Gold price on May 13, 2025: Domestic and world gold prices increased slightly again

Gold price on May 13, 2025: Domestic and world gold prices increased slightly again as investors increased their purchases of gold at low prices yesterday.

Domestic gold price today May 13, 2025

At the time of survey at 4:30 p.m. on May 13, 2025, the domestic gold price increased slightly again by more than 1 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.5-120.5 million VND/tael (buy - sell), the gold price increased by 1.3 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.8 million VND/tael for buying and 1.3 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.5-120.5 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.5-120.5 million VND/tael (buy - sell), gold price increased 1.3 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 113-115.5 million VND/tael (buy - sell); the price increased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); an increase of 1 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 13, 2025 is as follows:

| Gold price today | May 13, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 118.5 | 120.5 | +1300 | +1300 |

| DOJI Group | 118.5 | 120.5 | +1300 | +1300 |

| Mi Hong | 119 | 120.5 | +1800 | +1300 |

| PNJ | 118.5 | 120.5 | +1300 | +1300 |

| Vietinbank Gold | 120.5 | +1300 | ||

| Bao Tin Minh Chau | 118.5 | 120.5 | +1300 | +1300 |

| Phu Quy | 117.5 | 120.5 | +1300 | +1300 |

| 1.DOJI- Updated: 13/5/2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,500▲1300K | 120,500▲1300K |

| AVPL/SJC HCM | 118,500▲1300K | 118,500▲1300K |

| AVPL/SJC DN | 118,500▲1300K | 118,500▲1300K |

| Raw material 9999 - HN | 110,200▲500K | 113,000▲500K |

| Raw materials 999 - HN | 110,100▲500K | 112,900▲500K |

| 2.PNJ- Updated: 13/5/2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 999.9 gold bar | 11,850 | 12,050 |

| PNJ 999.9 Plain Ring | 11,300 | 11,550 |

| Kim Bao Gold 999.9 | 11,300 | 11,550 |

| Gold Phuc Loc Tai 999.9 | 11,300 | 11,550 |

| 999.9 gold jewelry | 11,280 | 11,530 |

| 999 gold jewelry | 11,269 | 11,519 |

| 9920 gold jewelry | 11,198 | 11,448 |

| 99 gold jewelry | 11,175 | 11,425 |

| 750 Gold (18K) | 7,913 | 8,663 |

| 585 Gold (14K) | 6,010 | 6,760 |

| 416 Gold (10K) | 4,062 | 4,812 |

| PNJ Gold - Phoenix | 11,300 | 11,550 |

| 916 Gold (22K) | 10,322 | 10,572 |

| 610 Gold (14.6K) | 6,298 | 7,048 |

| 650 Gold (15.6K) | 6,760 | 7,510 |

| 680 Gold (16.3K) | 7,105 | 7,855 |

| 375 Gold (9K) | 3,589 | 4,339 |

| 333 Gold (8K) | 3,070 | 3,820 |

| 3.SJC- Updated: 13/5/2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,500▲1300K | 120,500▲1300K |

| SJC gold 5 chi | 118,500▲1300K | 120,520▲1300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,500▲1300K | 120,530▲1300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,000▲500K | 115,500▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,000▲500K | 115,600▲500K |

| 99.99% jewelry | 113,000▲500K | 114,900▲500K |

| 99% Jewelry | 109,262▲495K | 113,762▲495K |

| Jewelry 68% | 71,790▲340K | 78,290▲340K |

| Jewelry 41.7% | 41,568▲208K | 48,068▲208K |

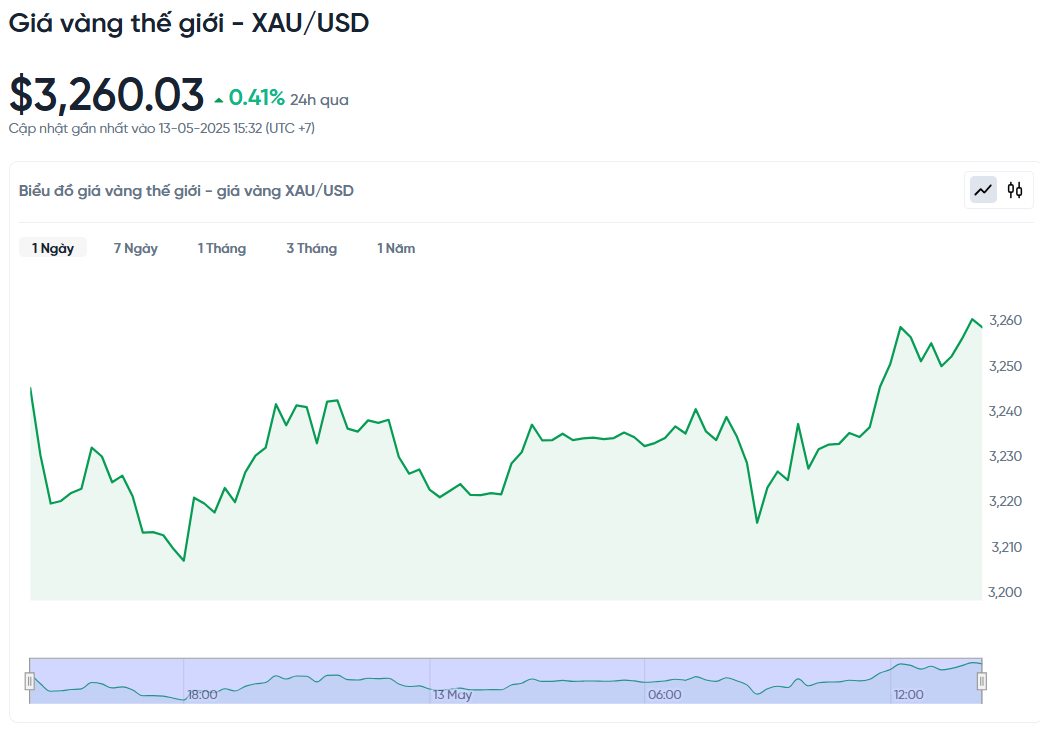

World gold price today May 13, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 2:30 p.m. today, Vietnam time, was 3,260.03 USD/ounce. Today's gold price increased by 13.42 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,140 VND/USD), the world gold price is about 103.83 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 16.64 million VND/tael higher than the international gold price.

World gold prices have started to rise again after hitting their lowest level in more than a week yesterday. The initial reason for the decline in gold prices was due to the agreement to reduce tariffs between the US and China, which increased investors' interest in riskier assets, making gold less attractive.

Specifically, spot gold prices increased again by 0.41%, after falling 2.7% in the previous trading session. Meanwhile, gold futures prices in the US also increased by 1%, reaching 3,258.7 USD/Ounce.

After two days of negotiations in Geneva, the US and China announced plans to cut tariffs over the next three months. Specifically, the US reduced tariffs on Chinese goods from 145% to 30%, while China also reduced import tariffs on US goods from 125% to 10%. This immediately boosted global stock markets.

Some investors are buying gold at current levels, which is helping to support prices despite a more positive global growth outlook thanks to improved US-China relations, said Tim Waterer, market analyst at KCM Trade. In addition, a stable US dollar has also created conditions for gold prices to increase slightly.

Adriana Kugler, a member of the US Federal Reserve (Fed), said the pause in the import tariff increase reduces the possibility that the Fed will have to cut interest rates to respond to the economic downturn. Investors are now waiting for the US Consumer Price Index (CPI) report, scheduled for release later in the day, for more clues on the path of the Fed's monetary policy.

The market expects the Fed to cut interest rates by a total of 0.55% this year, starting in September. Mr. Waterer said that if inflation data is lower than expected, the USD could weaken, creating momentum for gold prices to increase.

Besides gold, silver increased 1.5% to 33.10 USD/ounce, platinum increased 1.2% to 987.85 USD and palladium also increased 0.6% to 950.95 USD.

Gold price forecast

According to Adrian Ash, research director of BullionVault, gold prices are very sensitive to moves from the White House, so it will be difficult for prices to increase sharply without a major change in market sentiment.

Currently, trends in other markets such as stocks and the US dollar contribute to reducing the attractiveness of gold, making the price of gold more expensive for international investors. Expert Jim Wyckoff said that gold is losing its short-term technical advantage and needs to overcome the $3,350/ounce mark to establish an upward trend again.

Meanwhile, Citi bank predicts that gold prices will continue to fluctuate in the range of 3,000 - 3,300 USD in the short term and adjusts its gold price target in the next 0-3 months down to 3,150 USD.

Nitesh Shah, WisdomTree's head of European macroeconomic and commodity research, said the next big risk to the economy lies not only in trade tensions, but also in US monetary policy and the independence of the Federal Reserve (FED).

If President Trump seeks to replace Fed Chairman Jerome Powell, this could raise market doubts about the central bank's independence, thereby increasing demand for safe-haven gold.

In its latest forecast, Mr. Shah’s model puts the base case for gold prices to reach $3,610 an ounce in the first quarter of 2026. However, with a series of uncertainties in financial markets, the risk factors are now tilted toward the possibility of gold prices rising.

On the other hand, in the worst-case scenario, Mr. Shah believes that gold could fall to $2,700/ounce. The current gold price decline scenarios are mild and not worrying compared to the possibility of a sharp increase. In a volatile market context, gold is still a necessary strategic asset, helping investors minimize risks.