Gold price on May 19, 2025: Domestic and world gold prices increased again by more than 1 million VND after Mr. Trump's threat

Gold price on the afternoon of May 19, 2025: Domestic gold price and world gold price increased again by more than 1 million VND after Mr. Trump's threat to "unfriendly" partners.

Domestic gold price today May 19, 2025

At the time of survey at 3:30 p.m. on May 19, 2025, the domestic gold price increased again by more than 1 million VND compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 116.8-119.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and 800 thousand VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 116.8-119.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying - an increase of 800 thousand VND/tael for selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 117-118.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 116.8-119.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying - an increase of 800 thousand VND/tael for selling compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 116.3-119.3 million VND/tael (buy - sell), gold price increased 1.3 million VND/tael for buying - increased 800 thousand VND/tael for selling compared to yesterday.

As of 3:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 111.5-114.5 million VND/tael (buy - sell); the price increased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 114.2-117.2 million VND/tael (buy - sell); an increase of 200 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 19, 2025 is as follows:

| Gold price today | May 19, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 116.8 | 119.3 | +1300 | +800 |

| DOJI Group | 116.8 | 119.3 | +1300 | +800 |

| Mi Hong | 117 | 118.5 | +300 | +300 |

| PNJ | 116.8 | 119.3 | +1300 | +800 |

| Vietinbank Gold | 119.3 | +800 | ||

| Bao Tin Minh Chau | 116.8 | 119.3 | +1300 | +800 |

| Phu Quy | 116.3 | 119.3 | +1300 | +800 |

| 1.DOJI- Updated: 19/5/2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 116,800▲1300K | 119,300▲800K |

| AVPL/SJC HCM | 116,800▲1300K | 119,300▲800K |

| AVPL/SJC DN | 116,800▲1300K | 119,300▲800K |

| Raw material 9999 - HN | 108,700▲500K | 112,000▲500K |

| Raw materials 999 - HN | 108,600▲500K | 111,900▲500K |

| 2.PNJ- Updated: 19/5/2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 999.9 gold bar | 11,680 | 11,930 |

| PNJ 999.9 Plain Ring | 11,150 | 11,450 |

| Kim Bao Gold 999.9 | 11,150 | 11,450 |

| Gold Phuc Loc Tai 999.9 | 11,150 | 11,450 |

| 999.9 gold jewelry | 11,150 | 11,400 |

| 999 gold jewelry | 11,139 | 11,389 |

| 9920 gold jewelry | 11,069 | 11,319 |

| 99 gold jewelry | 11,046 | 11,296 |

| 750 Gold (18K) | 7,815 | 8,565 |

| 585 Gold (14K) | 5,934 | 6,684 |

| 416 Gold (10K) | 4,007 | 4,757 |

| PNJ Gold - Phoenix | 11,150 | 11,450 |

| 916 Gold (22K) | 10,202 | 10,452 |

| 610 Gold (14.6K) | 6,219 | 6,969 |

| 650 Gold (15.6K) | 6,675 | 7,425 |

| 680 Gold (16.3K) | 7,017 | 7,767 |

| 375 Gold (9K) | 3,540 | 4,290 |

| 333 Gold (8K) | 3,027 | 3,777 |

| 3.SJC- Updated: 19/5/2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 116,800▲1300K | 119,300▲800K |

| SJC gold 5 chi | 116,800▲1300K | 119,320▲800K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 116,800▲1300K | 119,330▲800K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 111,500▲500K | 114,500▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 111,500▲500K | 114,600▲500K |

| 99.99% jewelry | 111,500▲500K | 113,900▲500K |

| 99% Jewelry | 108,272▲495K | 112,772▲495K |

| Jewelry 68% | 71,109▲340K | 77,609▲340K |

| Jewelry 41.7% | 41,151▲208K | 47,651▲208K |

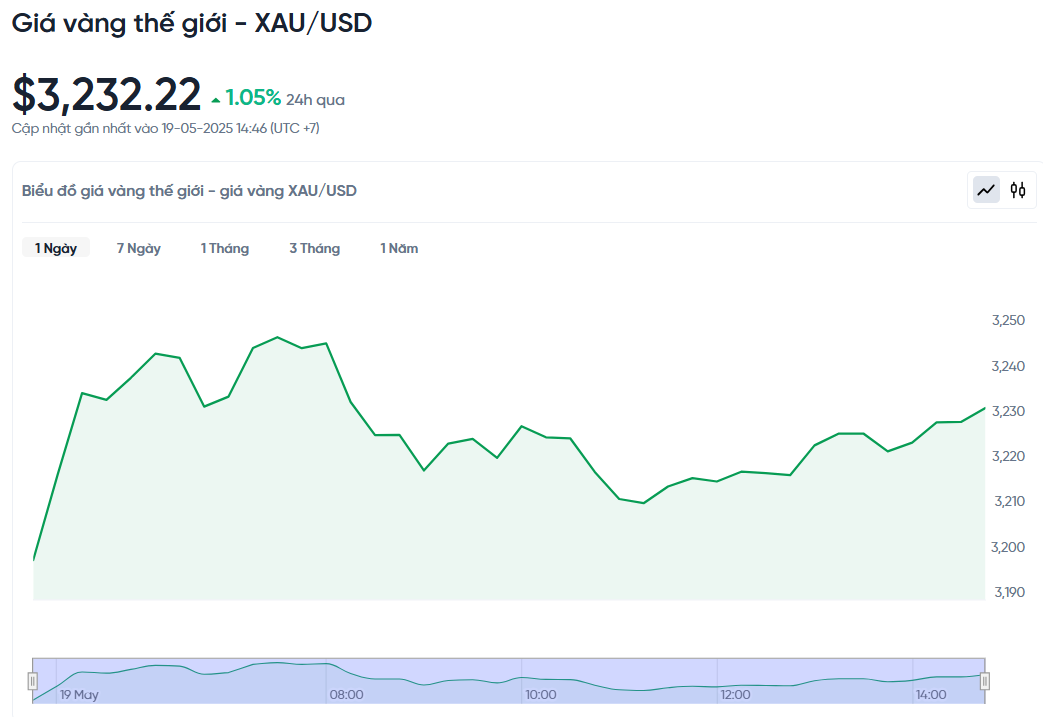

World gold price today May 19, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 3:30 p.m. today, Vietnam time, was 3,232.22 USD/ounce. Today's gold price increased by 38.1 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,130 VND/USD), the world gold price is about 102.9 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 16.4 million VND/tael higher than the international gold price.

The world gold price increased sharply after the USD fell and new concerns about trade broke out after the statement of US Treasury Secretary Scott Bessent that President Donald Trump could impose tariffs on "unfriendly" trade partners. This caused many investors to seek gold as a safe haven.

Specifically, spot gold prices increased by 1.05%, while gold futures prices in the US also increased by 1.4%, reaching 3,232.10 USD. Last week, gold prices fell more than 2% and recorded the sharpest weekly decline since November last year due to the market being more optimistic after the US-China trade agreement.

The USD exchange rate fell 0.5% this morning, making gold cheaper for foreign investors. In addition, the world's largest credit rating agency Moody's downgraded the US's credit rating, also contributing to the increase in gold prices.

According to Tim Waterer, market analyst at KCM Trade, this decision by Moody's has made investors more cautious and seek safe assets such as gold.

US Treasury Secretary Scott Bessent reiterated that President Trump will impose tariffs on trading partners if they do not negotiate in "good faith". Trump's hardline trade policies have so far caused disruption in global trade and caused financial markets to fluctuate.

Gold is considered a safe haven asset during times of political and economic uncertainty and tends to rise when interest rates are low. Recent data showed that US producer prices unexpectedly fell in April, retail sales growth slowed, and inflation was also lower than expected, raising the possibility of future rate cuts by the Federal Reserve.

According to Tim Waterer, the timing of the rate cut could be July or September, but the progress of Trump's trade negotiations will be the deciding factor.

Besides gold, silver price also increased 0.6% to 32.46 USD/ounce, while platinum and palladium prices both increased 0.6%, reaching 993.90 USD and 966.43 USD, respectively.

.png)

.jpg)