gold ETFs seeing a surge in inflows after four years of outflows, a modest correction in US equities could be the catalyst to push gold prices closer to $4,000,” McGlone said in a recent report. He also warned that the S&P 500’s outperformance relative to global markets could be a sign that risk assets are overvalued.

In addition to financial market factors, geopolitical instability led by the US is still considered an important supporting factor for gold prices. President Trump's recent statements refuting US statistics and the independence of the Fed could become a new driving force for the gold market in the coming time.

According to experts, in the current context, gold still maintains its role as a safe haven asset. The support level around 3,300 USD is considered an attractive price range for investors to consider buying, while the possibility of breaking out to the 4,000 USD zone is still completely possible if the stock market shows signs of weakness.