Business households and enterprises must switch to electronic invoices within 24 months.

According to new regulations, within 24 months from November 1, 2018, business households and enterprises must convert from paper invoices to electronic invoices.

During the period from November 1, 2018 to October 31, 2020, Decrees 51/2010/ND-CP and 04/2014/ND-CP of the Government are still in effect.

This is a regulation in Decree 119 of the Government on electronic invoices when providing services and takes effect from November 1, 2018.

|

| In November and December 2018, if households and individuals doing business in the restaurant and hotel sector have cash registers, they can apply a pilot program of electronic invoices with tax authority codes. |

Accordingly, in case enterprises and economic organizations have notified the issuance of electronic invoices without tax authority codes or have registered to apply electronic invoices with tax authority codes before November 1, 2018, they can continue to use the electronic invoices in use from November 1, 2018.

As for enterprises, economic organizations, households and business individuals who have notified the issuance of printed invoices, self-printed invoices, or purchased invoices from tax authorities for use before November 1, 2018, they can continue to use printed invoices, self-printed invoices, and purchased invoices until October 31, 2020 and must still carry out invoice procedures according to the provisions of the Decrees: Decree 51/2010/ND-CP and Decree 04/2014/ND-CP of the Government.

During the period from November 1, 2018 to October 31, 2020, in case the tax authority notifies a business establishment to convert to apply electronic invoices with codes, if the business establishment does not meet the conditions on information technology infrastructure but continues to use paper invoices in the form of pre-printed or self-printed invoices, the business establishment shall send invoice data to the tax authority along with submitting the value-added tax declaration.

The Decree also clearly states that public service organizations (educational institutions, public health facilities) that have used receipts will continue to use receipts and gradually switch to applying electronic invoices (or electronic receipts) according to the roadmap of the Ministry of Finance.

Decree 119 also stipulates that from the time of using electronic invoices with or without codes from tax authorities, enterprises, economic organizations, other organizations, households and business individuals must destroy any remaining but unused paper invoices.

In addition, Decree 119 has a new point that stipulates that households and individuals doing business keeping accounting books, regularly employing 10 or more employees and having revenue in the previous year of 3 billion VND or more in the fields of agriculture, forestry, fisheries, industry, construction or having revenue in the previous year of 10 billion VND or more in the fields of trade and services must use electronic invoices with codes of tax authorities when selling goods and providing services, regardless of the value of each sale of goods or provision of services.

Households and individuals doing business that are not required to do so but keep accounting books and are required to do so can also use electronic invoices with tax authority codes according to regulations.

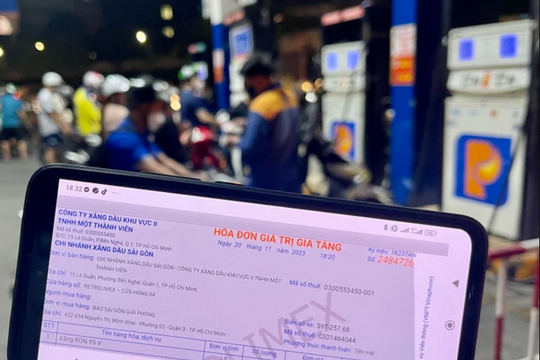

Households and individuals doing business in the fields of restaurants, hotels, retail of modern medicines, retail of consumer goods, and providing services directly to consumers in some areas with favorable conditions will pilot the implementation of electronic invoices with tax authority codes generated from cash registers connected to electronic data transfer with tax authorities from 2018.

Thus, in November and December 2018, if households and individuals doing business in this field have cash registers, they can pilot the use of electronic invoices with tax authority codes.

For business households and individuals who do not meet the conditions to use electronic invoices with tax authority codes but need invoices to deliver to customers, the tax authority will issue electronic invoices with tax authority codes for each occurrence and must declare and pay taxes before the tax authority issues electronic invoices.

.jpeg)