More than 3,500 billion in gasoline tax difference: Where is the responsibility?

Regarding the responsibility for the 3,500 billion VND difference in gasoline tax, Deputy Minister of Finance Vu Thi Mai said that the Ministry is directing a review.

Regarding the heated public opinion about the need to hold accountable and strictly handle organizations and individuals involved in causing policy loopholes that have allowed petroleum enterprises to benefit more than VND3,000 billion due to tax differences, at the regular press conference of the first quarter of 2016 of the Ministry of Finance on the afternoon of March 31, Deputy Minister Vu Thi Mai replied: "The handling of officials must clearly follow the regulations on personnel work. For now, the Ministry of Finance is directing, inspecting and reviewing this matter."

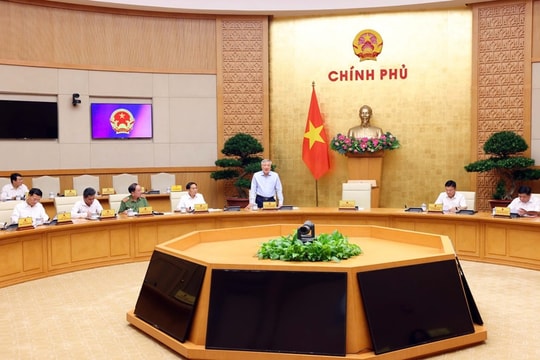

|

| Illustration photo |

Ms. Mai further explained: In our country's current economy, changes arising in practice always come first and policies and regulations must be adjusted promptly to promote the economy. The policy-making process must also be ensured according to legal documents. It is also predictable, but there are also things that arise in practice.

In addition, at the press conference, the reporter raised the question, if the enterprise declares correctly and enjoys that tax difference, it is natural. The fault does not belong to the enterprise but to the management agency. When the Ministry of Finance said it would inspect and examine petroleum trading enterprises, what content will it inspect at the enterprise?

Ms. Mai said that the figure of 3,500 billion VND is just a basic figure, not the final figure. If the enterprise proves that it has not violated the law and has paid taxes that are eligible for a tax refund, the state will be responsible for refunding them. The inspection and audit of petroleum enterprises is an annual task because this is an energy product that plays an important role in the input of production and business and affects daily petroleum consumers. Therefore, inspection by competent authorities is necessary to ensure transparency and check whether the enterprise complies with tax laws.

“There is now information about a tax difference of up to 3,500 billion VND, so it is even more necessary to conduct an inspection. The inspection content will be the compliance with the law on finance and tax of enterprises,” Ms. Mai affirmed./.

According to VOV